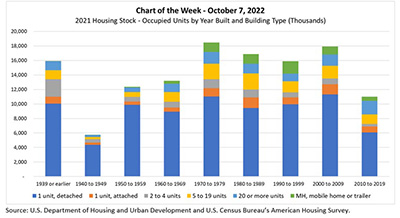

In this week’s MBA Chart of the Week, we show the stock of occupied homes in the U.S. by the decade built and by building type. The chart indicates that the housing stock in the U.S. is aging.

Tag: MBA Chart of the Week

MBA Chart of the Week Oct. 7, 2022: 2021 Housing Stock

In this week’s MBA Chart of the Week, we show the stock of occupied homes in the U.S. by the decade built and by building type. The chart indicates that the housing stock in the U.S. is aging.

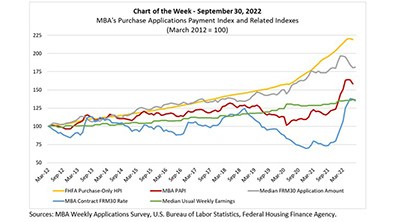

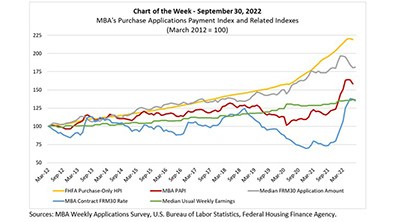

MBA Chart of the Week Sept. 30, 2022: MBA Purchase Applications Payment Index

Last week, the Federal Housing Finance Agency released its Purchase-Only House Price Index for July. The HPI was down 0.6% from the previous month, although up 13.9% from July 2021. The HPI has increased by nearly 120% since March 2012 (yellow line), and is up 39% since the start of the COVID-19 pandemic in March 2020.

MBA Chart of the Week Sept. 30, 2022: MBA Purchase Applications Payment Index

Last week, the Federal Housing Finance Agency released its Purchase-Only House Price Index for July. The HPI was down 0.6% from the previous month, although up 13.9% from July 2021. The HPI has increased by nearly 120% since March 2012 (yellow line), and is up 39% since the start of the COVID-19 pandemic in March 2020.

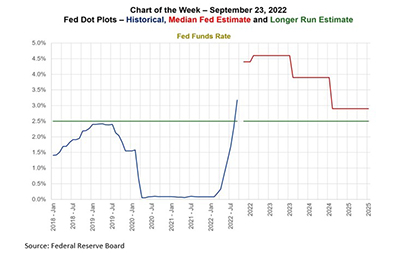

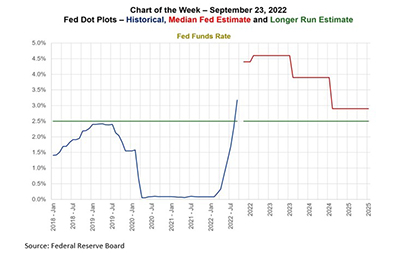

MBA Chart of the Week Sept. 23, 2022–Fed Dot Plots

In response to inflation continuing to run well above its target of 2%, the Federal Reserve this week again raised the federal funds target by 75 basis points. Now at 3%, the rate above what most FOMC members consider to be the long-term level and should be effective in reducing demand and slowing inflation over time.

MBA Chart of the Week Sept. 23, 2022–Fed Dot Plots

In response to inflation continuing to run well above its target of 2%, the Federal Reserve this week again raised the federal funds target by 75 basis points. Now at 3%, the rate above what most FOMC members consider to be the long-term level and should be effective in reducing demand and slowing inflation over time.

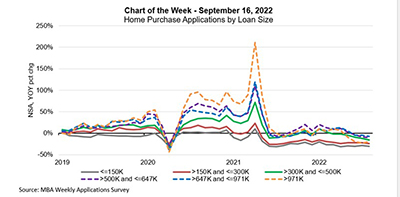

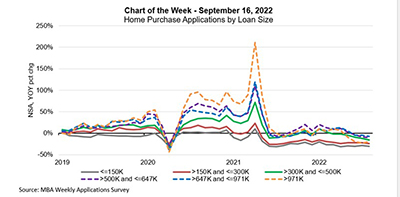

MBA Chart of the Week, Sept. 16, 2022: Home Purchase Applications by Loan Size

The housing market continues to face challenges from economic uncertainty, high home-price growth and volatile mortgage rates. MBA’s Weekly Applications Survey data show that overall mortgage application activity continues to trend lower, as refinances have quickly dried up due to rates rising throughout the year and hitting the 6-percent mark for the first time since 2008.

MBA Chart of the Week, Sept. 16, 2022: Home Purchase Applications by Loan Size

The housing market continues to face challenges from economic uncertainty, high home-price growth and volatile mortgage rates. MBA’s Weekly Applications Survey data show that overall mortgage application activity continues to trend lower, as refinances have quickly dried up due to rates rising throughout the year and hitting the 6-percent mark for the first time since 2008.

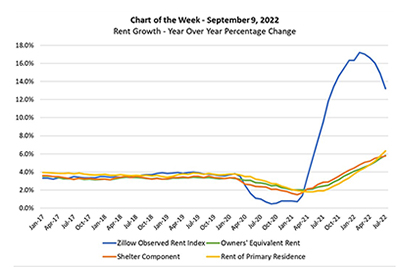

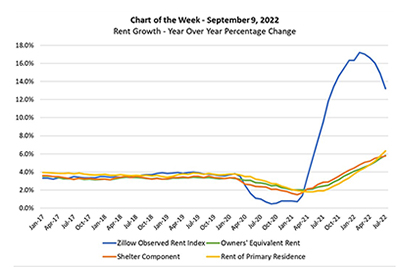

MBA Chart of the Week: Rent Growth–Year-over-Year Percentage Change

This week’s MBA Chart of the Week highlights a question related to housing costs and inflation: If home price appreciation and rent growth have been in double digits in the past few quarters—as highlighted by the (blue lined) Zillow Observed Rent Index in the chart—why is the shelter component (orange line) of the Consumer Price Index below 6%?

MBA Chart of the Week: Rent Growth–Year-over-Year Percentage Change

This week’s MBA Chart of the Week highlights a question related to housing costs and inflation: If home price appreciation and rent growth have been in double digits in the past few quarters—as highlighted by the (blue lined) Zillow Observed Rent Index in the chart—why is the shelter component (orange line) of the Consumer Price Index below 6%?