MBA Chart of the Week, Dec. 9, 2022: Housing Cost Indices

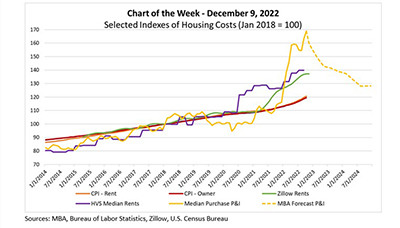

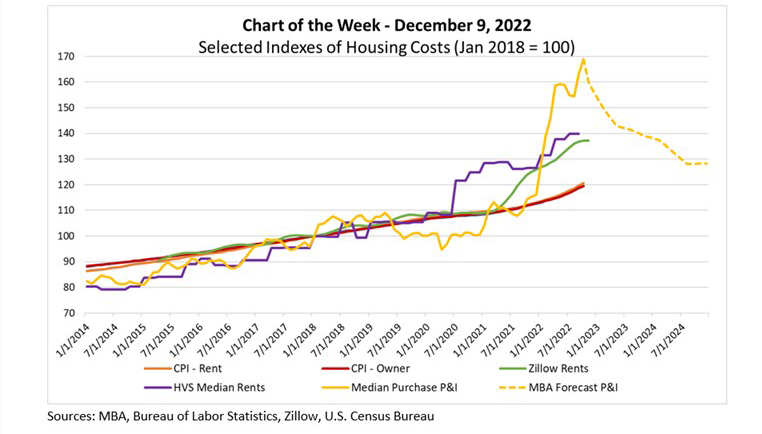

Housing costs are – appropriately – getting a lot of attention. Part of that attention stems from affordability challenges heightened by recent rapid increases in home prices, interest rates and rents. Another part stems from the fact that shelter costs are such a significant driver of measures of inflation, and thus a key motivator of Federal Reserve policies. In this week’s Chart of the Week, we examine selected indices of housing costs.

Until recently, various gauges of housing costs moved more or less in unison. These include:

- Asking rents, like those tracked by Zillow and the Housing Vacancy Survey (HVS),

- In-place rents, like those followed by the consumer price index (CPI) for rents and for owners’ equivalent rents (OER), and

- Mortgage principal and interests (P&I) payments, like those tracked by MBA’s Purchase Application Payment Index (PAPI).

But the housing market gyrations over the last two years have thrown these measures out of whack. The monthly P&I payment of a typical home purchase has surged more than 63 percent since the start of 2021. The rental market has also been hit but not nearly as significantly –with rising demand pushing asking rents up 26 percent over that period. In-place rents, including those paid by tenants under longer-term leases, have adjusted more slowly and are up 10 percent.

If the previous decade is any indication, one might expect those different measures of housing costs to re-align. If they do, what might that look like?

MBA’s November Mortgage Market Forecast anticipates home prices will grow 0.7 percent in 2023, -0.1 percent in 2024, and 2.0 percent in 2025. We anticipate year-end mortgage rates of 6.7 percent in 2022, 5.2 percent in 2023, and 4.4 percent in 2024 and 2025. Put that all together and the monthly P&I payment for the typical home purchase is likely to fall by nearly 25 percent between now and the end of 2025.

To get back to realignment, asking rents would need to fall by 6 to 8 percent (total) and in-place rents to rise by 7 to 8 percent over that three-year period. There are likely many twists and turns for the housing market in the coming quarters and years. In this scenario, moderation to what has been a rapid rise in housing costs would appear to be good news.

–Jamie Woodwell jwoodwell@mba.org; Edward Seiler eseiler@mba.org; Joel Kan jkan@mba.org.