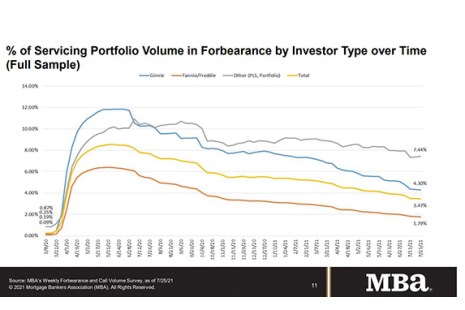

Loans in forbearance fell for the twenty-second consecutive week, the Mortgage Bankers Association said on Monday.

Tag: Mike Fratantoni

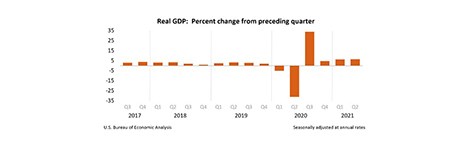

2Q GDP Heats Up Some More

Real gross domestic product increased at an annual rate of 6.5 percent in the second quarter, according to the “advance” (first) estimate reported Thursday by the Bureau of Economic Analysis.

Share of Mortgage Loans in Forbearance Slightly Dips to 3.48%

Loans in forbearance fell for the 21st consecutive week, the Mortgage Bankers Association said on Monday.

Share of Mortgage Loans in Forbearance Slightly Dips to 3.48%

Loans in forbearance fell for the 21st consecutive week, the Mortgage Bankers Association said on Monday.

Share of Mortgage Loans in Forbearance Slightly Dips to 3.48%

Loans in forbearance fell for the 21st consecutive week, the Mortgage Bankers Association said on Monday.

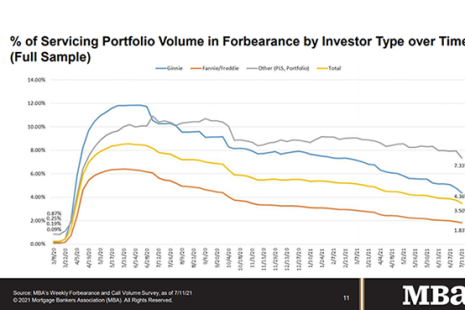

Share of Mortgage Loans in Forbearance Decreases to 3.50%

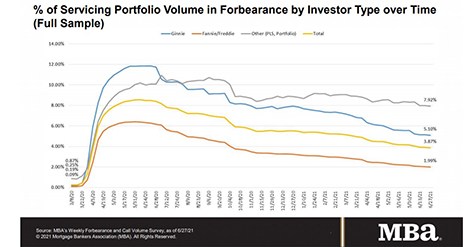

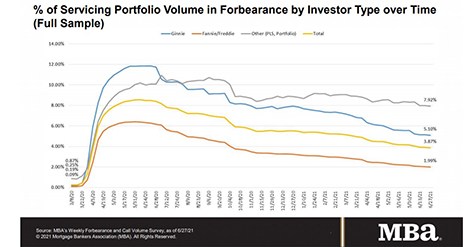

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 26 basis points to 3.50% of servicers’ portfolio volume as of July 11–the twentieth consecutive weekly decline.

Share of Mortgage Loans in Forbearance Decreases to 3.76%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 11 basis points to 3.76% of servicers’ portfolio volume as of July 4 from 3.87% the week before,–the 19th consecutive weekly decline. MBA estimates 1.9 million homeowners are in forbearance plans.

Share of Mortgage Loans in Forbearance Decreases to 3.76%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 11 basis points to 3.76% of servicers’ portfolio volume as of July 4 from 3.87% the week before,–the 19th consecutive weekly decline. MBA estimates 1.9 million homeowners are in forbearance plans.

MBA: Homeowners in Forbearance Plans Fall to under 2 Million

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased by 4 basis points to 3.87% of servicers’ portfolio volume as of June 27 from 3.91% the prior week. MBA estimates 1.9 million homeowners are in forbearance plans–the first time that two million or fewer homeowners have been in forbearance plans since March 2020, at the onset of coronavirus pandemic.

MBA: Homeowners in Forbearance Plans Fall to under 2 Million

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased by 4 basis points to 3.87% of servicers’ portfolio volume as of June 27 from 3.91% the prior week. MBA estimates 1.9 million homeowners are in forbearance plans–the first time that two million or fewer homeowners have been in forbearance plans since March 2020, at the onset of coronavirus pandemic.