Job Growth Slows Heading into Uncertain Winter

Total nonfarm payroll employment growth slowed to 245,000 in November, the Bureau of Labor Statistics reported Friday, with nearly 10 million fewer jobs currently compared to a year ago.

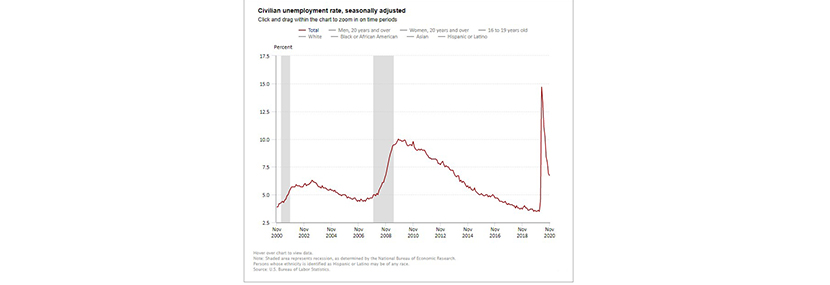

The report said the unemployment rate edged down to 6.7 percent. While that is down by 8 percentage points from its recent high in April, it is still 3.2 percentage points higher than in February. The number of unemployed persons, at 10.7 million, continued

to trend down in November but is 4.9 million higher than in February.

BLS revised total nonfarm payroll employment for September up by 39,000, from +672,000 to +711,000, and for October down by 28,000, from +638,000 to +610,000. With these revisions, employment in September and October combined was 11,000 more than previously reported.

The labor force participation rate edged down to 61.5 percent in November; this is 1.9percentage points below its February level. The employment-population ratio, at 57.3 percent, changed little over the month but is 3.8 percentage points lower than in February.

“The pace of employment growth slowed in November, partially due to a loss of government jobs tied to the 2020 U.S. Census count, but also reflecting a slowdown in private sector job growth,” said Mike Fratantoni, Chief Economist with the Mortgage Bankers Association. “A notable bright spot was the gain in construction jobs in the residential sector, another sign that the strong housing market continues to lead the overall economy.”

Fratantoni noted while the decline in the unemployment rate is a positive, “there are 10.7 million people who are unemployed, and an increasing number of long-term unemployed – those out of work for more than 26 weeks. Moreover, the decline in labor force participation helped to decrease the unemployment rate, as some stopped looking for work and were not counted as unemployed.”

Fratantoni also noted over the past three months, private sector job gains have averaged 717,000 per month, a slowdown from the rapid recovery over the summer, “but still an impressive pace. However, the pace of improvement is clearly slowing in the face of an uptick in the intensity of COVID-19 cases and the mitigation efforts to slow the spread. Certain segments of the economy – particularly in-person service sector jobs – are going to be slower to come back from this environment. “We do expect that the ongoing improvement in the job market will continue to support the strong housing market. That is why our forecast calls for a record year in 2021 of purchase origination volume.”

Sarah House, Senior Economist with Wells Fargo Securities, Charlotte, N.C., said strains of the latest COVID surge are starting to take a toll on the labor market.

The 245K new jobs added in November marks a sharp slowdown in hiring and leaves the economy with 9.8M fewer jobs since February.

“A further moderation in hiring is therefore likely in December, with real potential for payrolls to decline outright next month,” House said. “The more subdued pace of hiring stems in part from revenue pressure on businesses, but also staffing challenges as workers contend with the health risks and family care needs presented by the pandemic.”

“Today’s report shows that the labor market continues to make progress, now having regained slightly more than half of the 22 million jobs lost at the onset of the pandemic,” said Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif. “The only major sector to display immunity to the economic impacts of the coronavirus is the housing market, which has experienced a strong V-shaped recovery. This is largely due to the fact this has been a services-driven recession, disproportionally hurting younger, lower wage renters that are less likely to be homeowners or home buyers.”

Kushi noted while the labor market bifurcation has allowed demand to remain strong, the housing market continues to suffer from a dearth of supply following years of under building. “Residential building jobs initially rebounded strongly from April’s low point and are continuing the slow increase to pre-pandemic levels,” she said. “In the most recent report, jobs in residential building increased by nearly 0.2 percent compared with one month ago, and hovers just 0.7 percent below its February level. Since more hammers leads to more homes, the continued rise in residential construction employment was welcome news for a housing market in desperate need of more supply.”

The report said average hourly earnings for all employees on private nonfarm payrolls in November increased by 9 cents to $29.58. Average hourly earnings of private-sector production and nonsupervisory employees increased by 7 cents to $24.87.

The average workweek for all employees on private nonfarm payrolls remained unchanged at 34.8 hours in November. In manufacturing, the workweek decreased by 0.2 hour to 40.3 hours, and overtime decreased by 0.1 hour to 3.1 hours. The average workweek for production and non-supervisory employees on private nonfarm payrolls was unchanged at 34.2 hours.