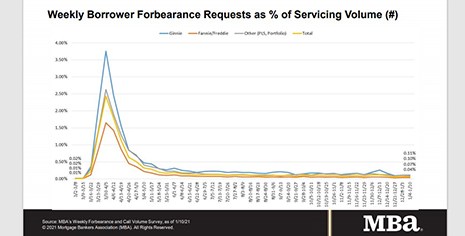

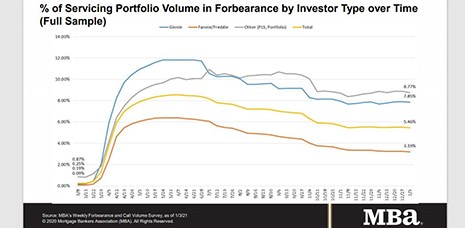

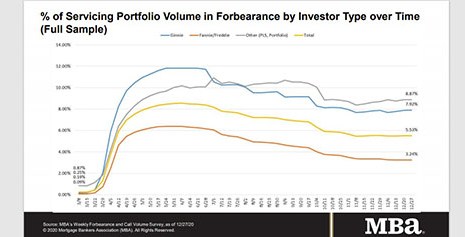

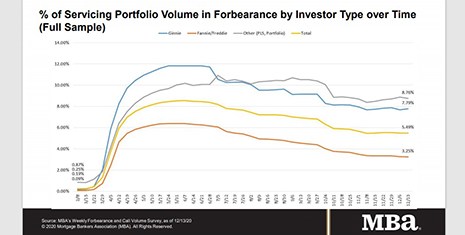

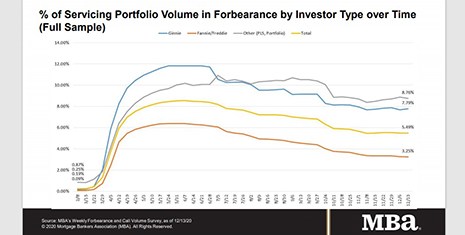

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance fell to 5.37% of servicers’ portfolio volume as of Jan. 10, compared to 5.46% the previous week. MBA estimates 2.7 million homeowners are in forbearance plans.

Tag: Mike Fratantoni

MBA: Share of Loans in Forbearance Drops to 5.46%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased to 5.46% of servicers’ portfolio volume as of Jan. 3 compared to 5.46% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

MBA: Share of Loans in Forbearance Drops to 5.46%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased to 5.46% of servicers’ portfolio volume as of Jan. 3 compared to 5.46% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

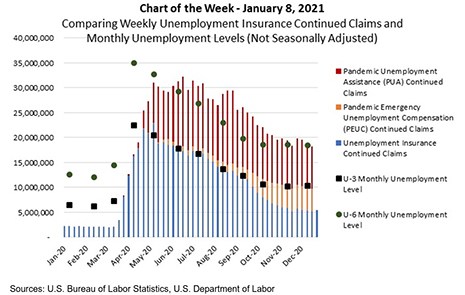

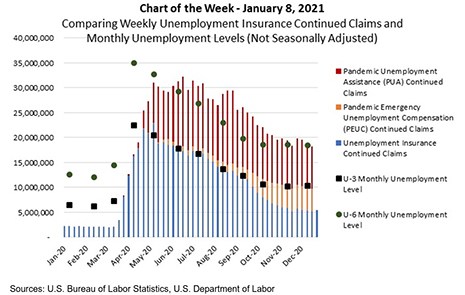

MBA Chart of the Week: Unemployment Insurance Continued Claims

The COVID-19 pandemic continued to impact the labor market to close 2020. Friday’s release from the Bureau of Labor Statistics showed that faster layoffs led to a loss of 140,000 jobs in December and kept the headline unemployment rate (U-3) at 6.7 percent.

MBA Chart of the Week: Unemployment Insurance Continued Claims

The COVID-19 pandemic continued to impact the labor market to close 2020. Friday’s release from the Bureau of Labor Statistics showed that faster layoffs led to a loss of 140,000 jobs in December and kept the headline unemployment rate (U-3) at 6.7 percent.

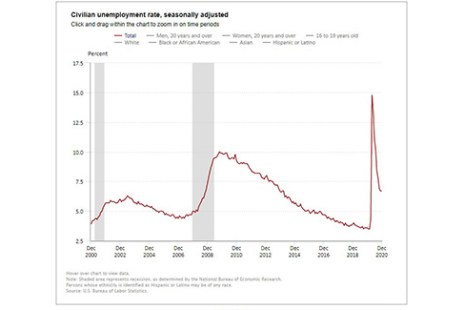

Job Losses Mark December Employment Report

The U.S. economy shed 140,000 jobs in December, the Bureau of Labor Statistics reported Friday, although the unemployment rate held steady at 6.7 percent.

MBA: Share of Mortgage Loans in 2-Month Holding Pattern

The Mortgage Bankers Association’s Forbearance and Call Volume Survey showed little change over the holiday season–and in fact, has shown little change over the past two months.

MBA: Share of Mortgage Loans in 2-Month Holding Pattern

The Mortgage Bankers Association’s Forbearance and Call Volume Survey showed little change over the holiday season–and in fact, has shown little change over the past two months.

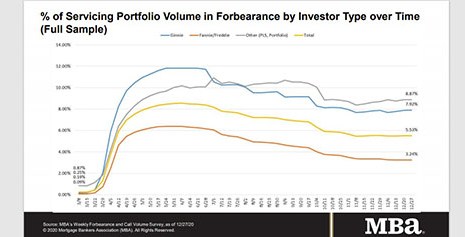

MBA: Share of Mortgages in Forbearance Ticks Up

The Mortgage Bankers Association’s latest Forbearance & Call Center Survey reported loans in forbearance increased slightly to 5.49% of servicers’ portfolio volume as of December 13 from 5.49% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

MBA: Share of Mortgages in Forbearance Ticks Up

The Mortgage Bankers Association’s latest Forbearance & Call Center Survey reported loans in forbearance increased slightly to 5.49% of servicers’ portfolio volume as of December 13 from 5.49% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.