November Jobs Up by 210,000; Unemployment Rate Falls to 4.2%

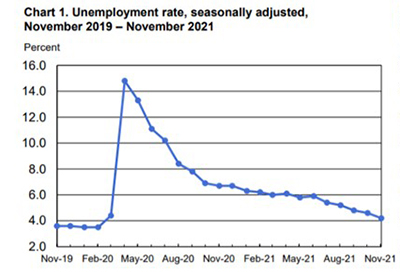

The November employment report followed a recent and inconsistent pattern: employment rose in November, although well below expectations, while the unemployment rate fell sharply, the Bureau of Labor Statistics reported Friday.

The report said total nonfarm payroll employment rose by 210,000 in November, and the unemployment rate fell by 0.4 percentage point to 4.2 percent. The change in total nonfarm payroll employment for September revised up by 67,000, from +312,000 to +379,000, while the change for October revised up by 15,000, from +531,000 to +546,000. With these revisions, employment in September and October was 82,000 higher than previously reported.

So far this year, monthly job growth has averaged 555,000. Nonfarm employment has increased by 18.5 million since April 2020 but remains down by 3.9 million, or 2.6 percent, from its pre-pandemic level in February 2020.

Notable job gains in November occurred in professional and business services, transportation and warehousing, construction and manufacturing. Employment in retail trade declined over the month.

The labor force participation rate edged up to 61.8 percent in November, but was 1.5 percentage points lower than in February 2020. The employment-population ratio increased by 0.4 percentage point to 59.2 percent in November. This measure is up from its low of 51.3 percent in April 2020 but remains below the figure of 61.1 percent in February 2020.

“Any way you look at it, the job market continues to improve,” said Mike Fratantoni, Chief Economist with the Mortgage Bankers Association. “The headline nonfarm payroll gain of 210,000 jobs in November was smaller than anticipated. However, as has been the case several times this year, there are reasons to believe that this understates the improvement. Almost six million more people are employed compared to last November. There was an almost 800,000 monthly increase on an unadjusted basis, and the seasonal adjustment factors are less reliable given the volatility during the pandemic. Finally, the employment gauge from the household survey was up 1.1 million over the month.”

Fratantoni noted the large decline in the unemployment rate to 4.2%, the increase in the labor force participation rate and the nearly 5% year-over-year gain in average hourly earnings (see below) all highlight the tightening job market. “Coupled with the still elevated number of job openings, and this suggests that the economy is getting closer to full employment,” he said. “It is also worth highlighting the steady gains in construction employment. More workers are needed to support the pickup in home construction MBA is forecasting in 2022.”

Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif., noted nearly 2.4 million workers still missing from the labor force compared with pre-pandemic levels, and their return has been slow.

“The focus remains on the other side of the labor market equation – labor supply,” Kushi said. “ November’s jobs report brought some good news for labor force participation as it increased to its highest level since March 2020. We need a low unemployment rate and a high participation rate to consider a labor market ‘healthy.’”

Kushi added while it’s too soon to tell what impact the Omicron variant of the coronavirus will ultimately have on the recovery, another wave of COVID-19 infections may further slow the return of workers to the labor market.” Indeed, the sector that faces the largest jobs shortfall compared with pre-pandemic levels – leisure and hospitality – is most dependent on controlling the virus,” she said.

Sarah House, Senior Economist with Wells Fargo Economics, Charlotte, N.C., agreed. “The household survey indicated that the labor market continues to rapidly tighten,” she said. “The unemployment rate tumbled to 4.2% even as the labor force participation rate rose and finally broke out of its post-pandemic range. The [Federal Open Market Committee] will clearly be discussing a faster taper at its upcoming December 15 meeting, but this morning’s payroll number and lighter read on average hourly earnings growth gives the Committee an out to perhaps punt to its January meeting.”

Mark Palim, Deputy Chief Economist with Fannie Mae, Washington, D.C., said the report continues to paint an “inconsistent picture” of the labor market. “BLS estimates that nonfarm payrolls grew by a disappointing 210,000 in November on a seasonally adjusted basis, a marked deceleration from prior months’ growth,” he said. “However, the household survey was much more positive this month, as household employment surged by more than 1.1 million in November and the unemployment rate fell by four-tenths to 4.2 percent.”

The report said average hourly earnings for all employees on private nonfarm payrolls jumped by 8 cents to $31.03 in November; over the past 12 months, average hourly earnings have increased by 4.8 percent. Average hourly earnings of private-sector production and nonsupervisory employees rose by 12 cents to $26.40.

BLS reported the average workweek for all employees on private nonfarm payrolls increased by 0.1 hour to 34.8 hours in November. In manufacturing, the average workweek edged up by 0.1 hour to 40.4 hours, and overtime was unchanged at 3.2 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls was unchanged at 34.1 hours.