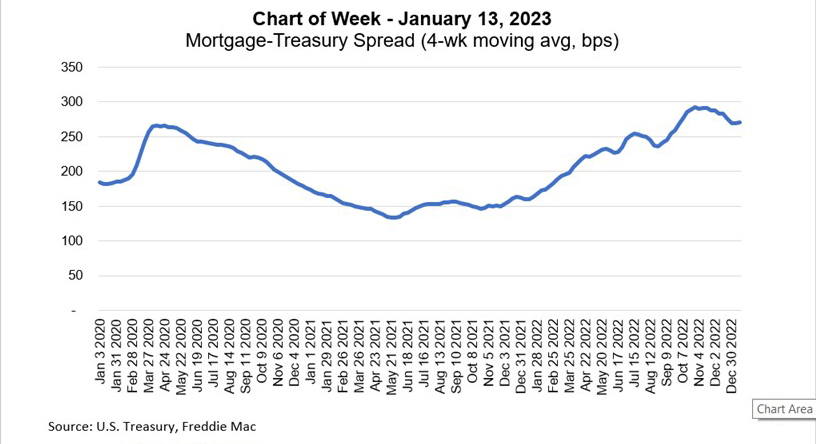

MBA Chart of the Week Jan. 13, 2023: Mortgage-Treasury Spread

This week’s MBA Chart of the Week looks at the spread of mortgage rates relative to Treasury yields. This has been one of the more puzzling aspects of the current environment and a contributor to the rapid rise in mortgage rates over the past year. This spread has historically averaged around 180 basis points, but reached 300 basis points later in 2022— a level not seen since the fall of 2008.

The exceedingly high level of interest rate volatility, likely a consequence of the Federal Reserve’s balance sheet reduction/quantitative tightening (QT), directly feeds into these wider spreads, as higher rate volatility leads to increased prepayment risk, which is priced in by investors. Beyond this effect, investors are also wary of the Fed’s announced intentions to move from passive roll-off of their large mortgage-backed securities (MBS) portfolio to a period of active MBS sales at some point in the future. We do not expect the Fed to begin selling MBS any time soon but do believe they will at some point over the next few years.

The widening of the mortgage-Treasury spread coincided with the 10-Year Treasury increasing from 1.7 percent in January 2022 to a peak of just over 4 percent in October 2022, pushing the 30-year fixed from 3.3 percent to its recent high of more than 7 percent in October 2022.

The impact of this increase in rates has already been widely felt, with refinance originations down more than 70 percent in 2022 and purchase volume seeing a 15 percent drop. The increase in mortgage rates contributed to pushing the median monthly payment on a purchase mortgage up 43 percent to $1,977 over the course of the year, which exacerbated affordability challenges across the housing market.

We are forecasting that this spread will normalize through the course of 2023 as investors realize this relative value, with the spread coming in to 220 basis points by the end of the year, and the 30-year fixed rate declining to around 5.2 percent from its current level of 6.2 percent. The 10-year Treasury yield is expected to end 2023 at around 3 percent.

–Mike Fratantoni mfratantoni@mba.org; Joel Kan jkan@mba.org.