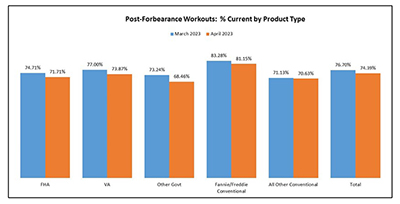

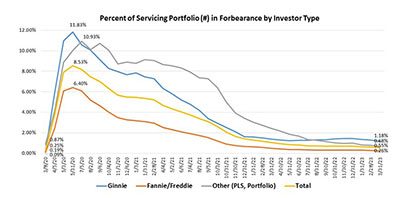

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance decreased by 4 basis points to 0.51% of servicers’ portfolio volume as of April 30 from 0.55% in March.

Tag: Marina Walsh CMB

MBA: Share of Mortgage Loans in Forbearance Falls in April to 0.51%

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance decreased by 4 basis points to 0.51% of servicers’ portfolio volume as of April 30 from 0.55% in March.

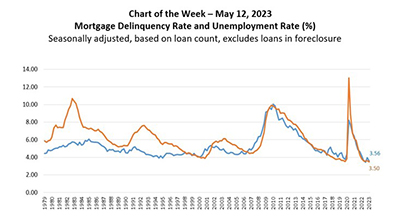

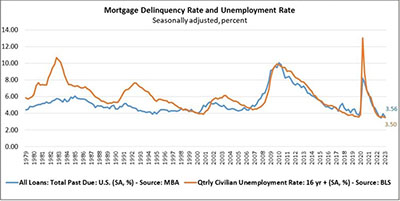

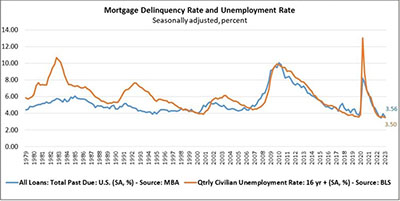

MBA Chart of the Week May 12, 2023: Mortgage Delinquency Rate, Unemployment Rate

This week’s chart shows that mortgage delinquencies and the unemployment rate continue to track each other closely.

MBA Chart of the Week May 12, 2023: Mortgage Delinquency Rate, Unemployment Rate

This week’s chart shows that mortgage delinquencies and the unemployment rate continue to track each other closely.

MBA: 1Q Mortgage Delinquency Rates Near Historic Lows

Mortgage delinquency rates fell to near-historic lows in the first quarter, the Mortgage Bankers Association reported Thursday.

MBA: 1Q Mortgage Delinquency Rates Near Historic Lows

Mortgage delinquency rates fell to near-historic lows in the first quarter, the Mortgage Bankers Association reported Thursday.

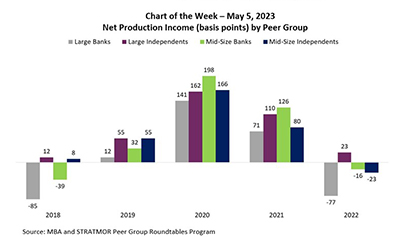

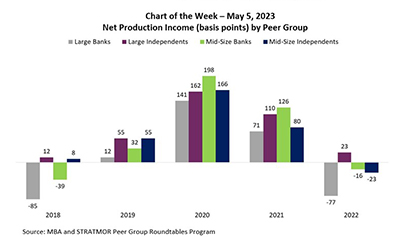

MBA Chart of the Week May 5, 2023: Net Production Income by Peer Group

In this week’s MBA Chart of the Week, we look at pre-tax net production income from a different source – the MBA and STRATMOR Peer Group Roundtables Program. This program was started in 1998 along with STRATMOR Group and is our most comprehensive data collection – providing results for both banks and independents, and then further divided by volume and business model.

MBA Chart of the Week May 5, 2023: Net Production Income by Peer Group

In this week’s MBA Chart of the Week, we look at pre-tax net production income from a different source – the MBA and STRATMOR Peer Group Roundtables Program. This program was started in 1998 along with STRATMOR Group and is our most comprehensive data collection – providing results for both banks and independents, and then further divided by volume and business model.

MBA Research Roundup May 2023

Each month, MBA Research releases a roundup of recent data, activities and other pertinent developments crucial to the real estate finance industry. For more information regarding MBA Research products, click on the headline.

MBA: Share of Mortgage Loans in Forbearance Decreases to 0.55%

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance decreased by 5 basis points to 0.55% of servicers’ portfolio volume in March from 0.60% in February.