TransUnion, Chicago, said the financial services industry is rebounding strongly from the early impacts of the COVID-19 pandemic, with auto, credit card, mortgage and personal loan industries exhibited renewed signs of strength at the mid-point of 2021.

Tag: Matt Komos

TransUnion: Majority of Consumers in Accommodation Programs Continue to Make Payments

Enrollment in financial hardship programs grew significantly as a result of the COVID-19 pandemic – to 7% of all accounts for credit products such as auto loans and mortgages. However, a new TransUnion study reported the majority of consumers continued to make payments on their accounts, even when in an accommodation program.

TransUnion: Consumer Credit Performance Improving, Demand Increasing

TransUnion, Chicago, said despite shockwaves felt from the COVID-19 pandemic, the consumer credit market is strongly positioned as many parts of the country prepare to enter new phases of re-opening this summer.

Housing Market Roundup: Apr. 15, 2021

Beware the Ides of April—unless it’s news you seek. Because we have plenty of housing market reports below to slake your thirst.

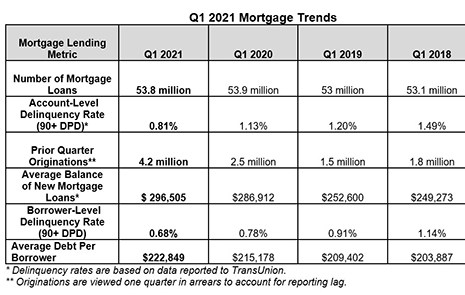

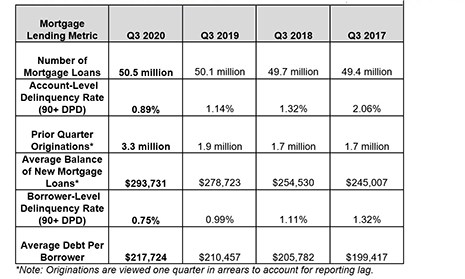

TransUnion: Popularity of 15-, 20-Year Mortgages Continues to Grow

TransUnion, Chicago, said as low interest rates drive refinance activity, short-term loans—i.e., 15-year and 20-year mortgages—continue to increase in popularity, a trend that played out in the third quarter.

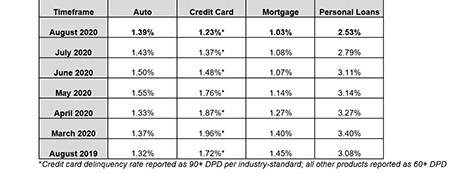

Consumers Resilient Despite Broader Economic Challenges

Serious delinquency rates in August improved once more across all consumer credit segments even as the number of people in accommodation programs dropped for the second consecutive month, reported TransUnion, Chicago.

TransUnion: Consumer Credit Market Withstands Coronavirus Challenges

TransUnion, Chicago, reported the total percentage of accounts in “financial hardship” status dropped during July for mortgages, auto loans, credit cards and personal loans – marking the first such decrease since the start of the COVID-19 pandemic.

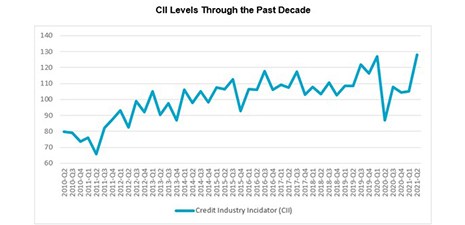

Consumers Poised for Continued Strong Credit Activity

TransUnion, Chicago, said its quarterly Industry Insights Report points to several factors that portend good things for retailers this holiday season.