Mortgage Delinquency Declines Approach Pre-Pandemic Levels

As home equity continues to soar, mortgage delinquency rates fell to levels not seen since onset of the coronavirus pandemic, said CoreLogic, Irvine, Calif.

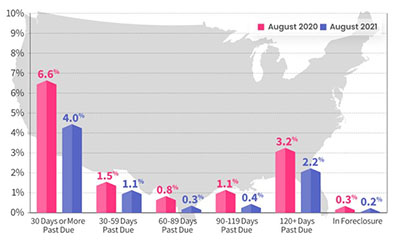

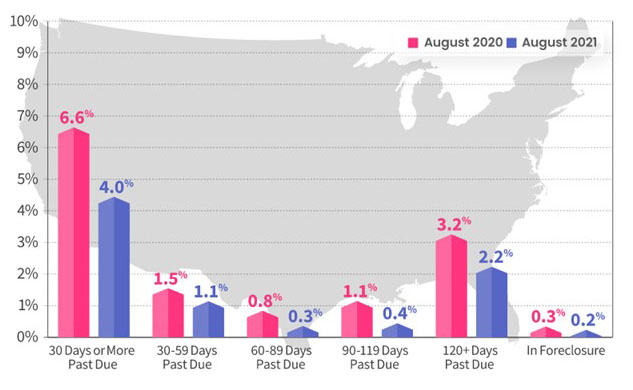

The company’s monthly Loan Performance Insights Report said 3.9% of all mortgages in the U.S. were in some stage of delinquency (30 days or more past due, including those in foreclosure) in September, representing a 2.4-percentage point decrease from a year ago, when it was 6.3%. Two years ago, the rate was 3.8%. The serious delinquency rate declined to lowest level since spiking in May 2020

Other key findings:

• Early-Stage Delinquencies (30 to 59 days past due): 1.1%, down from 1.5% in September 2020.

• Adverse Delinquency (60 to 89 days past due): 0.3%, down from 0.7% in September 2020.

• Serious Delinquency (90 days or more past due, including loans in foreclosure): 2.4%, down from 4.2% in September 2020.

• Foreclosure Inventory Rate (the share of mortgages in some stage of the foreclosure process): 0.2%, down from 0.3% in September 2020. This remains the lowest foreclosure rate recorded since 1999.

• Transition Rate (the share of mortgages that transitioned from current to 30 days past due): 0.6%, down from 0.8% in September 2020.

“The economic recovery has pushed down the percent of delinquent borrowers to the lowest level since the pandemic began,” said CoreLogic Chief Economist Frank Nothaft. “The number of borrowers past due on their mortgage doubled between March and May 2020. The past due rate in September 2021 was the lowest since March 2020.”

The report said despite nearly one-in-two delinquent borrowers being behind on their mortgages by six months or more, high levels of equity assure that relatively few of these borrowers will fall into foreclosure as they exit forbearance. Additionally, the U.S. unemployment rate continued to fall over to 4.2 percent in November, 10.6 percentage points lower than in April 2020. Employment and income growth provide the means for borrowers to remain current on their mortgages.

“Record home equity levels have been a boon to many homeowners navigating the cross currents of the pandemic,” said Frank Martell, president and CEO of CoreLogic. “Not only have homeowners used this equity to fuel a record level of home improvements and renovation, it has proven to be a vital factor in helping families ward off foreclosure, pay down existing debt and weather changing market conditions.”

The report said all states logged year-over-year declines in overall delinquency rate in September. States with the largest declines were Nevada (down 3.7 percentage points); Florida (3.6 percentage points); and New Jersey (3.6 percentage points).

• Two metro areas posted annual increases in overall delinquency in September 2021—Houma-Thibodaux, La. (up 3.3 percentage points) and Hammond, La. (up 0.3 percentage points). All other metros saw annual decreases, with Lake Charles, La., posting the largest decrease at 9.3 percentage points.