June Jobs Report Blows Past Expectations

Total nonfarm employment increased by 850,000 in June, the Bureau of Labor Statistics reported Friday, well above expectations amid rising demand for services hit hard by the coronavirus pandemic.

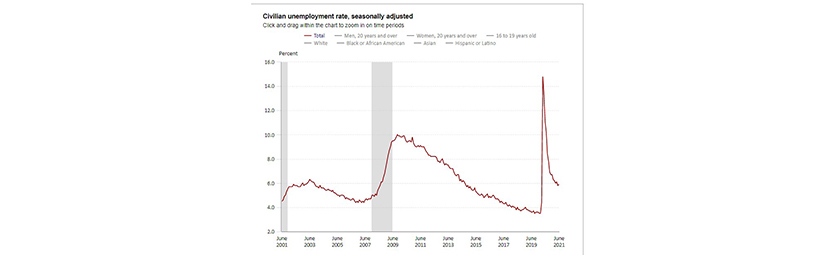

Despite the sharp jump in jobs, the unemployment rate actually rose by one-tenth of a percentage point, to 5.9 percent. BLS attributed the increase to more workers re-entering the job force. The number of unemployed persons remained at 9.5 million.

The report noted nonfarm payroll employment is up by 15.6 million since April 2020 but is down by 6.8 million, or 4.4 percent, from its pre-pandemic level in February 2020. Notable job gains in June occurred in leisure and hospitality, public and private education, professional and business services, retail trade and other services.

The change in total nonfarm payroll employment for April was revised down by 9,000, from +278,000 to +269,000, and the change for May was revised up by 24,000, from +559,000 to +583,000. With these revisions, employment in April and May combined is 15,000 higher than previously reported.

The labor force participation rate was unchanged at 61.6 percent in June and has remained within a narrow range of 61.4 percent to 61.7 percent since June 2020. The participation rate is 1.7 percentage points lower than in February 2020. The employment-population ratio, at 58.0 percent, was also unchanged in June but is up by 0.6 percentage point since December 2020. However, this measure is 3.1 percentage points below its February 2020 level.

“A faster rate of job growth in June, which followed slower than expected growth in April and May, leaves the economy still 6.8 million jobs short of where it was in February 2020. However, the economy is certainly headed in the right direction,” said Mike Fratantoni, Senior Vice President and Chief Economist with the Mortgage Bankers Association. “The country’s reopening is challenged by supply chain constraints and worker shortages in certain sectors, but we expect robust job growth to continue.”

Fratantoni noted while job gains were largest in the leisure and hospitality sector last month, the report also cited broad-based gains in the service sector. “With respect to the housing market, while total construction employment declined, this was due to a decrease in the non-residential components,” he said. “There were an additional 15,000 jobs in residential construction, which should benefit the pace of homebuilding. Insufficient housing inventory levels continue to slow what should be a stronger pace of home sales.”

Fratantoni was unconcerned with the slight rise in the unemployment rate. “It is important to note a few changes in the details: Fewer workers reported working part-time for economic reasons, suggesting that they may now have full-time jobs,” he said. “And the number of workers reported as ‘job leavers’ increased, lining up with the higher quit rate seen in other data. There is a fair amount of churn in the job market right now as workers seek the best match, moving to jobs and sectors that are paying more due to the severe shortages in some segments of the job market.”

Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif., said If monthly gains continue at the June pace, the labor force could return to the pre-COVID employment peak by February 2022.

“Residential building employment is up nearly 0.3% this month—great news as the housing market continues to face a severe shortage of homes and construction employment is a non-substitutable input necessary to increase the pace of housing starts and increase the housing stock,” Kushi said. “While residential building construction employment has steadily increased and even outpaced its pre-COVID level, overall construction employment is still 3.1% below its February 2020 level. Attracting skilled labor remains a key priority for construction firms in months to come.”

“One caveat to the strong job growth seen in this report is that some gains may have been overstated due to a distorted seasonal pattern; in particular, the 268,300 jobs added across the state, local, and private education sectors, which were likely affected by an abnormal seasonal pattern of returning to in-person education,” said Doug Duncan, Chief economist with Fannie Mae, Washington, D.C.

“June’s jobs report demonstrated that despite the continued headaches caused by the inability of many businesses to find the help they need, the labor market recovery has picked up speed,” said Sarah House, Senior Economist with Wells Fargo Economics, Charlotte, N.C. “Staffing challenges remain supportive of strong wage growth at the industry level, which leads us to expect inflation will remain elevated in the months ahead. Even with this solid step on the road to ‘substantial further progress,’ we do not think this report will hurry the Fed in its current thinking on when to eventually start tapering.

House noted the gain comes as demand for labor remains red-hot this summer. “Job openings sit at record levels, hiring plans are at all-time highs and more consumers than ever view jobs as ‘plentiful,’” she said. “But supply has been the major hold up to a more robust payroll recovery amid concerns over COVID, childcare issues, more generous income support and for many a broader re-think about what they want out of a job.”

House added the report should be “encouraging” for the Federal Reserve. “Employers seem to be finding ways to step up hiring even given current constraints, as rising job opportunities and pay among prime-age workers seem to be unlocking labor supply,” she said.

The report said average hourly earnings for all employees on private nonfarm payrolls rose by 10 cents to $30.40 in June, following increases in May and April (+13 cents and +20 cents, respectively). Average hourly earnings of private-sector production and nonsupervisory employees rose by 10 cents to $25.68 in June. “The data for recent months suggest that the rising demand for labor associated with the recovery from the pandemic may have put upward pressure on wages,” the report said.

The average workweek for all employees on private nonfarm payrolls decreased by 0.1 hour to 34.7 hours. In manufacturing, the average workweek fell by 0.2 hour to 40.2 hours, and overtime declined by 0.1 hour to 3.2 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls declined by 0.2 hour to 34.1 hours.