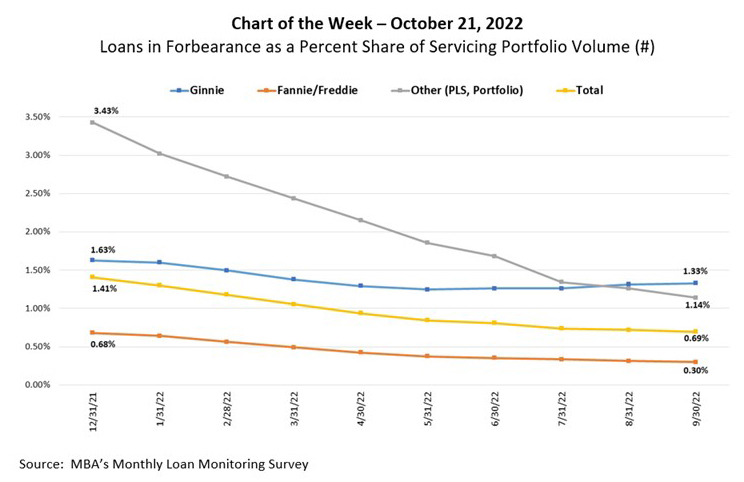

MBA Chart of the Week Oct. 21 2022: Loans in Forbearance

According to MBA’s Monthly Loan Monitoring Survey released last week, the share of loans in forbearance dropped slightly to 0.69 percent of servicers’ portfolio volume as of September 30,, from 0.72 percent the prior month. Nearly 345,000 homeowners are still in forbearance plans, after reaching a peak of almost 4.3 million homeowners in June 2020.

While the overall number of loans in forbearance continued to drop in September and was well below the 2020 peak, the pace of forbearance exits slowed to a new survey-low and new forbearance requests continued to come in. Compared to substantial improvements in the second half of 2020 and 2021, results for 2022 show more incremental improvements, especially in the past six months.

In this week’s Chart of the Week, we show the year-to-date forbearance rates across all investor categories. The most substantial improvement was among portfolio and private-label securities loans. The forbearance rate has dropped 229 basis points since the beginning of the year. In contrast, the Ginnie Mae forbearance rate improved by 30 basis points, and in recent months, has moved upward. In August, the forbearance rate for Ginnie Mae loans surpassed the forbearance rate for portfolio and PLS loans for the first time since May 2020.

It is important to note that the portfolio and PLS investor category includes Ginnie Mae buyouts – FHA, VA and other government loans that were bought out of Ginnie Mae pools. The buyouts allow servicers to stop advancing principal and interest payments, and to work with borrowers to find solutions that could eventually result in re‐securitizing the loans back into Ginnie Mae pools. The portion of Ginnie Mae buyouts in the portfolio and PLS volume has dropped to approximately 5 percent in September, from more than 8 percent a year ago. Market conditions – particularly rising mortgage rates and mortgage-backed security demand – may deter Ginnie Mae buyouts.

With the COVID-19 federal health emergency still in effect, borrowers can still seek initial COVID-19 hardship forbearance in most cases. And with the recent hurricane in the Southeast and the threat of a recession in 2023, forbearance rates – particularly in the Ginnie Mae investor category – will likely increase in future months.

- Marina Walsh, CMB (mwalsh@mba.org)