MBA: Pandemic Takes Aim at Commercial, Multifamily Mortgage Delinquency Rates

The coronavirus pandemic had a “dramatic and immediate impact” on delinquency rates for some mortgages backed by commercial and multifamily properties in the second quarter, although most continued to perform well, the Mortgage Bankers Association said today in two reports.

The findings come from MBA’s new Commercial Real Estate Finance Loan Performance Survey for August; and the latest quarterly Commercial/Multifamily Delinquency Report for the second quarter. MBA designed the CREF Loan Performance Survey to better understand the ways pandemic is and is not impacting commercial mortgage loan performance. MBA’s regular quarterly analysis of commercial/multifamily delinquency rates is based on third-party numbers covering each of the major capital sources.

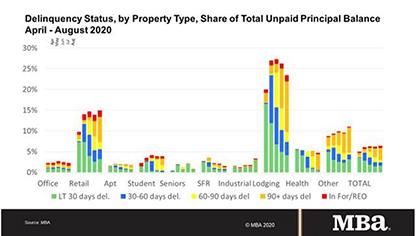

“The onset of the COVID-19 pandemic had a dramatic and immediate impact on lodging and retail properties, which flowed through to the mortgages backed by those properties and led to a spike in delinquency rates in April and May,” said MBA Vice President of Commercial Real Estate Research Jamie Woodwell. “While delinquency rates for both hotel and retail properties have since stabilized–and even declined slightly in July and August for hotel-backed loans–they still remain elevated.”

Overall, the vast majority of the balance of loans backed by other major property types continues to perform well, Woodwell noted.

“The property-specific differences flow through to the major capital sources,” Woodwell said. “The commercial mortgage-backed securities market, which has the greatest reliance on hotel and retail loans, has seen delinquency rates rise to record highs. Meanwhile, the delinquency rates for other capital sources has also increased, but not to the same degree, with many remaining closer to all-time lows than record highs.”

Key Findings from MBA’s CREF Loan Performance Survey for August:

Note: The survey includes a range of delinquency measures, but for the purposes of understanding the impacts from the pandemic, we focus on all non-current loans in the following summary on delinquencies.

- In August, there was relatively little change in overall commercial/multifamily delinquency rates, as well as continued declines in borrower inquiries and requests, with a comparatively high volume of executed actions.

- Hotel and retail properties continue to see the greatest stress. The delinquency rate for lodging properties fell for the second month in a row, while the delinquency rate for retail properties rose to a new series high.

- Most commercial and multifamily mortgages are still performing well.

- 93.6 percent of commercial/multifamily mortgage balances were current as of August 20, down slightly from 93.8 percent in July and 93.7 percent in June.

- Lodging and retail loans continue to show the greatest impacts from the COVID-19 pandemic, with delinquency rates falling in August for lodging property loans and rising for retail. The share of lodging property loan balances that were non-current fell to 23.4 percent in August (from 26.2 percent in July and 27.3 percent in June). For retail property loans, delinquencies rose to 15.0 percent in August (from 13.9 percent in July and 14.7 percent in June).

- Delinquencies of mortgages backed by most other major property types remained low: 98.3 percent of the balance of apartment loans were current (up from 98.1 percent last month), as were 97.8 percent of office loan balances (compared to 97.5 percent last month). The share of industrial loans that were current fell to 96.7 percent in August from 98.3 percent in July.

- Driven by the concentration of lodging and retail properties, CMBS loans had seen the greatest increases in delinquencies in previous months. After a decline in July, CMBS delinquencies rose again, hitting 12.6 percent in August, from 12.0 percent in July and 12.9 percent in June.

- Delinquencies for most other capital sources remained relatively low and stable. In August, 97.5 percent of FHA loan balances were current (unchanged from 97.5 percent a month earlier), as were 97.7 percent of life company balances (compared to 97.4 percent a month earlier) and 98.7 percent of GSE multifamily loan balances (flat from a month earlier).

- COVID-19-related inquiries and requests fell during August. Executed actions held relatively steady.

- Borrowers inquired about relief related to 0.7 percent of the balance of commercial and multifamily mortgages in August, down significantly from 0.9 percent in July, 1.6 percent in June, 6.0 percent in May and the 12.8 percent that inquired in April.

- Formal requests for payment or other changes were made on 0.4 percent of loan balances, down from 0.7 percent in July, 1.3 percent in June, 4.1 percent in May and 7.0 percent in April.

- Servicers executed modifications, forbearance or other actions on 1.4 percent of the aggregate loan balances, compared to 1.6 percent in July, 1.3 percent in June, 1.9 percent in May and 1.1 percent in April.

- Given the larger share of retail and hotel loans than in other capital sources, the CMBS market has seen far more inquiries and requests and has extended more executed actions as a percent of outstanding balance than other capital sources.

- Forbearance is in effect on 15.8 percent of hotel loan balances outstanding and 7.7 percent of retail loan balances outstanding.

For more information on the MBA CREF Loan Performance Survey for August, visit: https://www.mba.org/store/products/research/general/report/commercial-real-estate-finance-loan-performance-survey.

Key Findings from MBA’s Second Quarter Commercial/Multifamily Delinquency Report:

Note: MBA’s quarterly report relies on the headline delinquency measures used by each capital source. Each capital source’s measure is different. The different measures can give a good indication of delinquency trends within a source, but should not be used to compare any one capital source to another.

- Commercial and multifamily mortgage delinquency rates increased for every major capital source in the second quarter, but the increases varied dramatically.

- Headline delinquency rates (30+ days delinquent or in foreclosure or REO) for the commercial mortgage-backed securities market increased to a record high of 9.6 percent, which eclipsed the previous record of 8.9 percent from second quarter. The 782-basis-point increase in the delinquency rate during the quarter is nearly four times the previous largest quarterly increase (206 basis points in second-quarter 2009).

- The 60+ day delinquency rate for life insurance company loans rose from 0.04 percent to 0.15 percent–roughly half the peak levels seen during the Great Financial Crisis and the recession in 2001.

- Fannie Mae reported a multifamily 60+ day delinquency rate of 1.00 percent and Freddie Mac reported a rate of 0.10 percent. Fannie Mae reports loans receiving payment forbearance as delinquent, while Freddie Mac excludes those loans.

- The 90+ day delinquency rate for commercial and multifamily loans held on bank balance sheets rose from 0.51 percent to 0.64 percent and is still one of the lowest overall levels recorded by the Federal Deposit Insurance Corp.

- MBA’s analysis incorporates the measures used by each individual investor group to track the performance of their loans. Because each investor group tracks delinquencies in its own way, delinquency rates are not comparable from one group to another.

Differences between the delinquencies measures are detailed in Appendix A. To view the report, visit: https://www.mba.org/Documents/Research/2Q20CMFDelinquency.pdf.