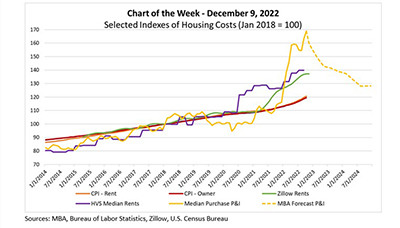

Housing costs are – appropriately – getting a lot of attention. Part of that attention stems from affordability challenges heightened by recent rapid increases in home prices, interest rates and rents. Another part stems from the fact that shelter costs are such a significant driver of measures of inflation, and thus a key motivator of Federal Reserve policies. In this week’s Chart of the Week, we examine selected indices of housing costs.

Tag: Joel Kan

MBA Chart of the Week, Dec. 9, 2022: Housing Cost Indices

Housing costs are – appropriately – getting a lot of attention. Part of that attention stems from affordability challenges heightened by recent rapid increases in home prices, interest rates and rents. Another part stems from the fact that shelter costs are such a significant driver of measures of inflation, and thus a key motivator of Federal Reserve policies. In this week’s Chart of the Week, we examine selected indices of housing costs.

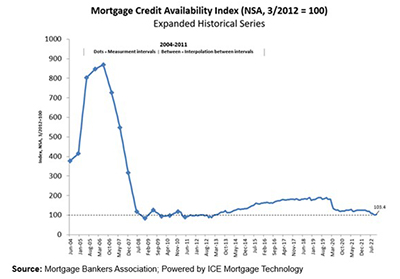

MBA: Mortgage Credit Availability Up for 1st Time in 9 Months

Mortgage credit availability increased in November—the first monthly increase since February—the Mortgage Bankers Association reported Thursday.

MBA: Mortgage Credit Availability Up for 1st Time in 9 Months

Mortgage credit availability increased in November—the first monthly increase since February—the Mortgage Bankers Association reported Thursday.

MBA Weekly Survey Dec. 7, 2022: Applications Down 2nd Straight Week

Mortgage applications fell by nearly 2 percent last week, although falling interest rates sparked an uptick in refinance applications, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending December 2.

MBA Weekly Survey Dec. 7, 2022: Applications Down 2nd Straight Week

Mortgage applications fell by nearly 2 percent last week, although falling interest rates sparked an uptick in refinance applications, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending December 2.

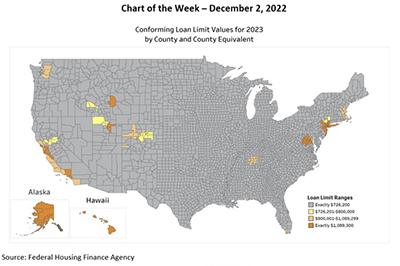

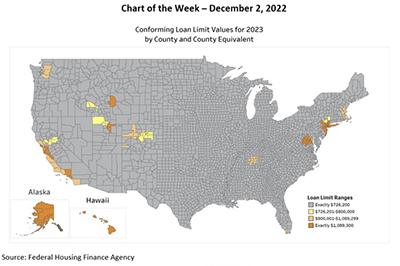

MBA Chart of the Week Dec. 2, 2022: GSE Conforming Loan Limits

Last week, the Federal Housing Finance Agency announced conforming loan limits for mortgages eligible to be acquired by Fannie Mae and Freddie Mac in 2023. The 2023 loan limit for one-unit properties for most of the country will be $726,200, an increase of $79,000 from $647,200 in 2022.

MBA Chart of the Week Dec. 2, 2022: GSE Conforming Loan Limits

Last week, the Federal Housing Finance Agency announced conforming loan limits for mortgages eligible to be acquired by Fannie Mae and Freddie Mac in 2023. The 2023 loan limit for one-unit properties for most of the country will be $726,200, an increase of $79,000 from $647,200 in 2022.

MBA Weekly Survey Nov. 30, 2022: Applications Down Despite Falling Rates

Mortgage applications fell for the first time in three weeks despite interest rates falling below 6.5 percent, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending November 25.

MBA Weekly Survey Nov. 30, 2022: Applications Down Despite Falling Rates

Mortgage applications fell for the first time in three weeks despite interest rates falling below 6.5 percent, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending November 25.