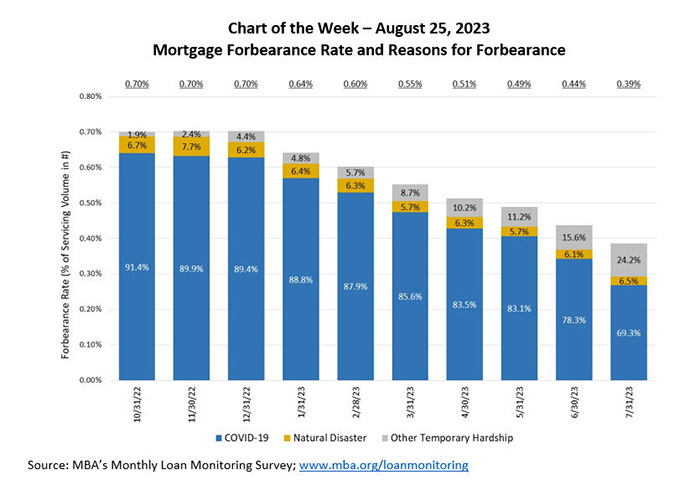

MBA Chart of the Week Aug. 28: Mortgage Forbearance Rate and Reasons for Forbearance

Source: MBA’s Monthly Loan Monitoring Survey; www.mba.org/loanmonitoring

According to the July results from MBA’s Monthly Loan Monitoring Survey, the total number of loans now in forbearance decreased by 5 basis points from 0.44% of servicers’ portfolio volume in the prior month to 0.39% as of July 31, 2023. Over the past three years, the forbearance rate has dropped from a monthly peak of 8.53% reached at the end of May 2020. According to MBA’s estimate, 195,000 homeowners remain in forbearance plans, and mortgage servicers have provided forbearance to approximately 7.9 million borrowers since March 2020.

This Chart of the Week highlights the decline in the forbearance rate relative to borrower reasons for forbearance over the past ten months. With the COVID-19 national emergency lifted and agency announcements setting deadlines for COVID-19 forbearance and forbearance workouts, the stated reasons that borrowers are in forbearance are changing. Over two-thirds of borrowers are still in forbearance because of the effects of COVID-19, but a growing share of borrowers are in forbearance for other reasons such as natural disasters and other temporary hardships causing financial distress including divorce, death, and job loss, among others.

Going forward, it will be important for borrowers to understand that the terms of forbearance for natural disasters and temporary hardships are different from COVID-related forbearance, with some of the flexibilities available during the pandemic sunsetting.

By Marina Walsh, CMB; Jon Penniman