TransUnion: Popularity of 15-, 20-Year Mortgages Continues to Grow

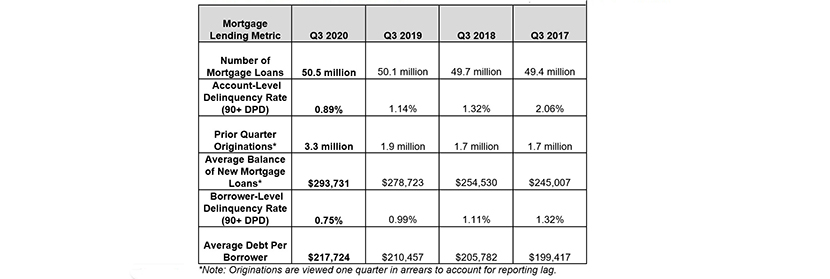

(Chart courtesy TransUnion.)

TransUnion, Chicago, said as low interest rates drive refinance activity, short-term loans—i.e., 15-year and 20-year mortgages—continue to increase in popularity, a trend that played out in the third quarter.

The company’s quarterly Industry Insights Report noted mortgage originations increased to 3.3 million in in the second quarter, a 76% increase over the 1.9 million from a year ago. Refinance originations continue to drive a substantial percentage of origination activity with a 256% increase over last year. Rate and term refinance originations grew at a rate of 444%, while cash out refinance originations grew 113% year over year. Meanwhile, purchase originations grew at a slower rate of 5% year over year.

The Mortgage Bankers Association expects that trend to continue as well. The MBA forecasts 2020 mortgage originations to jump to $3.18 trillion by the end of 2020 and come in at 2.49 trillion, with refinancings dropping to $946 billion and purchase originations to increase to $1.54 trillion.

TransUnion reported for home purchases, 15- and 20-year loans grew by 62% and 57%, respectively, outpacing the growth of 30-year loans, which experienced no growth in the third quarter. The report said shorter loan terms have outpaced the growth of 30-year loans since Q3 2019. Market share for 15-year purchase loans increased from 6% to 9% year over year and 20-year purchase loans rose from 2% to 3%. Market share for traditional 30-year loans declined from 87% to 83% over that same period.

“Historically, low interest rates have contributed to substantial refinance origination growth in the mortgage market,” said Joe Mellman, Senior Vice President and Mortgage Business Leader with TransUnion. “We observed this over the past quarter with refis accounting for the lion’s share of origination activity.”

Mellman said despite economic uncertainties presented by COVID-19, purchase originations have remained strong with some consumers exploring shorter term loan options such as the 15-year and 20-year loans. “As refinance volumes are likely to decline in 2021, lenders may find opportunities for origination volume growth on the purchase market side, particularly with first-time home buyers,” he said.

The report also found credit card balances decreased significantly on both a quarterly and annual basis, a trend TransUnion said places even more emphasis on this year’s 2020 holiday shopping season.

The report said credit cards are the most widely used credit product in the U.S. with nearly 450 million accounts as of the third quarter. However, average consumer-level credit card balances have declined across all credit risk tiers over the course of the COVID-19 pandemic and now stand at $5,075 as of the third quarter, down from $5,668 a year ago. Additionally, total bankcard balances fell to $723 billion, a decline of more than 10% year over year and the lowest level since Q2 2017.

“Credit card balances have been severely impacted by the COVID-19 pandemic as consumers have slowed purchases, especially on travel and entertainment,” said Paul Siegfried, senior vice president and credit card business leader at TransUnion. “With fewer people using their credit cards to buy airline tickets or spend money on vacations, it’s understandable to see such a precipitous drop in balances. At the same time, we’ve observed consumers using their credit cards to spend more on home-related purchases. There is also a belief that with the immense slowdown in balance growth during the last few quarters, we may see increased credit usage this fourth quarter as some consumers may be positioned to make more purchases this holiday season.”

The recent declines in total credit card balances reverse a three-year trend between the third quarters of 2017-2019. During those years, consumers consistently increased the balances of their private-label and general purpose credit cards in the quarters preceding the holiday shopping season; balance increases continued during the fourth quarter holiday shopping season. In the 2019 holiday shopping season, consumers added $40.4 billion in bankcard balances – an increase of nearly 27% from the 2018 season.

The report said consumer sentiment, though, puts pressure on the continuation of this trend. A TransUnion financial hardship survey in late October found more than half of Americans (54%) said they have been financially impacted by the COVID-19 pandemic. Of those persons, half said they expect to decrease retail spending in the next three months and nearly six in 10 (59%) will do less discretionary spending.

“At the onset of the pandemic, financial hardship programs and the first round of government assistance initially boosted consumer liquidity,” said Matt Komos, vice president of research and consulting with TransUnion. “However, external factors such as rising unemployment and uncertainty regarding additional stimulus legislation may be impacting spending. Consequently, consumers have tightened their wallets to account for a decrease in disposable income. This holiday season will be of special importance to determine if consumers may start turning the corner on spending, or if we will see continued tightening of credit use.”