The forward path of inflation remains a topic of great debate and conjecture. How that path plays into the relative benefits of different investment options – including commercial real estate and other real assets – will give us even more insights into the relationship.

Tag: MBA Chart of the Week

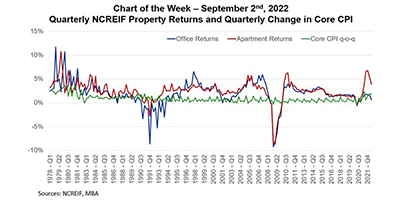

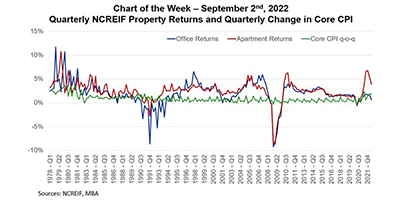

MBA Chart of the Week: Quarterly NCREIF Property Returns

The forward path of inflation remains a topic of great debate and conjecture. How that path plays into the relative benefits of different investment options – including commercial real estate and other real assets – will give us even more insights into the relationship.

MBA Chart of the Week: Quarterly NCREIF Property Returns

The forward path of inflation remains a topic of great debate and conjecture. How that path plays into the relative benefits of different investment options – including commercial real estate and other real assets – will give us even more insights into the relationship.

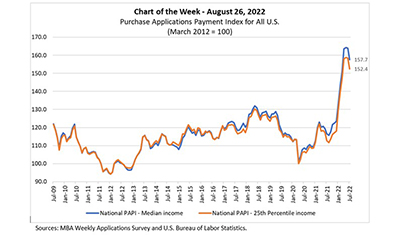

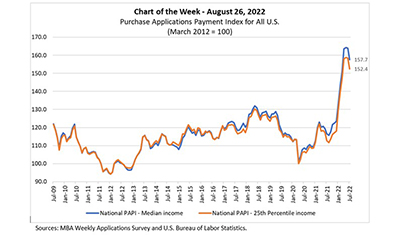

MBA Chart of the Week, Aug. 26, 2022: MBA Purchase Applications Payment Index

In this MBA Chart of the Week, we examine how market transitions are affecting homebuyer affordability.

MBA Chart of the Week, Aug. 26, 2022: MBA Purchase Applications Payment Index

In this MBA Chart of the Week, we examine how market transitions are affecting homebuyer affordability.

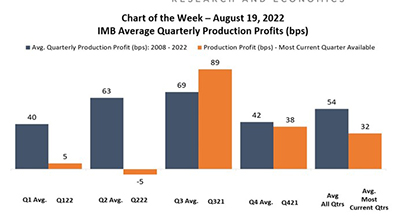

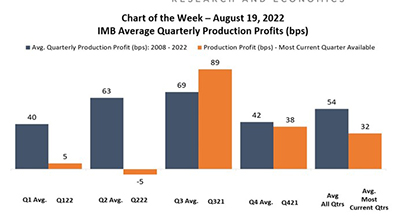

MBA Chart of the Week Aug. 19 2022: IMB Average Quarterly Production Profits

This week’s MBA Chart of the Week illustrates the average historical pre-tax production profits for each respective quarter of the year, from Q3 2008 to Q2 2022. These historical quarterly averages are then compared to the most current net production profit corresponding to that quarter.

MBA Chart of the Week Aug. 19 2022: IMB Average Quarterly Production Profits

This week’s MBA Chart of the Week illustrates the average historical pre-tax production profits for each respective quarter of the year, from Q3 2008 to Q2 2022. These historical quarterly averages are then compared to the most current net production profit corresponding to that quarter.

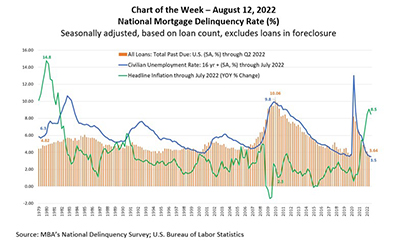

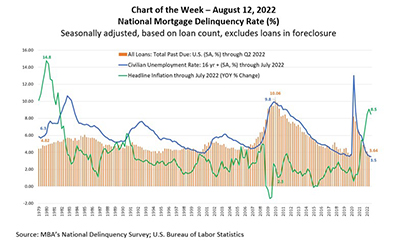

MBA Chart of the Week, Aug. 12, 2022: National Mortgage Delinquency Rate

This week’s MBA Chart of the Week highlights the relationship between MBA’s mortgage delinquency rate and two economic indicators, the unemployment rate, and year-over-year changes in headline inflation – measuring the price of goods and services in the economy.

MBA Chart of the Week, Aug. 12, 2022: National Mortgage Delinquency Rate

This week’s MBA Chart of the Week highlights the relationship between MBA’s mortgage delinquency rate and two economic indicators, the unemployment rate, and year-over-year changes in headline inflation – measuring the price of goods and services in the economy.

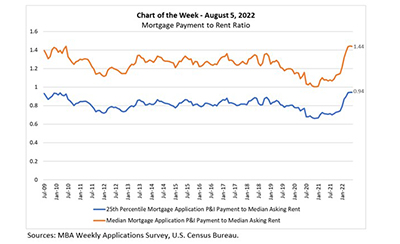

MBA Chart of the Week Aug. 8, 2022: Mortgage Payment to Rent Ratio

This MBA Chart of the Week examines the relationship between mortgage payments and asking rents since the second half of 2009. MBA’s national mortgage payment to rent ratio compares the national median and 25th percentile mortgage payments to the national median asking rent.