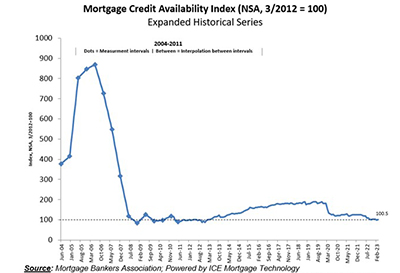

Mortgage credit availability rose in March after falling to a 10-year-low in February, the Mortgage Bankers Association reported Tuesday.

Tag: Joel Kan

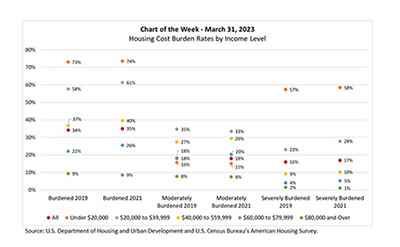

MBA Chart of the Week Mar. 31, 2023: Housing Cost Burden Rates by Income Level

In this week’s MBA Chart of the Week, we look at housing cost ratios by household income level, using data from the 2021 American Housing Survey.

MBA Weekly Survey Mar. 29, 2023: Applications Up 4th Straight Week as Rates Continue to Fall

Mortgage interest rates fell for the third straight week, and mortgage application activity increased for the fourth straight week, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending March 24.

MBA Weekly Survey Mar. 29, 2023: Applications Up 4th Straight Week as Rates Continue to Fall

Mortgage interest rates fell for the third straight week, and mortgage application activity increased for the fourth straight week, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending March 24.

MBA Weekly Survey Mar. 22, 2023: Falling Rates Drive Applications Up Third Straight Week

Mortgage interest rates fell to their lowest level since February, spurring increased application activity for the third straight week, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending March 17.

MBA Weekly Survey Mar. 22, 2023: Falling Rates Drive Applications Up Third Straight Week

Mortgage interest rates fell to their lowest level since February, spurring increased application activity for the third straight week, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending March 17.

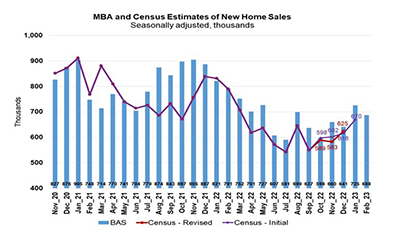

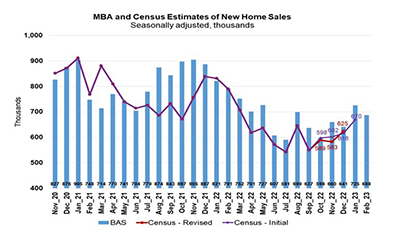

February New Home Purchase Mortgage Applications Up 4%

The Mortgage Bankers Association on Thursday reported mortgage applications for new home purchases increased by 4 percent in February from January and by 1.2 percent from a year ago.

February New Home Purchase Mortgage Applications Up 4%

The Mortgage Bankers Association on Thursday reported mortgage applications for new home purchases increased by 4 percent in February from January and by 1.2 percent from a year ago.

MBA Weekly Survey Mar. 15, 2023: Rates Drop; Applications Up Second Straight Week

Mortgage applications rose for the second consecutive week as a drop in mortgage interest rates spurred an uptick in activity, the Mortgage Bankers Association reported Tuesday in its Weekly Mortgage Applications Survey for the week ending March 10.

MBA Weekly Survey Mar. 15, 2023: Rates Drop; Applications Up Second Straight Week

Mortgage applications rose for the second consecutive week as a drop in mortgage interest rates spurred an uptick in activity, the Mortgage Bankers Association reported Tuesday in its Weekly Mortgage Applications Survey for the week ending March 10.