CoreLogic: Delinquencies Stay Low Despite Pandemic Impact

CoreLogic, Irvine, Calif., said its analysis of March mortgage delinquencies and foreclosures found despite the early impact of the coronavirus pandemic, delinquencies remained relatively low.

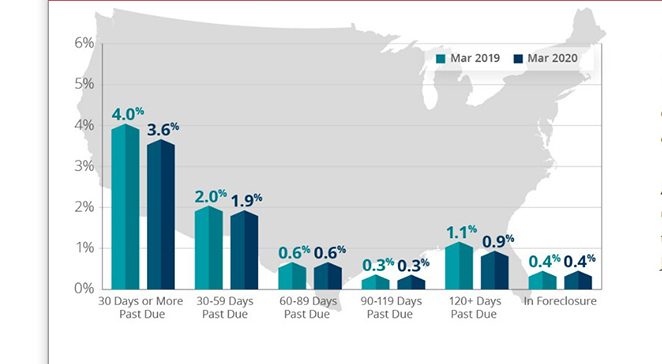

The company’s monthly Loan Performance Insights Report said on a national level, 3.6% of mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure), an 0.4-percentage point decrease from a year ago.

The report said the share of mortgages that transitioned from current to 30 days past due increased to 1% in March but remained below the 20-year average of 1.3%. The U.S. serious delinquency remained at 1.2% in March, the lowest level since June 2000; for the 17th consecutive month, the U.S. foreclosure rate was the lowest in at least 21 years.

“The first three months of 2020 reflected one of the strongest quarters for U.S. mortgage performance in recent history,” said Frank Martell, president and CEO of CoreLogic. “The build-up in home equity over the past several years, government stimulus programs, and lower borrowing costs have helped cushion homeowners from the initial financial shock of the pandemic and kept widespread delinquencies at bay during the first months of the recession.”

But Martell acknowledged that is likely to change going forward, given the full impact of the coronavirus on mortgage performance (the Mortgage Bankers Association this week reported 8.53% of mortgage loans were in forbearance). “Looking ahead, we can expect a more widespread impact on U.S. delinquency rates as the economic toll of elevated unemployment and shelter-in-place orders becomes more evident.”

Other report findings:

–Early-Stage Delinquencies (30- 59 days past due): 1.9% in March, down from 2% a year ago.

–Adverse Delinquency (60-89 days past due): 0.6% in March, unchanged from a year ago.

–Serious Delinquency (90 days or more past due, including loans in foreclosure): 1.2% in March, down from 1.4% a year ago. For the third consecutive month, the serious delinquency remained at its lowest level since June 2000.

–Foreclosure Inventory Rate (share of mortgages in some stage of the foreclosure process): 0.4% in March, unchanged from a year ago.

–Transition Rate (share of mortgages that transitioned from current to 30 days past due): 1% in March, up from 0.9% a year ago. In January 2007, just before the start of the financial crisis, the current- to 30-day transition rate was 1.2%, while it peaked in November 2008 at 2%.

CoreLogic Chief Economist Frank Nothaft said in the months leading up to the coronavirus pandemic, U.S. mortgage performance was showing sustained improvement. In March — one month after the U.S. annual unemployment rate hit a 50-year low — the nation’s overall delinquency rate continued to decline year over year, following a trend that began in January 2018. However, he acknowledge the job market began its downward spiral in March as shelter-in-place orders went into effect, thus increasing the likelihood of borrowers falling behind on their mortgage payments.

“The COVID-19 pandemic has shocked our economic system and led to unprecedented job loss, reducing the ability of affected families to make their monthly mortgage payments,” Nothaft said, noting the CoreLogic Home Price Index showed prices declining in 41 states through April 2021, “potentially erasing home equity and increasing foreclosure risk.”