New survey findings released by MBA this week highlight the unprecedented, widespread mortgage forbearance already requested by borrowers affected by the spread of the coronavirus (COVID-19).

Tag: MBA Chart of the Week

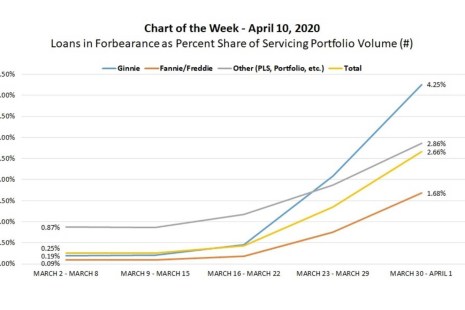

MBA Chart of the Week: Loans in Forbearance as Percent Share of Servicing Portfolios

New survey findings released by MBA this week highlight the unprecedented, widespread mortgage forbearance already requested by borrowers affected by the spread of the coronavirus (COVID-19).

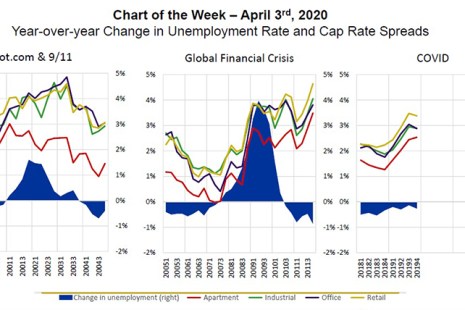

MBA Chart of the Week: Year-over-Year Change in Unemployment Rate and Cap Rate Spreads

For commercial real estate markets, a key factor in how we work through this period of uncertainty will be how investors value properties and their incomes. Our experiences in the past two recessions may provide some insights.

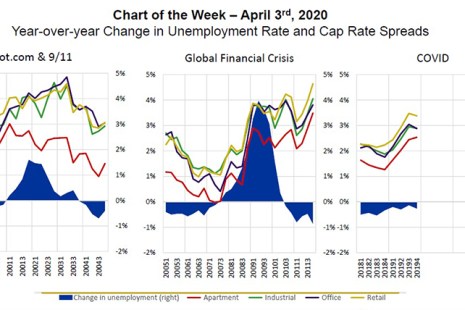

MBA Chart of the Week: Year-over-Year Change in Unemployment Rate and Cap Rate Spreads

For commercial real estate markets, a key factor in how we work through this period of uncertainty will be how investors value properties and their incomes. Our experiences in the past two recessions may provide some insights.

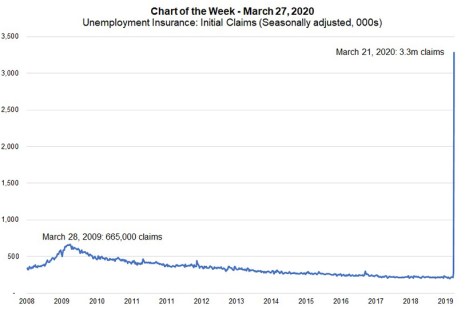

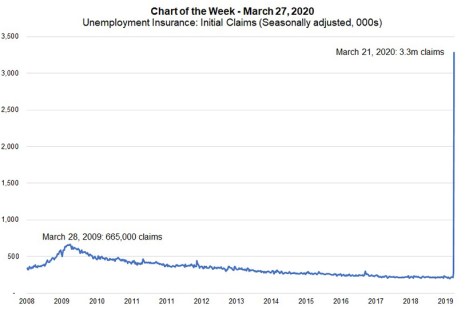

MBA Chart of the Week: Unemployment Insurance–Initial Claims

Last week provided our first indication of just how severe the shutdown of the U.S. economy could be, as Americans combat the ongoing spread of the coronavirus.

MBA Chart of the Week: Unemployment Insurance–Initial Claims

Last week provided our first indication of just how severe the shutdown of the U.S. economy could be, as Americans combat the ongoing spread of the coronavirus.

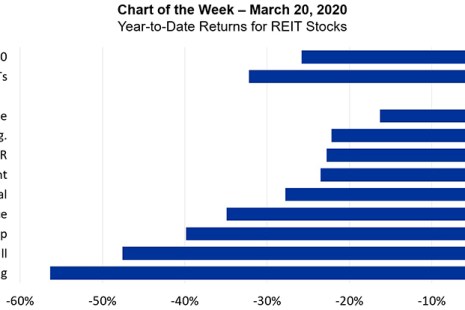

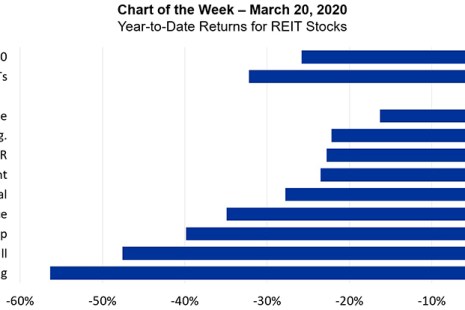

MBA Chart of the Week: Year-to-Date Returns for REIT Stocks

How the health, social and economic impacts of the coronavirus outbreak flow through to commercial and multifamily properties remains clouded in uncertainty – mainly because of the uncertainty about the virus itself and our public and private responses to it. One thing that is clear is that different property types and different markets will be affected differently.

MBA Chart of the Week: Year-to-Date Returns for REIT Stocks

How the health, social and economic impacts of the coronavirus outbreak flow through to commercial and multifamily properties remains clouded in uncertainty – mainly because of the uncertainty about the virus itself and our public and private responses to it. One thing that is clear is that different property types and different markets will be affected differently.

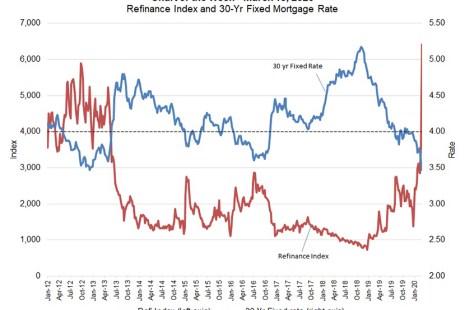

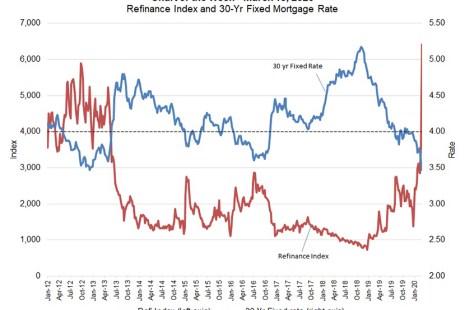

MBA Chart of the Week: Refinance Index and 30-Year Fixed Mortgage Rate

Treasury rates and mortgage rates have fallen to historic lows, driven down by the market turmoil and volatility caused by the uncertainty around the spread of the coronavirus.

MBA Chart of the Week: Refinance Index and 30-Year Fixed Mortgage Rate

Treasury rates and mortgage rates have fallen to historic lows, driven down by the market turmoil and volatility caused by the uncertainty around the spread of the coronavirus.