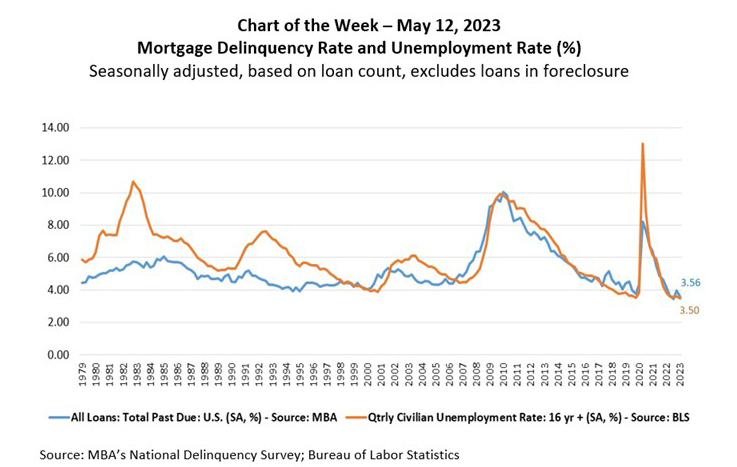

MBA Chart of the Week May 12, 2023: Mortgage Delinquency Rate, Unemployment Rate

According to the Mortgage Bankers Association’s National Delinquency Survey released last week, the delinquency rate for mortgage loans on one‐to‐four‐unit residential properties fell to a seasonally adjusted rate of 3.56 percent of all loans outstanding at the end of the first quarter.

The delinquency rate was down 40 basis points from the previous quarter and was 55 points lower than one year ago. The mortgage delinquency rate fell to its lowest level for any first quarter since MBA’s survey began in 1979 and was the second lowest quarterly rate overall, just 11 basis points above the survey low in third quarter 2022.

This week’s chart shows that mortgage delinquencies and the unemployment rate continue to track each other closely. Last week, the Bureau of Labor Statistics released its monthly employment data that showed a surprisingly strong job market in April; the unemployment rate fell back to 3.4 percent set in January. Consistent with this resilient job market, in which we are still seeing jobs being added to the economy and wages are growing at a steady pace, the performance of existing mortgages is exceeding expectations.

The most recent quarterly figures for the mortgage delinquency rate at 3.56 percent and unemployment rate at 3.50 percent are well below historical averages. Across the period from first quarter of 1979 to the first quarter of 2023, the mortgage delinquency rate averaged 5.28 percent, while the unemployment rate averaged 6.14 percent.

–Ahn Doan adoan@mba.org; Marina Walsh, CMB mwalsh@mba.org.