MBA: Mortgage Application Payments Hold Steady Despite Higher Rates

Homebuyer affordability was mostly unchanged in June, with the national median payment applied for by applicants down slightly to $1,893 from $1,897 in May, the Mortgage Bankers Association’s Purchase Applications Payment Index reported.

The MBA Purchase Applications Payment Index measures how new monthly mortgage payments vary across time relative to income using data from MBA’s Weekly Applications Survey.

“Median mortgage applications payments have held steady during the last two months but remain much higher than earlier this year,” said Edward Seiler, MBA Associate Vice President of Housing Economics and Executive Director of the Research Institute for Housing America.

Seiler noted the typical homebuyer’s mortgage payment in June was $509 more than in January, “which is why–along with rising economic uncertainty and high inflation–purchase demand has slowed in markets across the country,” he said.

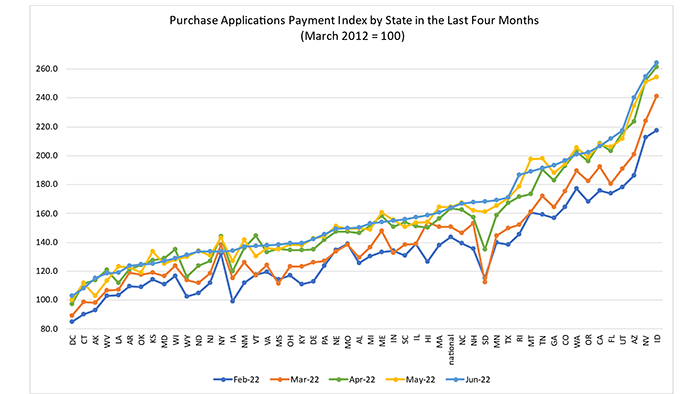

There are signs home-price growth is moderating, which Seiler called good news for overall affordability if mortgage rates also start declining. The median loan amount in June was down $10,182 from May and has dropped more than $20,000 since it peaked in February. “Sixteen states in June experienced improving affordability conditions due to lower mortgage application amounts,” he said.

An increase in MBA’s PAPI–which indicates declining borrower affordability conditions–means that the mortgage payment to income ratio is higher due to increasing application loan amounts, rising mortgage rates or a decrease in earnings. A decrease in the PAPI–indicative of improving borrower affordability conditions–occurs when loan application amounts decrease, mortgage rates decrease, or earnings increase.

The national PAPI decreased 0.2 percent to 163.9 in June from 164.2 in May, meaning payments on new mortgages take up a smaller share of a typical person’s income. Compared to June 2021 (119.3), the index has jumped 37.4 percent. For borrowers applying for lower-payment mortgages (the 25th percentile), the national mortgage payment was flat at $1,241.

Additional Key Findings of MBA’s Purchase Applications Payment Index (PAPI) – June 2022

• The national median mortgage payment was $1,893 in June, down from $1,897 in May and up from $1,889 in April. Payments have increased $509 (36.8%) in the first six months of 2022.

• The national median mortgage payment for FHA loan applicants was $1,474 in June, up from $1,430 in May and $1,022 in June 2021.

• The national median mortgage payment for conventional loan applicants was $1,959, down from $1,960 in May and up from $1,389 in June 2021.

• The top five states with the highest PAPI were: Idaho (264.2), Nevada (254.6), Arizona (240.2), Utah (217.3), and Florida (211.6).

• The top five states with the lowest PAPI were: Washington, D.C. (103.1), Connecticut (108.2), Alaska (115.4), West Virginia (118.5) and Louisiana (119.0).

• Homebuyer affordability increased slightly for Black households, with the national PAPI decreasing from 159.5 in May to 159.2 in June.

• Homebuyer affordability increased slightly for Hispanic households, with the national PAPI decreasing from 155.2 in May to 154.9 in June.

• Homebuyer affordability increased slightly for White households, with the national PAPI decreasing from 165.1 in May to 164.7 in June.

Click here for additional information on MBA’s Purchase Applications Payment Index.