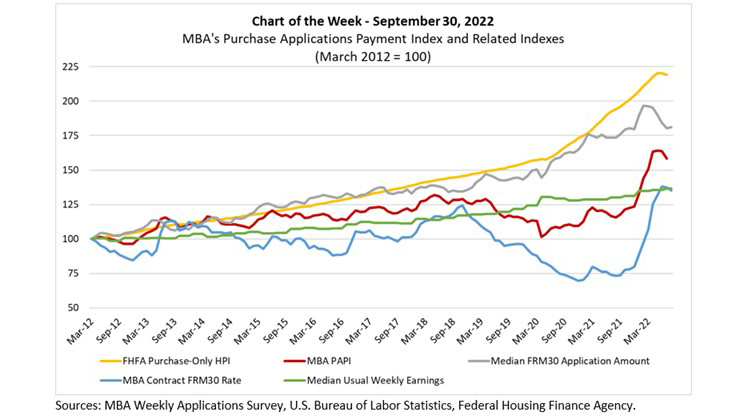

MBA Chart of the Week Sept. 30, 2022: MBA Purchase Applications Payment Index

Last week, the Federal Housing Finance Agency released its Purchase-Only House Price Index for July. The HPI was down 0.6% from the previous month, although up 13.9% from July 2021. The HPI has increased by nearly 120% since March 2012 (yellow line), and is up 39% since the start of the COVID-19 pandemic in March 2020.

In this week’s MBA Chart of the Week, we show how the change in FHFA’s HPI is related to changes in MBA’s Purchase Applications Payment Index and its related inputs.

PAPI measures how new mortgage principal and interest payments, based on MBA’s Weekly Applications Survey 30-year fixed-rate purchase mortgage applications, vary over time relative to income. The PAPI series in the chart (red line) is for the entire U.S. and is based on the median monthly application amount, 30-year fixed interest rate, and median usual weekly earnings. The PAPI was up by 1.5% over a span of eight years, from March 2012 to 101.5 in April 2020 but reached 123.5 at the end of 2021, a further 22% increase. It then increased 33% to reach a peak of 164.2 in May 2022 and has since fallen to 157.9 in August 2022. The 28% increase in PAPI in the first eight months of 2022 indicates an acute decline in homebuyer affordability.

The PAPI is relative to earnings (green line), which have increased by 37% since March 2012, and is also moderated by the median loan application amount (gray line) increasing at a slower pace than the HPI—exemplified by the gap between the yellow and gray lines since February 2021. The median application amount has decreased from a series high of $340,000 to $313,500 in August, as high-end home sales have slowed and many home purchasers are forced to reduce their target home price range.

The PAPI has also fallen in the last few months as interest rates decreased in July and August by 4 and 7 basis points, respectively (blue line). However, the increase in rates in the last few weeks—up to a 6.52% contract rate in this week’s Weekly Applications Survey—means that absent a large drop in the median loan application and/or a large increase in earnings, the PAPI for September will increase. If we assume nothing else changes, a 60 basis point increase in the September interest rate will increase the median monthly payment by $121 to a series high of $1,961. This would represent a 29.5% increase over the median payment at the end of 2022.

The September PAPI data will be released on Thursday, October 27.

—Edward Seiler eseiler@mba.org.