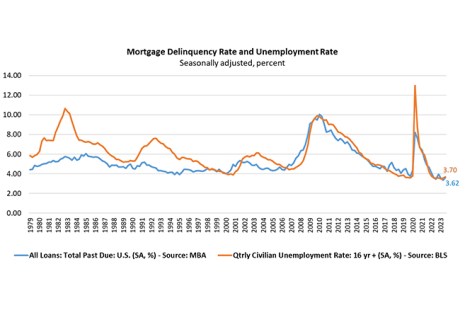

According to the latest MBA National Delinquency Survey, the overall delinquency rate for mortgage loans on one‐to‐four‐unit residential properties increased to 3.62 percent of all loans outstanding at the end of the third quarter of 2023.

Tag: Marina Walsh CMB

MBA: Mortgage Delinquencies Increase in the Third Quarter

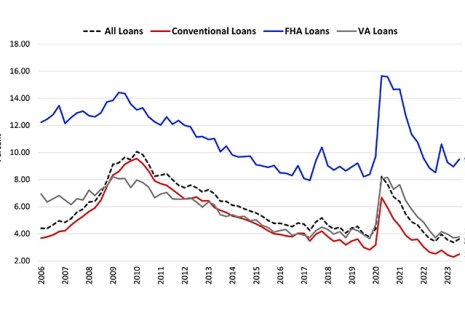

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.62% of all loans outstanding at the end of the third quarter of 2023, according to the Mortgage Bankers Association’s National Delinquency Survey.

MBA: Share of Mortgage Loans in Forbearance Decreases to 0.31% in September

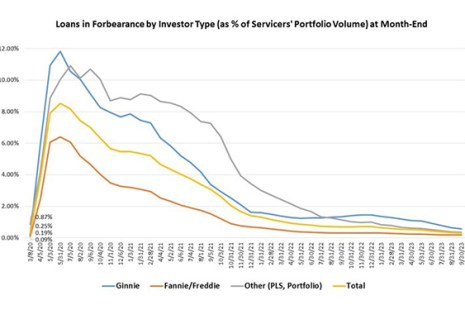

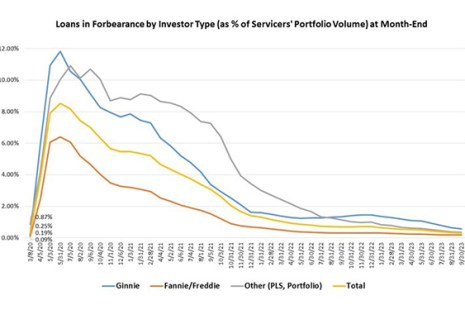

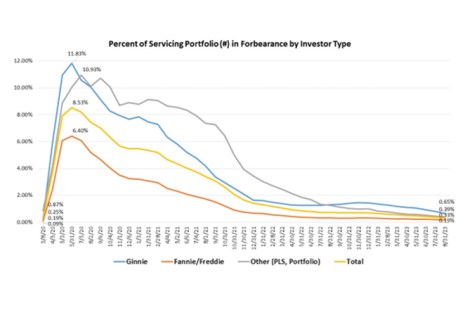

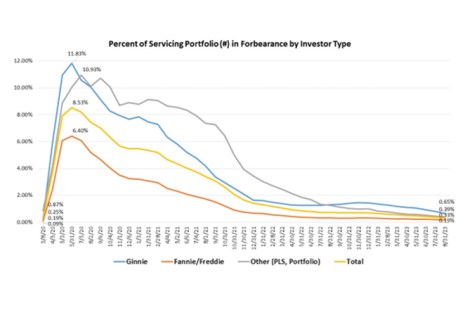

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 2 basis points from 0.33% of servicers’ portfolio volume in the prior month to 0.31% as of September 30, 2023.

MBA Forecast: Mortgage Originations to Increase 19% to $1.95 Trillion in 2024

PHILADELPHIA–The Mortgage Bankers Association announced at its 2023 Annual Convention & Expo that total mortgage origination volume is expected to increase to $1.95 trillion in 2024 from the $1.64 trillion expected in 2023.

Quote: Oct. 17, 2023

“The number of loans in forbearance dropped in September, but the overall performance of servicing portfolios and loan workouts declined slightly.”

–Marina Walsh, CMB, MBA Vice President of Industry Analysis.

MBA: Share of Mortgage Loans in Forbearance Decreases to 0.31% in September

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 2 basis points from 0.33% of servicers’ portfolio volume in the prior month to 0.31% as of September 30, 2023.

MBA Forecast: Mortgage Originations to Increase 19% to $1.95 Trillion in 2024

PHILADELPHIA–The Mortgage Bankers Association announced at its 2023 Annual Convention & Expo that total mortgage origination volume is expected to increase to $1.95 trillion in 2024 from the $1.64 trillion expected in 2023.

MBA Forecast: Mortgage Originations to Increase 19% to $1.95 Trillion in 2024

PHILADELPHIA–The Mortgage Bankers Association announced at its 2023 Annual Convention & Expo that total mortgage origination volume is expected to increase to $1.95 trillion in 2024 from the $1.64 trillion expected in 2023.

Share of Mortgage Loans in Forbearance Decreases to 0.33% in August

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 6 basis points from 0.39% of servicers’ portfolio volume in the prior month to 0.33% as of August 31, 2023. According to MBA’s estimate, 165,000 homeowners are in forbearance plans. Mortgage servicers have provided forbearance to approximately 7.92 million borrowers since March 2020.

Share of Mortgage Loans in Forbearance Decreases to 0.33% in August

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 6 basis points from 0.39% of servicers’ portfolio volume in the prior month to 0.33% as of August 31, 2023. According to MBA’s estimate, 165,000 homeowners are in forbearance plans. Mortgage servicers have provided forbearance to approximately 7.92 million borrowers since March 2020.