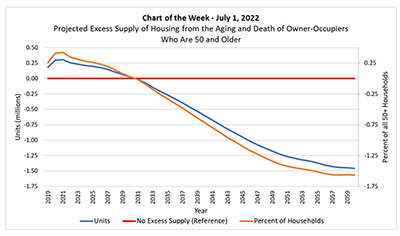

MBA Chart of the Week July 1, 2022: Projected Excess Supply of Housing from the Aging of Baby Boomers

The Research Institute for Housing America, MBA’s think tank, released a special report, “Who Will Buy the Baby Boomers’ Homes When They Leave Them?”, authored by Gary Engelhardt of Syracuse University. The report examines population aging, mortality and the future of the housing market.

In 2019, there were 32 million Boomer homeowners (i.e., 41% of all homeowners). Many analysts have suggested that their aging and eventual death may have an important impact on the future housing market, with the possibility that the residential market will “flood” with inventory, leading to substantially depressed house price growth and new construction—a phenomenon termed as the “Silver Tsunami.” In contrast to a tsunami, Engelhardt shows, using careful empirical analysis, that aging and mortality in the U.S. is slow-moving and largely predictable—perhaps more of a “Silver Glacier.”

This week’s MBA Chart of the Week replicates Figure 23 from the RIHA report. The blue line plots the projected excess supply of housing from the aging and death of older homeowners, defined as the difference between the projected supply of homes to the market for homeowners aged 50 and older for 2019-2060, and the projected total demand for homes supplied to the market by homeowners aged 50 and older (that transition to occupants of all ages). Similarly, the orange line measures the excess supply as a share of the total number of households with heads 50 and older.

Based on changing demographics, over the next decade there is projected to be a modest amount of excess supply of homes for sale—around quarter-million units annually. While this excess supply will be a very small share (less than one-half of a percent), it constitutes a non-trivial share of current new housing starts and completions, which suggests that most of the adjustment will be through a reduction in the growth of new housing, with some softness in the rental market. Beyond 2032, demographic change is more favorable to demand. This occurs because of compositional changes of the population toward the Millennials and general population growth, as well as the conversion of previously owner-occupied units to rental housing. Engelhardt’s report provides important predictions for the nation but does not drill-down to cities and states with large retiree populations (that could be disproportionately hit by the Silver Tsunami).

Englehardt concludes his report by noting that “Incorporating geographic variation into projections of future housing demand and supply from population aging is an important avenue for future research” – a topic that MBA Research will continue to follow