Consumers Resilient Despite Broader Economic Challenges

(Chart courtesy TransUnion)

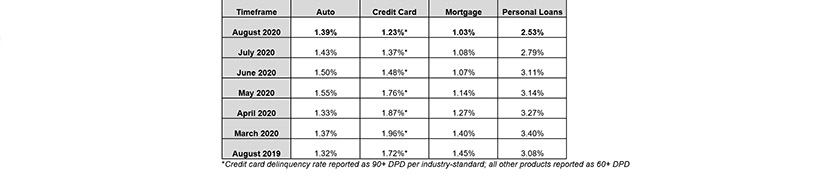

Serious delinquency rates in August improved once more across all consumer credit segments even as the number of people in accommodation programs dropped for the second consecutive month, reported TransUnion, Chicago.

However, TransUnion said despite positive consumer credit performance, its Monthly Industry Snapshot also points to potential challenges in the near future.

During August, serious consumer-level delinquency rates improved for auto loans, credit cards, mortgages and personal loans. Since the start of the pandemic in March, consumer performance has been mostly positive with continued month-over-month improvements for many of these products.

“A significant percentage of consumers utilized financial accommodations to defer or freeze payments during the early stages of the pandemic,” said Matt Komos, vice president of research and consulting with TransUnion. “As the first wave of consumers exit accommodation and a period of excess liquidity, they are returning to their debt obligations and continuing to perform. Consumers who still remain in hardship could be more likely to face income losses and thus have more difficulty exiting these programs than consumers who may have entered into hardship programs as a precautionary measure.”

The report found the percentage of accounts in “financial hardship” continued a downward month-over-month trajectory for auto loans, credit cards, mortgages and personal loans from the months of July to August. Across all credit products, the percentage of accounts in financial hardship during the month of August dipped to pre-May levels. Accommodation programs provided consumers with payment flexibility and added liquidity during the course of the pandemic. However, as the number of consumers leveraging such programs decreases and government relief funds are not expected to renew, many consumers may find themselves at an inflection point.

The report cautioned while serious delinquency rates continued to decline in August, negative movement occurred in 30-day delinquency rates. “This uptick for both products could signify that consumers are starting to roll forward on deferred payments as they come off of hardship programs,” Komos said. “However, it’s still much too early to tell. It could simply be a missed or delayed payment that is late by a few days or weeks, though the consumer’s intention is still to make the payment.”

Close attention is being paid to delinquency levels as TransUnion’s latest Financial Hardship Survey from the week of August 24th found that COVID-19 continues to financially impact consumers. While the percentage of financially impacted Americans dipped to 52% – the lowest level since the ongoing survey series began in March – the concern among impacted consumers regarding their ability to pay bills and loans remains high (75%).

According to the survey, nearly one-third of impacted consumers are turning to savings to pay bills or loans and 13% cited they plan to open new credit cards. Despite these concerns, data from the monthly snapshot found that consumers are continuing to make payments as the average credit card balance per consumer dropped to $5,127 in August, compared to $5,686 the previous year. In addition, the average Aggregate Excess Payment, the average amount consumers are paying over their respective minimum payments, increased to $330 in August 2020, though similar to what was observed at the same time last year ($300).

“Many consumers have continued to make payments even when enrolled in financial accommodation plans,” Komos said. “The real litmus test in regards to consumer credit health will become apparent in the coming months when these safeguards begin to expire and consumers have less payment flexibility.”