As home equity continues to soar, mortgage delinquency rates fell to levels not seen since onset of the coronavirus pandemic, said CoreLogic, Irvine, Calif.

Tag: Loan Performance Insights Report

CoreLogic: Delinquency Rates Approach Pre-Pandemic Levels

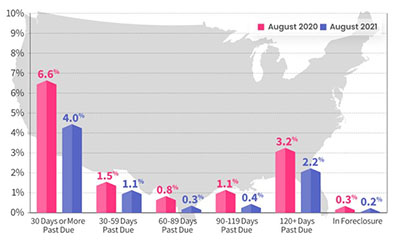

CoreLogic, Irvine, Calif., said delinquency rates on all mortgages in the U.S. fell in July to the lowest rates since March, edging closer to pre-pandemic levels.

Turning the Corner? Mortgage Delinquencies See 1st Annual Decrease in More than a Year

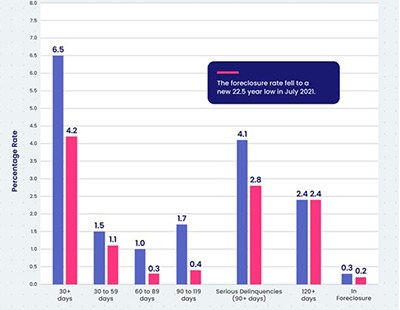

CoreLogic, Irvine, Calif., said all stages of mortgage delinquency except for the serious delinquency rate improved on an annual basis for the first time since March 2020.

CoreLogic: Mortgage Delinquency Rates Level Off in February

Despite a small uptick in overall delinquencies, serious delinquencies continued to decrease, CoreLogic, Irvine, Calif., reported this morning.

2020 Mortgage Delinquencies See Record Highs—and Record Lows

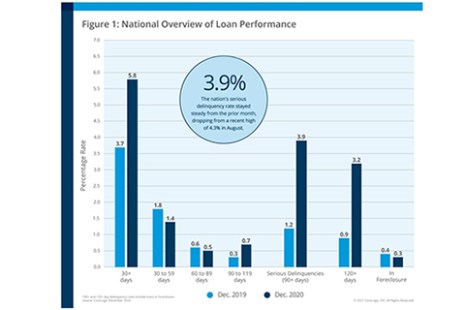

CoreLogic, Irvine, Calif., said its year-end Loan Performance Insights Report showed overall mortgage delinquency rates fell for the fourth straight month in December, ending a volatile year with signs of recovery.

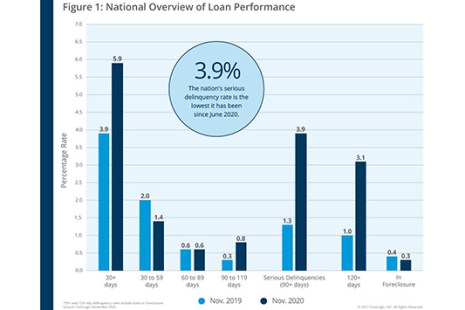

CoreLogic: November Mortgage Delinquency Rates at 11-Month Low

Ahead of this Thursday’s 4th Quarter National Delinquency Report from the Mortgage Bankers Association, CoreLogic, Irvine, Calif., said new November mortgage delinquencies fell below pre-pandemic levels and, while serious delinquencies fell to their lowest levels since June.

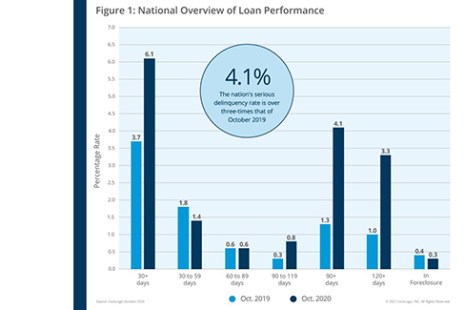

CoreLogic: Mortgage Delinquencies Rise, But Pace Moderates

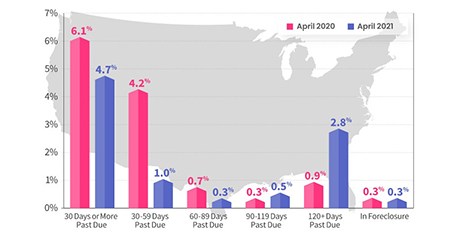

CoreLogic, Irvine, Calif., said on a national level, 6.1% of mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure) in October, a 2.4-percentage point increase from a year ago, when it was 3.7%.

CoreLogic: Serious Delinquencies Level Off in ‘Positive Signal’

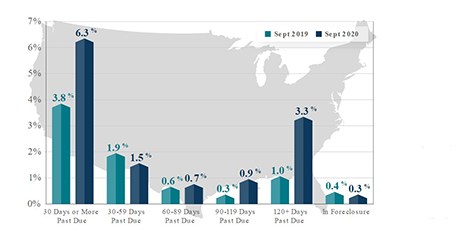

CoreLogic, Irvine, Calif., said its monthly Loan Performance Insights Report for September showed a leveling off of serious loan delinquencies, a “positive signal” that the housing finance industry is thus far adjusting to the pandemic-induced economic downturn.

CoreLogic: Foreclosures Remain Low; Serious Delinquencies Continue to Build Up

Ahead of this morning’s quarterly National Delinquency Survey from the Mortgage Bankers Association, CoreLogic, Irvine, Calif., said the 150-day delinquency rate reached its highest level since January 1999, noting that forbearance provisions have helped foreclosure rates maintain historic lows.

CoreLogic: Serious Delinquencies Spiking Despite Strong Housing Demand

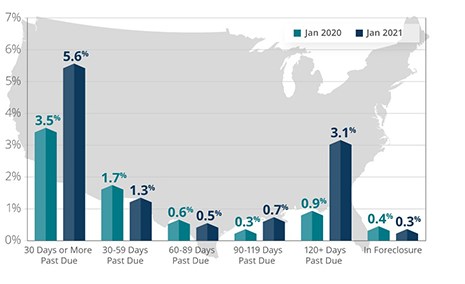

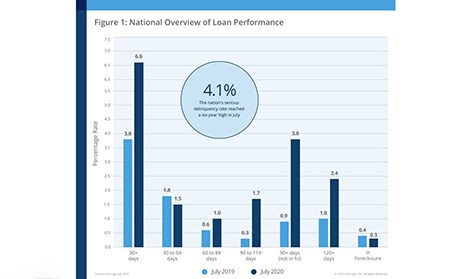

CoreLogic, Irvine, Calif., reported an increase in overall mortgage delinquency rates in July—and in particular, a spike in serious delinquencies to their highest level in more than six years.