MBA Chart of the Week: Delinquency Rate for Commercial/Multifamily Mortgages

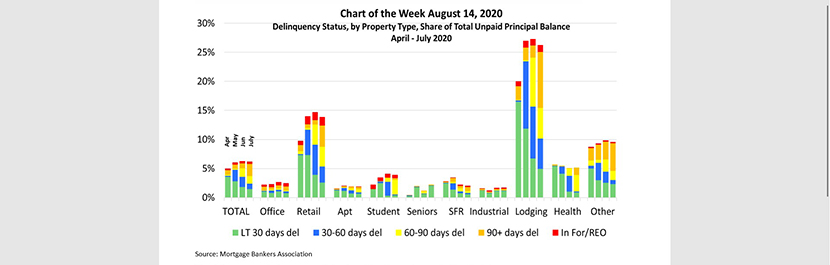

The delinquency rate for commercial and multifamily mortgages declined in July.

The rate had increased sharply in April at the onset of the pandemic, with 3.6% of loan balances becoming newly delinquent. In May, delinquencies increased again, with a new, but smaller, cohort of newly delinquent loans (2.8%) and slightly more than half of the balance of loans that had been less than 30-days delinquent in April moving to the 30-60 days delinquent category. The inflow of newly delinquent loans continued to slow in June (1.8% of overall balances) and July (1.4%).

The changes in the overall delinquency rate have been driven by loans backed by lodging and retail properties, which have felt the earliest and most dramatic impacts of the social and economic shutdown. In April, 16.5% of hotel loan balances were not current but were less than 30-days delinquent. Nearly three-quarters of that balance went on to become 30-60 days delinquent in May while an additional 11.9% became newly delinquent. Between April and May, the overall delinquency rate increased from 20.0% to 27.0%. In June, however, the all-in rate rose just 30 basis points, and in July it fell slightly to 26.2%.

Because the commercial mortgage-backed securities market has a greater share of hotel and retail loans than do other capital sources, its delinquency rates have been the most impacted. In April, 7.0% of the balance of CMBS loans became newly delinquent, followed by 5.5% in May, 3.4% in June and 2.3% in July. Roughly 70% of April and May’s newly delinquent loan balances remained delinquent the following month, as did 60% of June’s. With fewer new delinquencies coming in or moving on to the next stage of delinquency, the overall CMBS delinquency rate fell from 12.9% in June to 12.0% in July.

Commercial and multifamily mortgage delinquency rates reacted quickly to the onset of the pandemic. As the economy has stabilized, so too has loan performance.

–Jamie Woodwell (jwoodwell@mba.org); Reggie Booker (rbooker@mba.org)