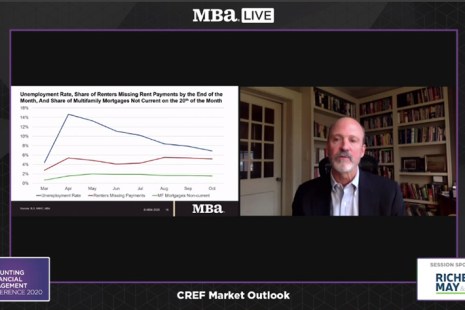

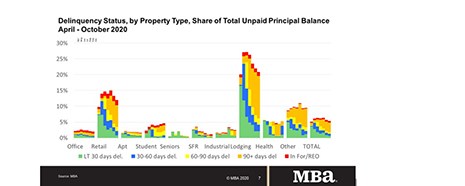

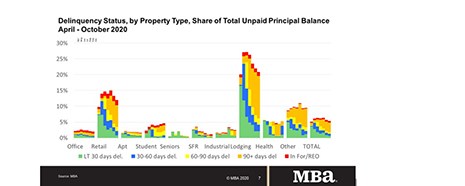

The pandemic has affected different commercial property types in very different ways, and they will likely perform differently when the economy bounces back, said MBA Vice President of Commercial Real Estate Research Jamie Woodwell.

Tag: Jamie Woodwell

MBA: Commercial/Multifamily Mortgage Delinquency Rates Continue to Vary by Property Types, Capital Sources

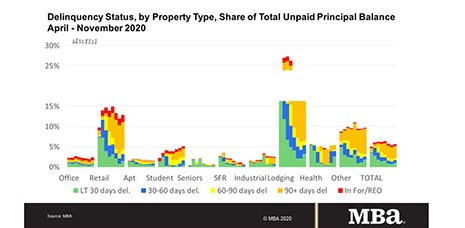

Commercial and multifamily mortgage performance remains mixed, revealing the various impacts the COVID-19 pandemic has had on different types of commercial real estate, according to two reports released today by the Mortgage Bankers Association.

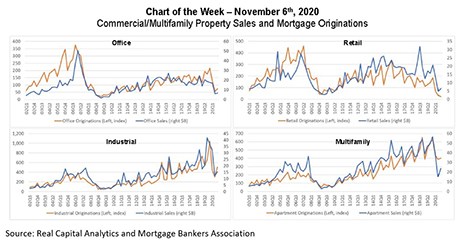

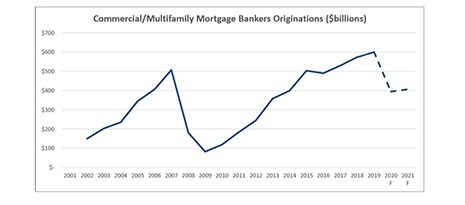

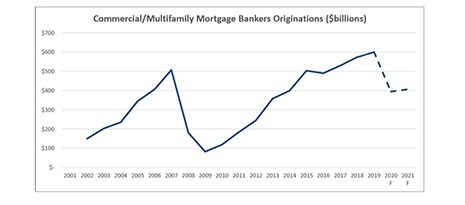

MBA Chart of the Week: Commercial/Multifamily Property Sales & Mortgage Originations

Commercial and multifamily mortgage origination volumes tend to move nearly in lockstep with property sales activity. With the onset of the COVID-19 pandemic, both tumbled, but with some important caveats.

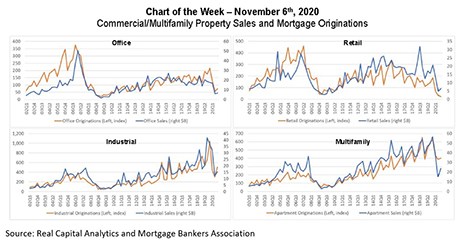

MBA Chart of the Week: Commercial/Multifamily Property Sales & Mortgage Originations

Commercial and multifamily mortgage origination volumes tend to move nearly in lockstep with property sales activity. With the onset of the COVID-19 pandemic, both tumbled, but with some important caveats.

ULI Forecast Sees Potential Rebound in 2021-2022

The Urban Land Institute, Washington, D.C., said a consensus of real estate economists surveyed expect a short-lived recession and above-average GDP growth in 2021 and 2022.

MBA Forecast: 2020 Commercial/Multifamily Lending Down 34% from 2019 Record Volumes

Commercial and multifamily mortgage bankers are expected to close $395 billion of loans backed by income-producing properties in 2020, a 34 percent decline from 2019’s record $601 billion, according to a new Mortgage Bankers Association forecast.

MBA Forecast: 2020 Commercial/Multifamily Lending Down 34% from 2019 Record Volumes

Commercial and multifamily mortgage bankers are expected to close $395 billion of loans backed by income-producing properties in 2020, a 34 percent decline from 2019’s record $601 billion, according to a new Mortgage Bankers Association forecast.

Commercial, Multifamily Mortgage Delinquencies Decline in October

Delinquency rates for mortgages backed by commercial and multifamily properties declined in October, the Mortgage Bankers Association’s latest monthly CREF Loan Performance Survey reported.

Commercial, Multifamily Mortgage Delinquencies Decline in October

Delinquency rates for mortgages backed by commercial and multifamily properties declined in October, the Mortgage Bankers Association’s latest monthly CREF Loan Performance Survey reported.

Commercial/Multifamily Borrowing Falls 47 Percent in Third Quarter

Commercial and multifamily mortgage loan originations were 47 percent lower in the third quarter compared to a year ago, and increased 12 percent from the second quarter of 2020, the Mortgage Bankers Association reported.