2Q GDP Heats Up Some More

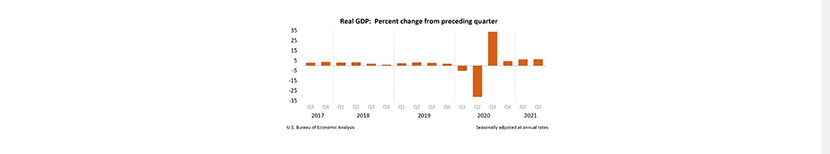

Real gross domestic product increased at an annual rate of 6.5 percent in the second quarter, according to the “advance” (first) estimate reported Thursday by the Bureau of Economic Analysis.

GDP ticked up slightly from the first quarter, when it increased by 6.3 percent, but remains red-hot as it surged past its pre-pandemic peak. The GDP estimate is based on source data that are incomplete or subject to further revision by the source agency The second (revised) estimate for the second quarter, based on more complete data, will be released on August 26.

BEA said the increase in real GDP in the second quarter reflected increases in personal consumption expenditures, nonresidential fixed investment, exports and state and local government spending, partly offset by decreases in private inventory investment, residential fixed investment and federal government spending. Imports, a subtraction in the calculation of GDP, increased (table 2).

BEA noted the increase in second quarter GDP reflected “continued economic recovery, reopening of establishments and continued government response related to the COVID-19 pandemic.”

Current‑dollar GDP increased 13.0 percent at an annual rate, or $684.4 billion, in the second quarter to a level of $22.72 trillion. In the first quarter, current-dollar GDP increased 10.9 percent, or $560.6 billion (revised, tables 1 and 3). More information on the source data that underlie the estimates is available in the Key Source Data and Assumptions file on BEA’s website.

The price index for gross domestic purchases increased 5.7 percent in the second quarter, compared with an increase of 3.9 percent (revised) in the first quarter (table 4). The PCE price index increased 6.4 percent, compared with an increase of 3.8 percent (revised). Excluding food and energy prices, the PCE price index increased 6.1 percent, compared with an increase of 2.7 percent (revised).

“The first estimate of second quarter economic growth showed very strong consumer spending – at almost a 12 percent annual growth rate – but other factors held back the overall pace of growth,” said Mike Fratantoni, Chief Economist with the Mortgage Bankers Association. “First, inventories declined, a reflection of the supply-chain constraints impacting multiple sectors of the economy. Second, the stronger U.S. economy compared to the rest of the world led to imports growing faster than exports, which weighs on growth. Finally, federal government spending dipped a bit relative to the first quarter, likely the result of more of the stimulus funds pushed out earlier this year.”

Fratantoni said the recent jump in inflation has likely caught the attention of the Federal Reserve. “Whether this increase in inflation is transitory or more persistent is one of the more important questions for the Federal Reserve to ponder over the next few quarters as they decide their next steps on rates,” he said.

Jay Bryson, Chief Economist with Well Fargo Economics, Charlotte, N.C., said the report was not quite as strong as the consensus forecast had anticipated.

“Despite the lower-than-expected growth rate in Q2, real GDP is now 0.8% higher than it was at its pre-pandemic peak in Q4-2019,” Bryson said. “That said, output is still 2.5% below where it would have been had the pandemic never happened and real GDP would have grown at its 2010-2019 average rate of 2.3% (annualized) per quarter. In other words, there is still an ‘output gap,’ which is consistent with the level of payrolls still 4.4% below their pre-pandemic peak.”

Bryson said as supply chains become functional again in coming quarters, businesses will endeavor to rebuild stocks and this stock building should support GDP growth in coming quarters. “We look for overall GDP growth to remain generally solid in coming quarters,” he said. “Consumers remain flush with cash and there still is pent-up demand for spending on services. Additionally, recent monthly data on factory orders suggest that business spending on equipment remains solid. These orders will need to be produced in coming months.”

However, Bryson cautioned the recent surge in COVID cases represents a downside risk to the economic outlook. “We do not expect that the economy will lock down as it did a year ago; that said, consumers could potentially become more cautious regarding travel, restaurant dining, stadium attendance, etc. if cases surge significantly higher,” he said.