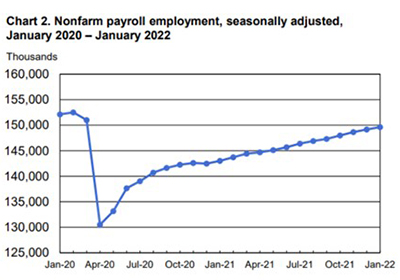

For the first time in months, the Employment Report from the Bureau of Labor Statistics exceeded expectations: employers added 467,000 jobs in January, despite a surge in Omicron-variant coronavirus cases, BLS reported Friday.

Tag: Mike Fratantoni

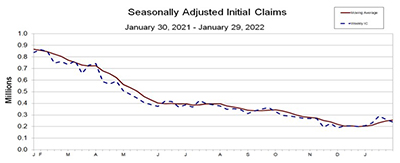

Initial Claims Down 23,000

Ahead of this morning’s employment numbers, the Labor Department reported initial claims for unemployment insurance fell by 23,000 last week.

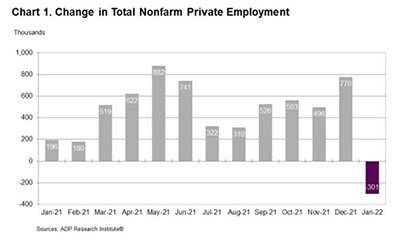

ADP: Private-Sector Employment Takes January Tumble

ADP, Roseland, N.J., said private-sector employment fell in January for the first time since December 2020, delivering a jolt to the post-pandemic economic recovery.

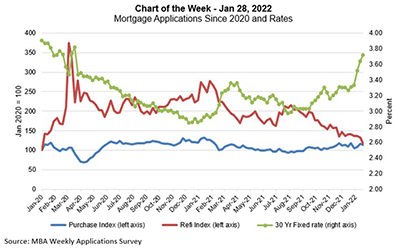

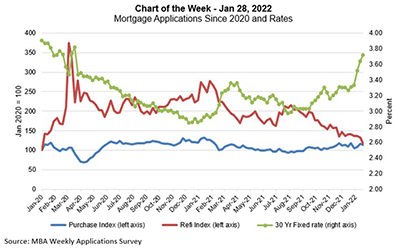

MBA Chart of the Week: Mortgage Applications, Rates Since 2020

This week’s MBA Chart of the Week features Weekly Applications Survey data, re-indexed to January 2020, to highlight the most recent refinance and home purchase trends.

MBA Chart of the Week: Mortgage Applications, Rates Since 2020

This week’s MBA Chart of the Week features Weekly Applications Survey data, re-indexed to January 2020, to highlight the most recent refinance and home purchase trends.

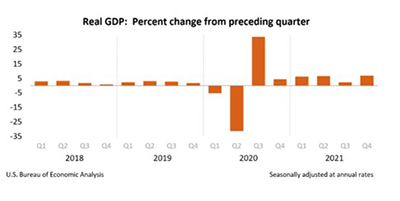

4Q GDP Shows Subtle Signs of Slowing

Despite the potential impact of Omicron variant on the U.S. economy, fourth quarter gross domestic product clipped along at nearly 7 percent, the Bureau of Economic Analysis reported Thursday. But the numbers might not be all that they seem, analysts said.

Fed Sets Stage for March Rate Hike

The Federal Open Market Committee on Wednesday did not pull trigger on an increase to the federal funds rate—but it left little doubt about action at its next policy meeting in March.

A More Challenging Economic Environment for IMBs

NASHVILLE, Tenn.—The nation’s economy—and just as importantly, the housing market—are as challenging and as opportunistic in any time in history, according to Mortgage Bankers Association economists.

A More Challenging Economic Environment for IMBs

NASHVILLE, Tenn.—The nation’s economy—and just as importantly, the housing market—are as challenging and as opportunistic in any time in history, according to Mortgage Bankers Association economists.

December Existing Home Sales Drop, But Annual Sales Reach 15-Year High

Existing home sales fell in December, the National Association of Realtors reported Thursday, snapping a streak of three straight monthly gains.