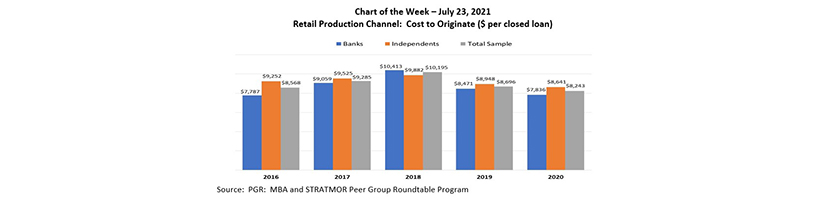

MBA Chart of the Week July 23 2021: Retail Production Channel Cost to Originate

In 2020, net production profit in the retail production channel (which excludes third party and consumer direct originations) averaged $5,351 per loan based on a cross-section of 91 lenders, including mid-size and large banks and independent mortgage companies. To a large extent, this net profit was driven by production revenues, as secondary marketing income escalated. But to what extent did production costs also play a role?

In this week’s MBA Chart of the Week, we focus on the production costs in the retail channel. The cost to originate averaged $8,243 per loan in 2020, a $453 per loan improvement over 2019. Breaking out the sample between depository banks and non-depository independent mortgage companies, costs per loan declined across both groups. However, the decline for the banks was substantially more, dropping by $635 per loan to $7,836 per loan in 2020. Meanwhile, the independents’ cost to originate dropped by $307 per loan to $8,641 per loan in 2020.

Over the past five years, the cost to originate was lower for banks compared to independents except in 2018. Banks tend to be more cautious in making staff adjustments for volume fluctuations, which could explain both the lower costs in 2020, and the higher costs in 2018 compared to the independents. In addition, other factors come into play to explain cost differences such as product and investor mix, average loan balances, sales structure and incentive plans, and processing times. Regardless of company type, overall cost improvements were modest compared to retail revenue gains that grew by $3,788 per loan to $13,594 loan in 2020.

Note: The cost to originate in the retail channel includes:

- Sales costs. Commissions, salary and other costs for loan officers, loan officer assistants, other sales managers and staffs, marketing, sales office leases, etc.

- Fulfillment costs for processing, underwriting, closing, and other functions necessary to close a loan.

- Technology costs for point-of-sale and loan origination systems, network technology, and help desk.

- Production support (non-tech) for post-closing, secondary, quality control, and credit policy.

- Corporate costs such as executive management, legal, human resources, corporate finance, and parent allocations.

–Marina Walsh, CMB mwalsh@mba.org.