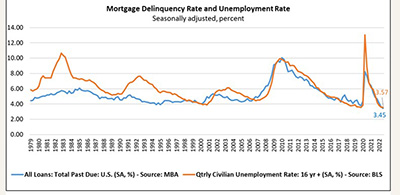

The Mortgage Bankers Association on Thursday released its 3rd Quarter National Delinquency Survey, reporting delinquency rate for mortgage loans on one-to-four-unit residential properties fell to its lowest level since the Survey’s inception.

Tag: Marina Walsh CMB

MBA: 3Q Mortgage Delinquencies Fall to New Survey Low

The Mortgage Bankers Association on Thursday released its 3rd Quarter National Delinquency Survey, reporting delinquency rate for mortgage loans on one-to-four-unit residential properties fell to its lowest level since the Survey’s inception.

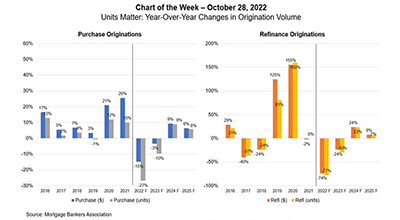

MBA Chart of the Week Oct. 28 2022: Year-Over-Year Changes in Origination Volume

This week’s MBA Chart of the Week examines year-over-year changes in origination volume ($ and units) dating back to 2016, and the forecasted volume from 2022 to 2025. In 2022, we expect a 15% decline in purchase origination dollars from 2021 but a steeper 27% decrease in the number of loans.

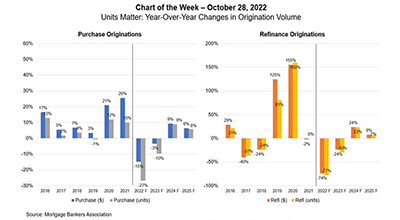

MBA Chart of the Week Oct. 28 2022: Year-Over-Year Changes in Origination Volume

This week’s MBA Chart of the Week examines year-over-year changes in origination volume ($ and units) dating back to 2016, and the forecasted volume from 2022 to 2025. In 2022, we expect a 15% decline in purchase origination dollars from 2021 but a steeper 27% decrease in the number of loans.

MBA Forecast: Recession Likely in 2023, Mortgage Originations to Decline 9% to $2.05 Trillion

NASHVILLE—The Mortgage Bankers Association said total mortgage origination volume is expected to decline to $2.05 trillion in 2023 from the $2.26 trillion expected in 2022. Purchase originations are forecast to decrease by 3 percent to $1.53 trillion next year, while refinance volume is anticipated to decline by 24 percent to $513 billion.

MBA Forecast: Recession Likely in 2023, Mortgage Originations to Decline 9% to $2.05 Trillion

NASHVILLE—The Mortgage Bankers Association said total mortgage origination volume is expected to decline to $2.05 trillion in 2023 from the $2.26 trillion expected in 2022. Purchase originations are forecast to decrease by 3 percent to $1.53 trillion next year, while refinance volume is anticipated to decline by 24 percent to $513 billion.

MBA Forecast: Recession Likely in 2023, Mortgage Originations to Decline 9% to $2.05 Trillion

NASHVILLE—The Mortgage Bankers Association said total mortgage origination volume is expected to decline to $2.05 trillion in 2023 from the $2.26 trillion expected in 2022. Purchase originations are forecast to decrease by 3 percent to $1.53 trillion next year, while refinance volume is anticipated to decline by 24 percent to $513 billion.

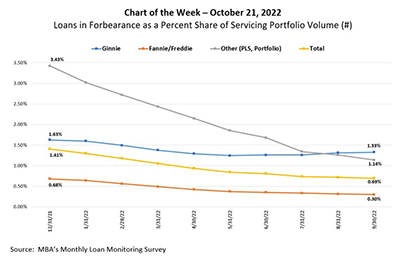

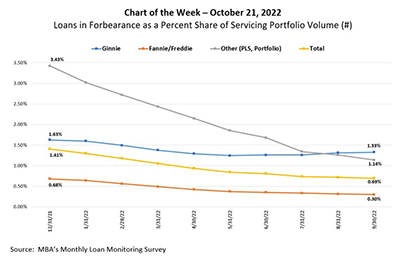

MBA Chart of the Week Oct. 21 2022: Loans in Forbearance

In this week’s Chart of the Week, we show the year-to-date forbearance rates across all investor categories. The most substantial improvement was among portfolio and private-label securities loans.

MBA Chart of the Week Oct. 21 2022: Loans in Forbearance

In this week’s Chart of the Week, we show the year-to-date forbearance rates across all investor categories. The most substantial improvement was among portfolio and private-label securities loans. The forbearance rate has dropped 229 basis points since the beginning of the year.

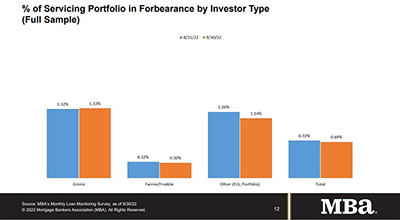

MBA: September Share of Mortgage Loans in Forbearance Decreases to 0.69%

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance decreased by 3 basis points to 0.69% of servicers’ portfolio volume as of Sept. 30, down from 0.72% in August. MBA estimates 345,000 homeowners remain in forbearance plans.