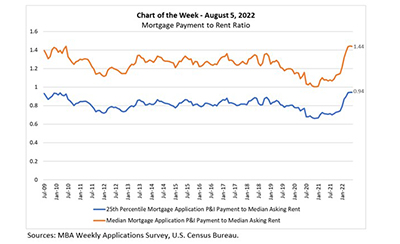

This MBA Chart of the Week examines the relationship between mortgage payments and asking rents since the second half of 2009. MBA’s national mortgage payment to rent ratio compares the national median and 25th percentile mortgage payments to the national median asking rent.

Tag: MBA Purchase Applications Payment Index

MBA: Mortgage Application Payments Hold Steady Despite Higher Rates

Homebuyer affordability was mostly unchanged in June, with the national median payment applied for by applicants down slightly to $1,893 from $1,897 in May, the Mortgage Bankers Association’s Purchase Applications Payment Index reported.

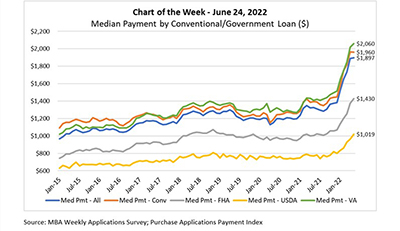

MBA Chart of the Week June 24, 2022: Median Payment by Conventional/Government Loan

The national median mortgage payment was $1,897 in May, a slight increase from $1,889 in April and $572 higher than in May 2021, according to this week’s Purchase Applications Payment Index release.

May Mortgage Application Payments Rise to $1,897

Homebuyer affordability was largely unchanged in May, with the national median payment applied for by applicants up slightly to $1,897 from $1,889 in April, according to the Mortgage Bankers Association’s monthly Purchase Applications Payment Index.

May Mortgage Application Payments Rise to $1,897

Homebuyer affordability was largely unchanged in May, with the national median payment applied for by applicants up slightly to $1,897 from $1,889 in April, according to the Mortgage Bankers Association’s monthly Purchase Applications Payment Index.

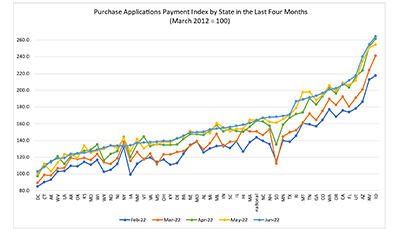

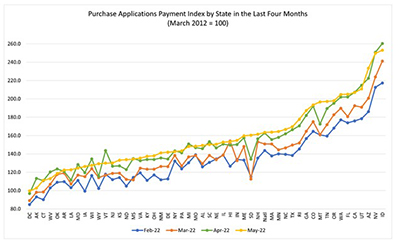

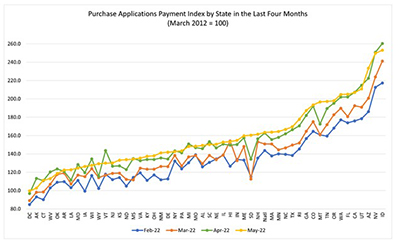

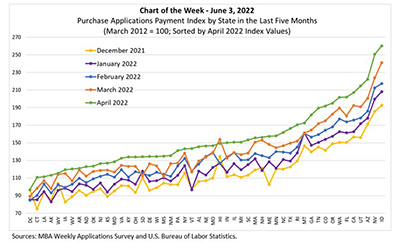

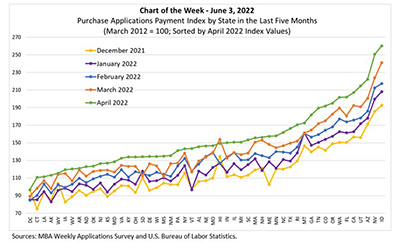

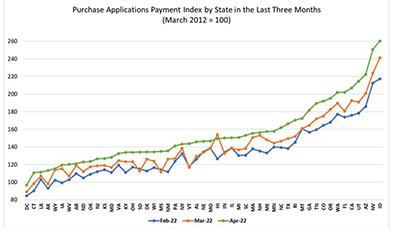

MBA Chart of Week June 3, 2022: MBA Purchase Applications Payment Index

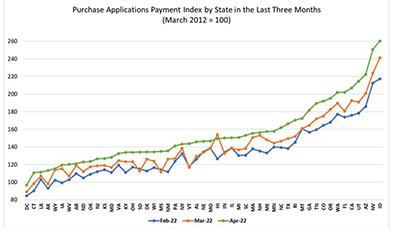

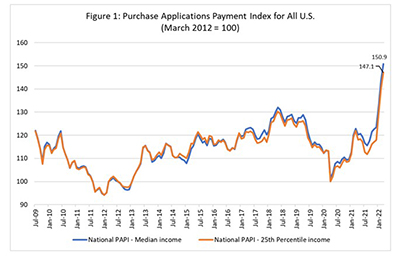

In March, MBA released its inaugural monthly Purchase Applications Payment Index (PAPI) – an affordability index that measures how new fixed-rate 30-year purchase mortgage payments vary across time relative to income. The third PAPI release on May 26 – based on April MBA Weekly Applications Survey data – gives us a picture of how affordability has been affected by increasing interest rates and elevated loan application amounts in the first third of 2022.

MBA Chart of Week June 3, 2022: MBA Purchase Applications Payment Index

In March, MBA released its inaugural monthly Purchase Applications Payment Index (PAPI) – an affordability index that measures how new fixed-rate 30-year purchase mortgage payments vary across time relative to income. The third PAPI release on May 26 – based on April MBA Weekly Applications Survey data – gives us a picture of how affordability has been affected by increasing interest rates and elevated loan application amounts in the first third of 2022.

MBA: April Mortgage Application Payments Jump 8.8% to $1,889

Homebuyer affordability decreased in April, with the national median payment applied for by applicants rising by 8.8 percent to $1,889 from $1,736 in March, the Mortgage Bankers Association reported Thursday.

MBA: April Mortgage Application Payments Jump 8.8% to $1,889

Homebuyer affordability decreased in April, with the national median payment applied for by applicants rising by 8.8 percent to $1,889 from $1,736 in March, the Mortgage Bankers Association reported Thursday.

MBA: March Median Mortgage Application Payment Jumps 5% to $1,736

Homebuyer affordability declined in March, with the national median payment applied for by applicants rising 5 percent to $1,736 from $1,653 in February, the Mortgage Bankers Association reported Thursday.