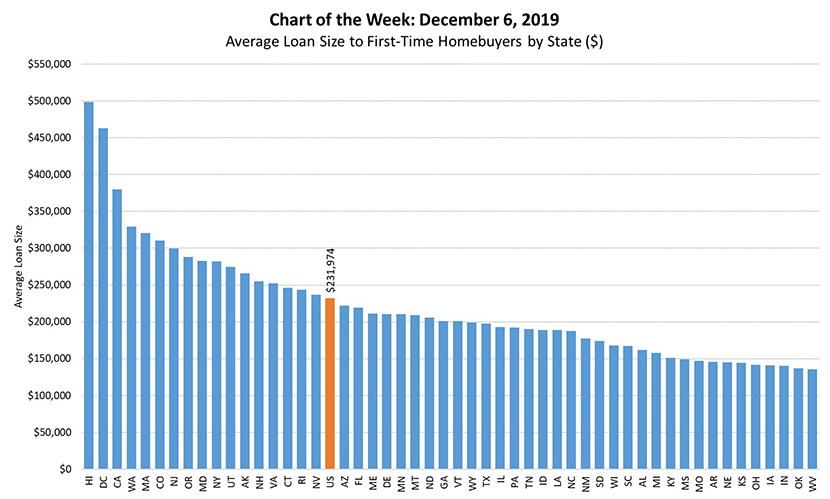

MBA Chart of the Week: Average Loan Size to First-Time Home Buyers

On average, the size of a first-time home buyer’s mortgage was $231,974 in the first three quarters of 2018, based on loan acquisitions data from Fannie Mae and Freddie Mac. This represents a 4.2% increase over the average size of $223,000 for mortgages to first-time home buyers originated in 2017 and an acceleration from the 1.8% annual gain in 2016.

Across states, average loan sizes varied substantially due to broad differences in home price trends. First-time home buyers in Hawaii took out the largest mortgages, averaging just shy of half a million dollars ($498,711), whereas mortgages to first-time home buyers in West Virginia were one-quarter of the size ($135,311). In general, most average loan sizes concentrated around the lower end of the spectrum, with 34 of 54 states falling below the national average loan size ($200,808). High-volume, high-price states such as California, New York, Washington, New Jersey and Massachusetts drove the national average higher.

While we have seen more first-time home buyers in the purchase market of late, we have also seen their characteristics change–they are older, have higher incomes and as shown in the chart, are taking out larger mortgages. This is likely driven by tighter credit in previous years, accelerating home-price appreciation, and other household finance factors such as student loan debt accumulation.

This week’s analysis comes from a sample of single-family mortgages originated in 2018 and acquired by Fannie Mae and Freddie Mac, and excludes condos, co-ops, PUDs and manufactured housing. First-time homebuyers are defined as those borrowers purchasing a property as their primary residence, and who had no sole or joint interest in a property in the 3 years prior to purchasing the mortgage.

(Jonathan Penniman is assistant director of systems and analytics with MBA; he can be reached at jpenniman@mba.org.)