The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance remained unchanged at 0.22% as of March 31, 2024.

Tag: Marina Walsh CMB

MBA Reports Share of Mortgage Loans in Forbearance Holds Steady at 0.22% in February

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed the total number of loans now in forbearance remained unchanged at 0.22% as of February 29, 2024.

MBA: Share of Mortgage Loans in Forbearance Decreases Slightly to 0.22% in January

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 1 basis point from 0.23% of servicers’ portfolio volume in the prior month to 0.22% as of Jan. 31, 2024.

The Light at the End of the Tunnel: #MBAIMB24

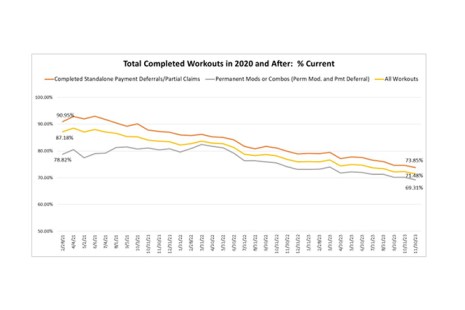

NEW ORLEANS–There is light at the end of the tunnel, MBA Vice President of Industry Analysis Marina Walsh, CMB, told attendees here at MBA’s Independent Mortgage Bankers conference.

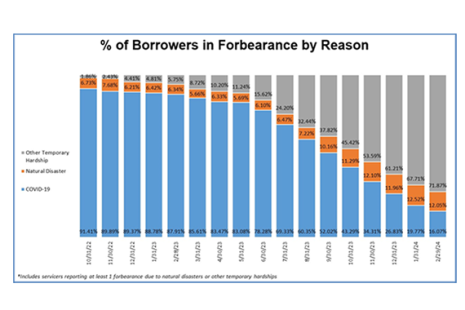

MBA: Share of Mortgage Loans in Forbearance Decreases to 0.23% in December

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 3 basis points from 0.26% of servicers’ portfolio volume in the prior month to 0.23% as of Dec. 31, 2023.

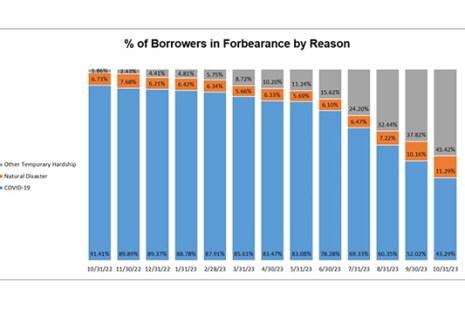

MBA: Share of Mortgage Loans in Forbearance Decreases to 0.26% in November

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 3 basis points from 0.29% of servicers’ portfolio volume in the prior month to 0.26% as of Nov. 30, 2023.

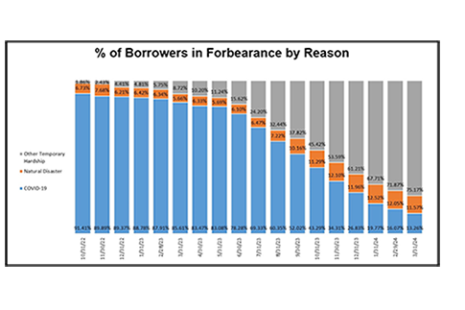

MBA: Share of Mortgage Loans in Forbearance Decreases to 0.29% in October

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 2 basis points from 0.31% of servicers’ portfolio volume in the prior month to 0.29% as of Oct. 31, 2023.

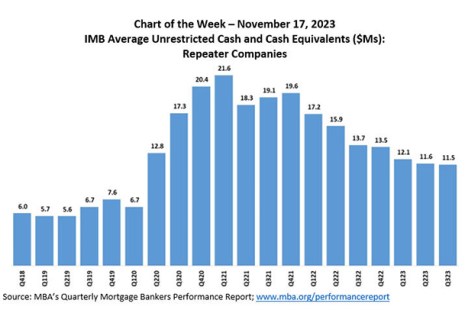

MBA Chart of the Week: IMB Average Unrestricted Cash & Cash Equivalents

MBA Research recently released the third quarter results of its Quarterly Mortgage Bankers Performance Report. The results showed that independent mortgage banks and bank subsidiaries reported a pre-tax net loss of $1,015 on each loan they originated in the third quarter of 2023, an increase from the reported loss of $534 per loan in the second quarter of 2023.

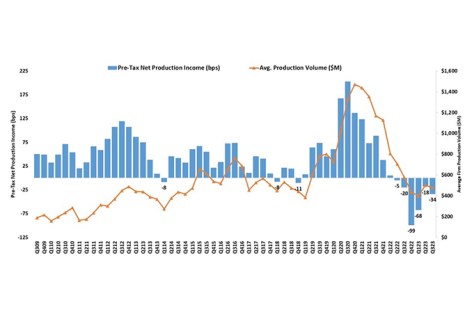

MBA: IMBs Report Net Production Losses in Third-Quarter 2023

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a pre-tax net loss of $1,015 on each loan they originated in the third quarter of 2023, an increase from the reported loss of $534 per loan in the second quarter of 2023, according to the Mortgage Bankers Association’s newly released Quarterly Mortgage Bankers Performance Report.

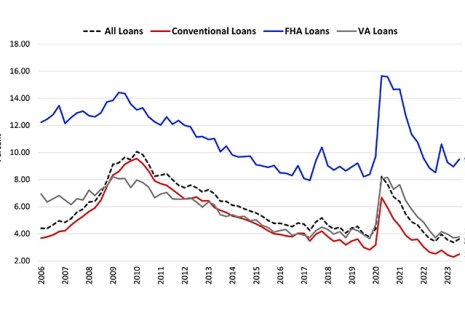

MBA Chart of the Week: Delinquency Rates by Loan Type, Conventional, FHA, VA

According to the latest MBA National Delinquency Survey, the overall delinquency rate for mortgage loans on one‐to‐four‐unit residential properties increased to 3.62% of all loans outstanding at the end of the third quarter of 2023.