New forbearance requests fell to a three-week low, the Mortgage Bankers Association reported Monday.

Tag: Mike Fratantoni

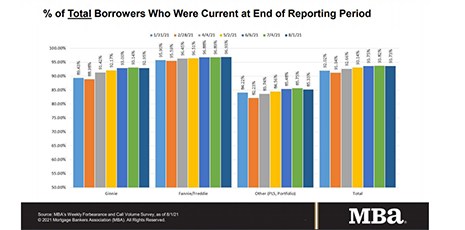

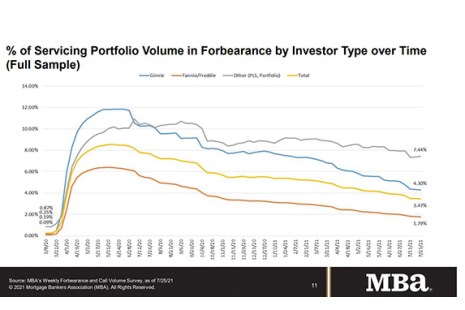

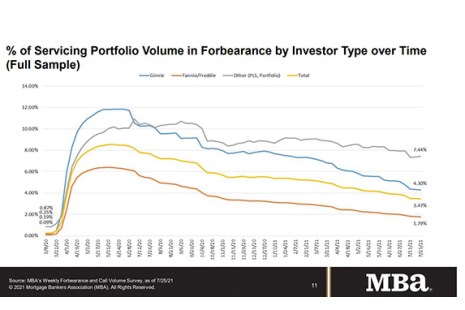

Share of Mortgage Loans in Forbearance Decreases to 3.40%

New forbearance requests fell to a three-week low, the Mortgage Bankers Association reported Monday.

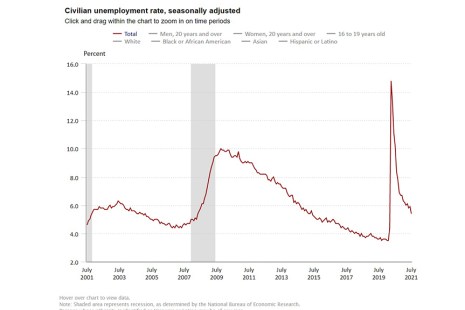

Hiring Heats Up in July

The labor market surged again in July with 943,000 new jobs created, the Bureau of Labor Statistics reported Friday.

Quote

The [Bureau of Labor Statistics employment report] showed employment up by more than one million in July, as the number of unemployed fell and more people returned to the labor force. Although there are concerns regarding the impact of the delta variant, these data show an economy that was continuing to recover in July.”

–MBA Chief Economist Mike Fratantoni

MBA Weekly Applications Survey Aug. 4, 2021: Applications Decrease

Mortgage applications decreased 1.7% from the week before, the Mortgage Bankers Association reported in its Weekly Mortgage Applications Survey for the week ending July 30, 2021.

Share of Mortgage Loans in Forbearance Slightly Decreases

Loans in forbearance fell for the twenty-second consecutive week, the Mortgage Bankers Association said Monday.

MBA Weekly Applications Survey Aug. 4, 2021: Applications Decrease

Mortgage applications decreased 1.7% from the week before, the Mortgage Bankers Association reported in its Weekly Mortgage Applications Survey for the week ending July 30, 2021.

Share of Mortgage Loans in Forbearance Slightly Decreases

Loans in forbearance fell for the twenty-second consecutive week, the Mortgage Bankers Association said on Monday.

MBA Weekly Applications Survey Aug. 4, 2021: Applications Decrease

Mortgage applications decreased 1.7% from the week before, the Mortgage Bankers Association reported in its Weekly Mortgage Applications Survey for the week ending July 30, 2021.

Share of Mortgage Loans in Forbearance Slightly Decreases

Loans in forbearance fell for the twenty-second consecutive week, the Mortgage Bankers Association said on Monday.