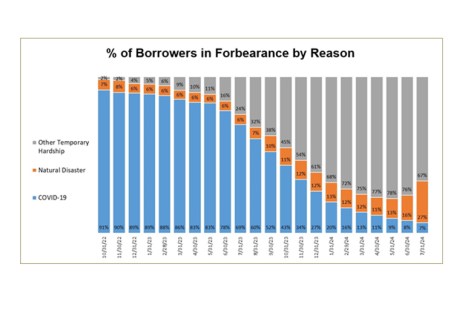

MBA’s monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 2 basis points from 0.40% of servicers’ portfolio volume in the prior month to 0.38% as of Feb. 28, 2025.

Tag: Marina Walsh

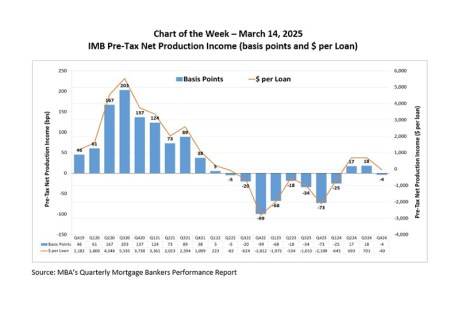

IMBs Report Production Losses in Fourth Quarter of 2024

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a pre-tax net loss of $40 on each loan they originated in the fourth quarter, a decrease from the reported net profit of $701 per loan in the third quarter, MBA’s Quarterly Mortgage Bankers Performance Report found.

Chart of the Week: IMB Pre-Tax Net Production Income

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a pre-tax net loss of 4 basis points in the fourth quarter, a decrease from the net profit of 18 basis points in the third quarter, MBA’s Quarterly Mortgage Bankers Performance Report found.

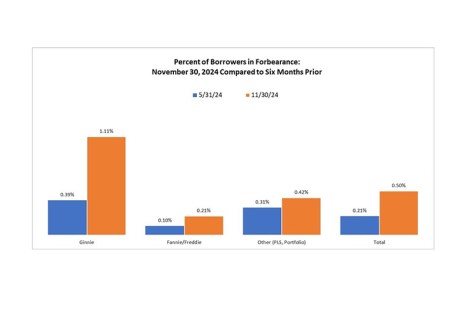

MBA: Share of Mortgage Loans in Forbearance Increases to 0.50% in November

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance increased to 0.50% as of Nov. 30, 2024.

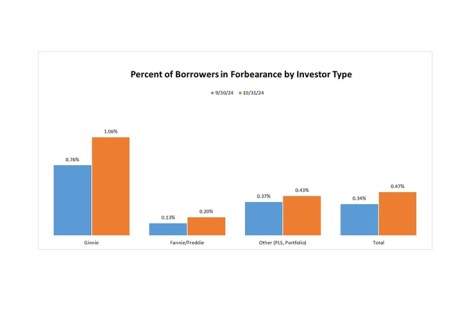

Share of Mortgage Loans in Forbearance Increases to 0.47% in October, MBA Finds

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance increased to 0.47% as of Oct. 31, 2024.

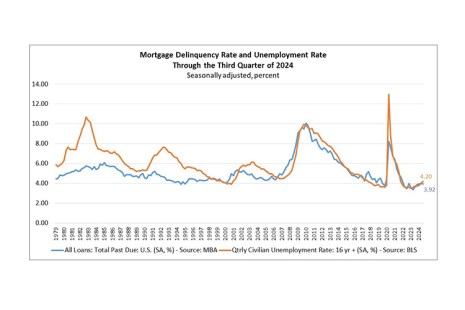

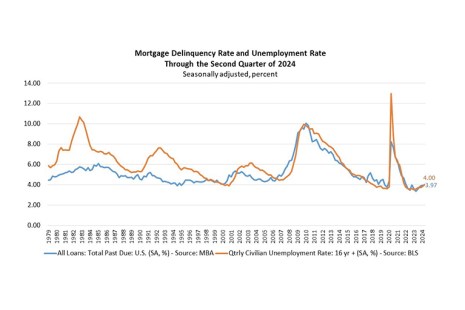

MBA: Mortgage Delinquencies Decrease Slightly in the Third Quarter of 2024, Up on Annual Basis

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased slightly to a seasonally adjusted rate of 3.92% of all loans outstanding at the end of the third quarter of 2024 compared to one year ago, according to the Mortgage Bankers Association’s National Delinquency Survey.

MBA Reports Share of Mortgage Loans in Forbearance Increases to 0.27% in July

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance increased to 0.27% as of July 31, 2024.

MBA: Mortgage Delinquencies Increase in Second Quarter

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.97% of all loans outstanding at the end of the second quarter, MBA’s National Delinquency Survey found.

MBA: Home Equity Lending Volume Stays Relatively Flat in 2023; Debt Outstanding Increases

Total originations of open-ended Home Equity Lines of Credit (HELOCs) and closed-end home equity loans increased in 2023 by 1.5% compared to the previous year, while debt outstandings increased 8.3%.

MBA: Share of Mortgage Loans in Forbearance Increases to 0.23% in June

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance increased to 0.23% as of June 30, 2024