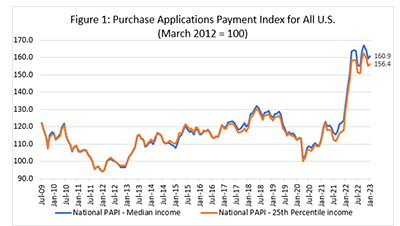

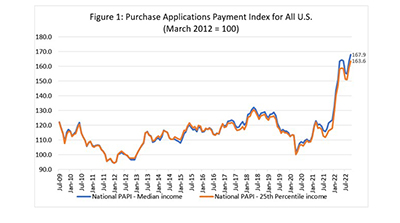

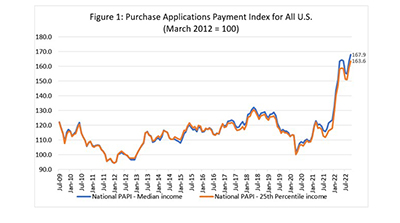

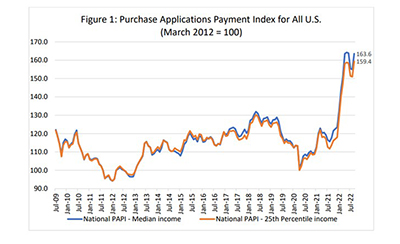

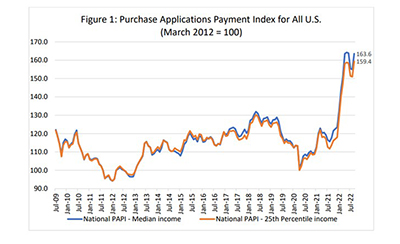

Homebuyer affordability declined in January, with the national median payment applied for by purchase applicants increasing 2.3 percent to $1,964 from $1,920 in December 2022, the Mortgage Bankers Association reported.

Tag: MBA Purchase Applications Payment Index

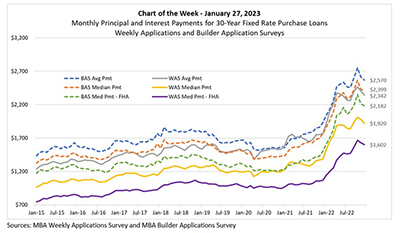

MBA Chart of the Week, Jan. 27, 2023: Monthly Principal, Interest Payments

In Thursday’s MBA Purchase Applications Payment Index (PAPI) release, MBA Research introduced a new measure—The Builders’ Purchase Applications Payment Index (BPAPI).

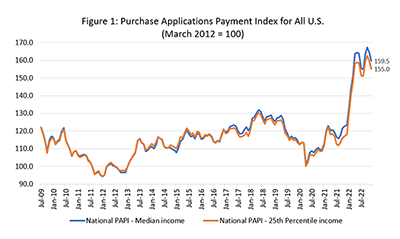

Mortgage Application Payments Fall 2.9% to $1,920 in December

Homebuyer affordability improved in December, with the national median payment applied for by purchase applicants decreasing 2.9 percent to $1,920 from $1,977 in November, the Mortgage Bankers Association reported.

November Mortgage Application Payments Fall 1.8% to $1,977

Homebuyer affordability improved in November, with the national median payment applied for by mortgage applicants decreasing 1.8 percent to $1,977 from $2,012 in October, according to the Mortgage Bankers Association’s Purchase Applications Payment Index.

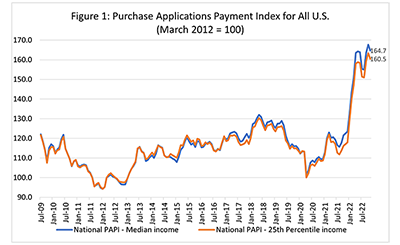

October Mortgage Application Payments Rise 3.7 Percent to $2,012

Homebuyer affordability continued its downward trajectory in October, as the national median payment applied for by applicants increased 3.7 percent to $2,012 from $1,941 in September, according to the Mortgage Bankers Association’s Purchase Applications Payment Index.

October Mortgage Application Payments Rise 3.7 Percent to $2,012

Homebuyer affordability continued its downward trajectory in October, as the national median payment applied for by applicants increased 3.7 percent to $2,012 from $1,941 in September, according to the Mortgage Bankers Association’s Purchase Applications Payment Index.

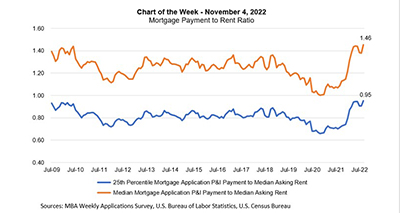

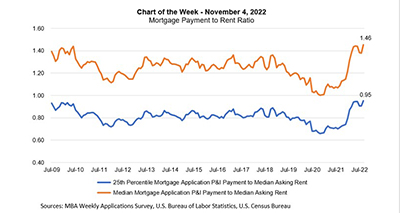

MBA Chart of the Week Nov. 4 2022: Mortgage Payment to Rent Ratio

This week’s MBA Chart of the Week examines another metric from our PAPI dataset – the mortgage payment to rent ratio. The orange line relates the median principal and interest payment to the median asking rent, and the blue line relates the 25th percentile mortgage application payment to the median asking rent (that may be a more suitable ratio for first-time homebuyers).

MBA Chart of the Week Nov. 4 2022: Mortgage Payment to Rent Ratio

This week’s MBA Chart of the Week examines another metric from our PAPI dataset – the mortgage payment to rent ratio. The orange line relates the median principal and interest payment to the median asking rent, and the blue line relates the 25th percentile mortgage application payment to the median asking rent (that may be a more suitable ratio for first-time homebuyers).

MBA: Homebuyer Affordability Drops in September Amid Surge in Mortgage Rates

Homebuyer affordability dropped in September, as the national median payment applied for by applicants increased by 5.5 percent to $1,941 from $1,839 in August, according to the Mortgage Bankers Association’s Purchase Applications Payment Index.

MBA: Homebuyer Affordability Drops in September Amid Surge in Mortgage Rates

Homebuyer affordability dropped in September, as the national median payment applied for by applicants increased by 5.5 percent to $1,941 from $1,839 in August, according to the Mortgage Bankers Association’s Purchase Applications Payment Index.