TransUnion: Consumer Credit Performance Improving, Demand Increasing

TransUnion, Chicago, said despite shockwaves felt from the COVID-19 pandemic, the consumer credit market is strongly positioned as many parts of the country prepare to enter new phases of re-opening this summer.

The company’s Q1 2021 Industry Insights Report found consumers are performing well one year since the pandemic began as serious delinquency rates remain mostly down and loan originations continue to rise from COVID-19 lows.

TransUnion said these improvements are occurring against a backdrop of a pandemic that caused one of the greatest shocks in the history of the American economy. In March 2020, the unemployment rate stood at 4.4%. In April 2020, it jumped to 14.7% — the highest reading since 1940.

The report noted a consequence of this dramatic rise was a sharp slowdown in loan originations. Some lenders tightened their standards and consumers held back on opening loans in the first months of the pandemic. For instance, unsecured personal loan originations dropped from 3.9 million in Q1 2020 to 2.6 million in Q2 2020. Credit card originations declined at an even faster rate – from 15.5 million to 8.6 million in the same timeframe.

However, the report pointed out several early 2021 signs point to more improvements ahead. Government programs and improving employment helped spur the University of Michigan Consumer Sentiment Index to move up from 76.8 in February 2021 to 84.9 in March. A report from the Commerce Department’s Bureau of Economic Analysis found that personal consumption expenditures increased 4.2% in March. And Oxford Economics anticipates real consumer spending growth of 9.6% in 2021.

The continued improvements in the economy have led to more loan activity. The report said in the past two quarters, credit card originations have risen to 12.3 million (Q3 2020) and 15.5 million (Q4 2020) from the lows observed in Q2 2020 (8.6 million). As demand for credit rises, serious delinquency rates stand near record lows. Lending and credit use slowed in Q2 2020, but government stimulus and forbearance programs caused an interesting dynamic to play out where serious delinquency levels have mostly dropped despite elevated unemployment.

“This last year has been like no other, but in many respects it has highlighted the wherewithal of the U.S. consumer to persevere under the most extreme conditions,” said Matt Komos, vice president of research and consulting with TransUnion. “Consumers and lenders, alike, took more prudent measures with their credit use. Buoyed by government stimulus programs, many consumers used their benefits to remain current on accounts. As we near the first half of the year and more of the country opens, there is a strong sense that pent up demand for new loans will lift the consumer credit market even higher.”

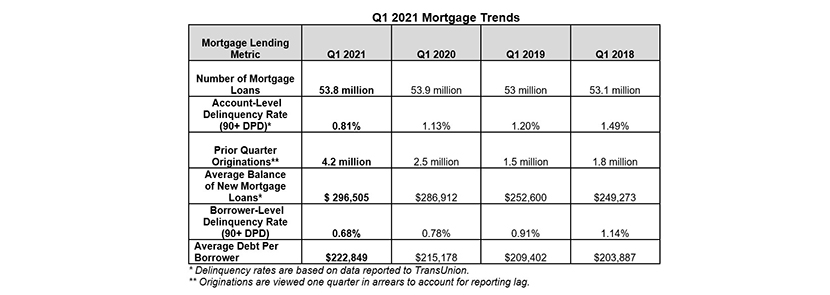

The report noted the surge in mortgage originations continued in Q4 2020 (viewed one quarter in arrears) as serious delinquencies headed lower in Q1 2021. Mortgage origination volume increased to more than 4 million in Q4 2020, 73% higher than at the same time last year. It is the highest quarterly volume recorded since TransUnion began tracking the metric in 2011. Refinancing made up 53% of the share compared to 47% from purchase. One year earlier, refinance constituted 43% of share compared to 57% for purchase. Both purchase and refinancing rose significantly in the last year with purchase up 42% and rate and term refinance increasing 160%. Cash out refinancing also increased 64% from the previous year. Serious mortgage delinquency rates continued to decline, falling from 1.13% in Q1 2020 to 0.81% in Q1 2021 – the lowest level observed in at least 10 years. The number of mortgage accounts in accommodation status remained elevated.

“The low interest rate environment and rising home values are driving the mortgage market,” said Joe Mellman, TransUnion Senior Vice President and Mortgage Business Leader. “Housing demand is outweighing housing supply, which is causing the rise in home values. At the same time, higher home values are giving more consumers opportunities to refinance and conduct cash out refinancing. Serious delinquency rates are at near record lows, partly driven by the percentage of accounts in accommodation status. While we anticipate delinquency rates to move higher once these accounts come out of accommodation, we also expect many of these consumers to do all they can to make payments and protect the equity in their homes.”

Additionally, the report said personal loan originations began to recover in the Q4 2020, steadily growing after the market contracted nearly 50% in Q2 2020, and 30% in Q3 2020. Originations were still 20% below Q4 2019 levels. Fintechs and bank lenders continue to see more significant year-over-year declines. In Q1 2021, total balances fell for the fourth consecutive quarter – led by 10%+ declines in the below prime tiers. Interestingly, super prime borrowers experienced a 6.3% increase in balance growth during the same timeframe. Serious delinquency rates dropped 73 basis points in the last year and now stand at 2.66% as of Q1 2021, even as the number of accounts in accommodation declines. Government stimulus and higher savings rates continue to contribute to lower delinquency.

“While many lenders are looking to return to growth in the coming quarters, we anticipate consumer demand for personal loans to grow more slowly,” said Liz Pagel, TransUnion Senior Vice President and Consumer Lending Business Leader.” Personal loans are often used for debt consolidation, and credit card balances were down significantly in 2020 and will take time to rebuild. As more states re-open their economies, we expect to see more activity as consumers seek to finance vacations, home improvements and other large purchases. We also expect that lenders will continue to gain confidence in the economy and open their buy-boxes to higher risk consumers, which could drive growth.”