MBA Chart of the Week: HELOC and Home Equity Loan Commitment Volume

(Image courtesy MBA Home Equity Lending Study, 2022 data)

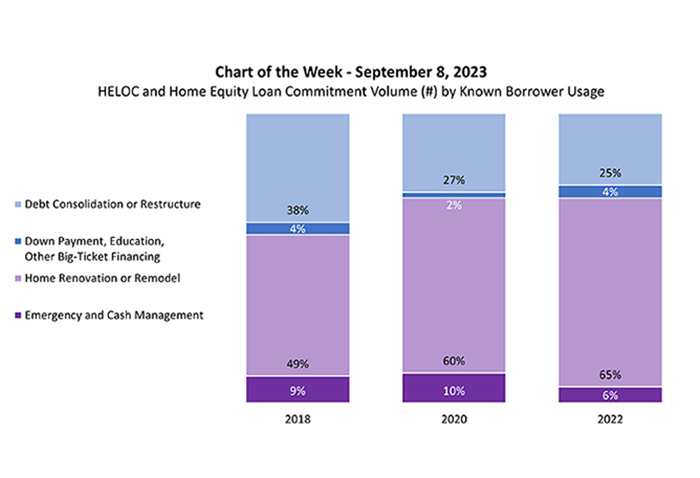

Dollar volume of open-end home equity lines of credit (HELOCs) and closed-end home equity loans originated in 2022 increased 50 percent compared to 2020, driven by home renovation or remodeling, according to MBA’s latest Home Equity Lending Study. This week’s Chart of the Week explores the known reasons that borrowers take out a HELOC or home equity loan, according to participants in our study.

Home renovation or remodeling has historically been the primary reason that borrowers leverage the equity in their homes, but this percentage has grown from about one-half (49 percent) of loans originated in 2018, to nearly two-thirds (65 percent) of loans originated in 2022. The combination of a high interest rate environment and home price appreciation driven by a shortage of housing inventory has encouraged borrowers to improve their existing homes rather than relocate and forfeit their low-rate first mortgage. Tax advantages of financing improvements via HELOC, home equity loan, and the persistence of remote work, are other contributing factors.

Another 25 percent of borrowers cited debt consolidation or restructure as their reason for taking out a HELOC or home equity loan, followed by 6 percent citing emergency and cash management (i.e., a “rainy day fund”), and the remaining 4 percent citing other big-ticket financing, such as down payments or education. Some borrowers cited “other” reasons or no reason at all for their HELOC or home equity loan, and those borrowers are not included in this week’s chart showing “known” usage.

Given borrowers’ trillions of untapped equity in real estate, lenders anticipate the home equity market to grow in the near term. If you are a lender or servicer of HELOCs or home equity loans and would like to gather data to benchmark your home equity business in this time of heightened demand, now is the time to register for MBA’s 2024 Home Equity Lending Study (covering 2023 data). A publication of highlighted data from the 2023 study (covering 2022 data) is also now available for purchase. Please contact homeequity@mba.org with any questions.

MBA’s Marina Walsh, CMB, will discuss the study results on a panel with HousingWire on Thursday, September 14th, 2023, from 2-3 PM ET. Registration is currently open.