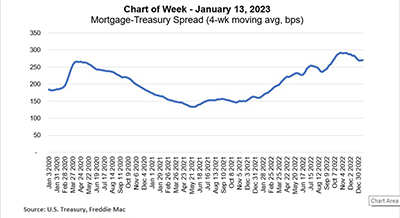

This week’s MBA Chart of the Week looks at the spread of mortgage rates relative to Treasury yields. This has been one of the more puzzling aspects of the current environment and a contributor to the rapid rise in mortgage rates over the past year.

Tag: Joel Kan

MBA Chart of the Week Jan. 13, 2023: Mortgage-Treasury Spread

This week’s MBA Chart of the Week looks at the spread of mortgage rates relative to Treasury yields. This has been one of the more puzzling aspects of the current environment and a contributor to the rapid rise in mortgage rates over the past year.

MBA Weekly Survey Jan. 11, 2023: Rates Down, Refis Up

Mortgage rates fell sharply last week, and borrowers—particularly those looking to refinance—took advantage, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending January 6.

MBA Weekly Survey Jan. 11, 2023: Rates Down, Refis Up

Mortgage rates fell sharply last week, and borrowers—particularly those looking to refinance—took advantage, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending January 6.

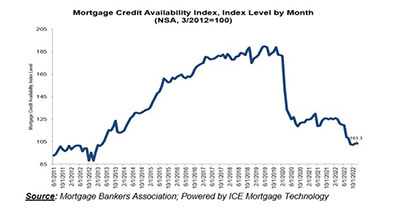

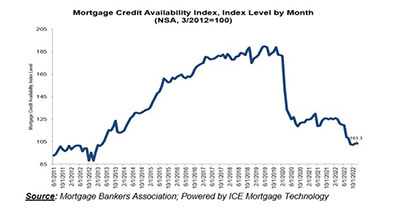

December Mortgage Credit Availability Inches Down

Mortgage credit availability fell by just 0.1 percent in December, the Mortgage Bankers Association reported Tuesday.

December Mortgage Credit Availability Inches Down

Mortgage credit availability fell by just 0.1 percent in December, the Mortgage Bankers Association reported Tuesday.

MBA Weekly Survey Jan. 4, 2023: Mortgage Applications Down 13% over Holidays

Mortgage applications fell by 13.2 percent over the two-week holiday period to their lowest level in 26 years, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the weeks ending December 23 and December 30.

MBA Weekly Survey Jan. 4, 2023: Mortgage Applications Down 13% over Holidays

Mortgage applications fell by 13.2 percent over the two-week holiday period to their lowest level in 26 years, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the weeks ending December 23 and December 30.

MBA Chart of the Week: New, Existing Home Sales

We are forecasting a weak start to 2023 for the housing market. Driven by a recession in the first half of the year and a continuation of the trends outlined above, we expect a 13% drop in existing home sales and a 4% decrease in new home sales for 2023, following 16% decreases in both segments in 2022.

MBA Chart of the Week: New, Existing Home Sales

We are forecasting a weak start to 2023 for the housing market. Driven by a recession in the first half of the year and a continuation of the trends outlined above, we expect a 13% drop in existing home sales and a 4% decrease in new home sales for 2023, following 16% decreases in both segments in 2022.