MBA Chart of the Week: New, Existing Home Sales

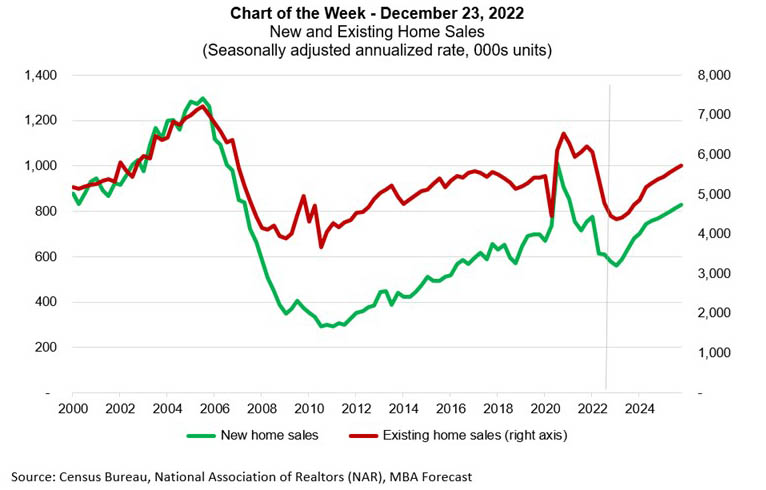

Recent data from NAR showed that the annualized pace of existing home sales in November was 4.09 million units – a 35% drop compared to November 2021. This decrease was consistent with the pace of home purchase applications, which have been running around 40% behind last year’s pace over the past few months, based on data from MBA’s Weekly Applications Survey.

Additionally, the National Association of Homebuilders’ index of builder sentiment has recorded declines in every month of 2022, citing slower buyer traffic and reduced sales expectations. The impact of that sentiment has shown up in Census data on single-family housing starts, weakening in all but two months so far this year and MBA’s estimate of new home sales, which has declined in eight out of the past 11 months.

One of the main drivers of these trends was the rapid doubling of mortgage rates over the course of 2022— from around 3% to over 7%, which pushed many buyers out of the market. The median purchase mortgage payment remained close to $2,000 in November, an increase of $594 over the first 11 months of the year, equal to a 42.9% increase, which has severely reduced homebuyer purchasing power.

Taking all this into account, we are forecasting a weak start to 2023 for the housing market. Driven by a recession in the first half of the year and a continuation of the trends outlined above, we expect a 13% drop in existing home sales and a 4% decrease in new home sales for 2023, following 16% decreases in both segments in 2022. Additionally, even though third quarter 2022 data still showed a 12% year-over-year increase in home prices, recent monthly changes have been negative, and the declines in some parts of the country have been quite large. We expect that the low inventory of existing homes and lack of distressed properties on the market will prevent a deeper decline in national home prices, but we do expect more quarters of negative year-over-year price changes.

—Mike Fratantoni mfratantoni@mba.org; Joel Kan jkan@mba.org.