The coronavirus pandemic had a “dramatic and immediate impact” on delinquency rates for some mortgages backed by commercial and multifamily properties in the second quarter, although most continued to perform well, the Mortgage Bankers Association said in two reports.

Tag: Jamie Woodwell

MBA: Pandemic Takes Aim at Commercial, Multifamily Mortgage Delinquency Rates

The coronavirus pandemic had a “dramatic and immediate impact” on delinquency rates for some mortgages backed by commercial and multifamily properties in the second quarter, although most continued to perform well, the Mortgage Bankers Association said today in two reports.

Andrew Foster: CMBS Market Musings

Taken together, the analysis from industry thought leaders indicates that CMBS will continue to have challenges with existing loans through 2021 as new issuance remains robust for agency MBS and at a tepid pace for conduit transactions. Challenges with maturing loans are starting as well; however, 2022 will bring a major wave of those loans.

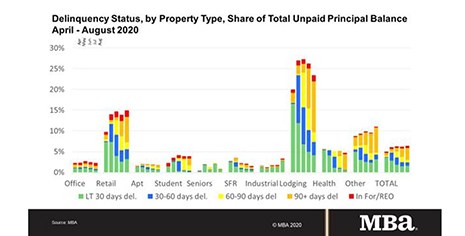

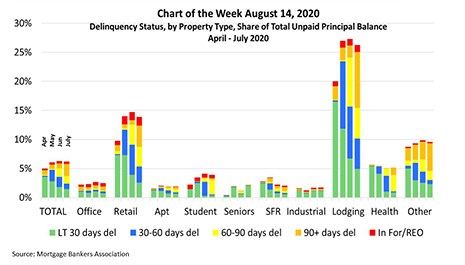

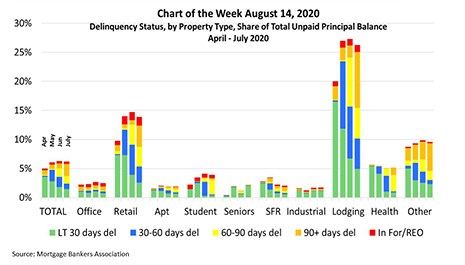

MBA Chart of the Week: Delinquency Rate for Commercial/Multifamily Mortgages

The delinquency rate for commercial and multifamily mortgages declined in July. The rate had increased sharply in April at the onset of the pandemic, with 3.6% of loan balances becoming newly delinquent. In May, delinquencies increased again, with a new, but smaller, cohort of newly delinquent loans.

MBA Chart of the Week: Delinquency Rate for Commercial/Multifamily Mortgages

The delinquency rate for commercial and multifamily mortgages declined in July. The rate had increased sharply in April at the onset of the pandemic, with 3.6% of loan balances becoming newly delinquent. In May, delinquencies increased again, with a new, but smaller, cohort of newly delinquent loans.

MBA: Second Quarter Commercial/Multifamily Borrowing Falls 48 Percent

Commercial and multifamily mortgage loan originations fell by 48 percent in the second quarter from a year ago and declined by 31 percent from the first quarter, the Mortgage Bankers Association reported in its Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations.

MBA: Second Quarter Commercial/Multifamily Borrowing Falls 48 Percent

Commercial and multifamily mortgage loan originations fell by 48 percent in the second quarter from a year ago and declined by 31 percent from the first quarter, the Mortgage Bankers Association reported this morning in its Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations.

MBA: 2019 Multifamily Lending Up 7% to Record High

Fueled by strong market fundamentals and low interest rates, 2,589 different multifamily lenders provided $364.4 billion in new mortgages in 2019 for apartment buildings with five or more units, according to the Mortgage Bankers Association’s annual multifamily lending market report.

MBA: 2019 Multifamily Lending Up 7% to Record High

Fueled by strong market fundamentals and low interest rates, 2,589 different multifamily lenders provided $364.4 billion in new mortgages in 2019 for apartment buildings with five or more units, according to the Mortgage Bankers Association’s annual multifamily lending market report.

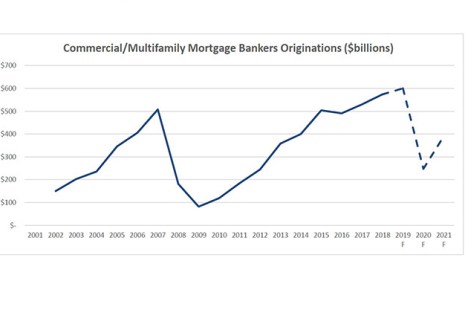

COVID-19 Pandemic to Cause Commercial/Multifamily Lending Pullback in 2020

Commercial and multifamily mortgage bankers are expected to close $248 billion in loans backed by income-producing properties this year, a 59 percent decline from 2019’s record volume of $601 billion, a new Mortgage Bankers Association forecast said.