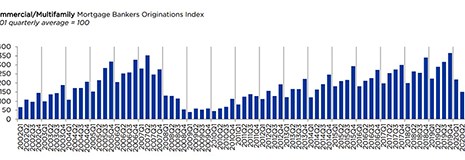

Commercial and multifamily mortgage loan originations fell by 18 percent in the fourth quarter from a year ago, but increased by 76 percent from the third quarter, according to the Mortgage Bankers Association’s Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations.

Tag: Jamie Woodwell

CRE Performance, Outlook Varies by Bucket

Investors and lenders are grouping commercial properties into distinct “buckets,” and different buckets will likely perform differently as the economy bounces back from the Pandemic Recession, said MBA Vice President of CRE Research & Economics Jamie Woodwell.

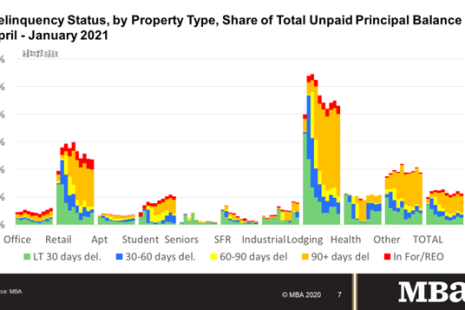

MBA: January Commercial, Multifamily Mortgage Delinquencies Decrease

Delinquency rates for mortgages backed by commercial and multifamily properties decreased in January, according to the Mortgage Bankers Association’s latest monthly MBA CREF Loan Performance Survey.

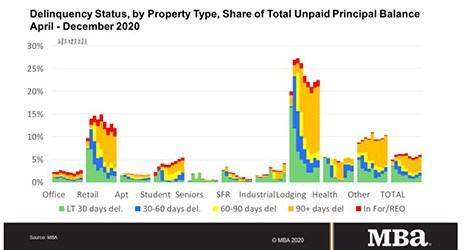

MBA: December Commercial/Multifamily Mortgage Delinquencies Rise

Delinquency rates for mortgages backed by commercial and multifamily properties Increased for the second month in a row in December, according to the Mortgage Bankers Association’s latest monthly MBA CREF Loan Performance Survey.

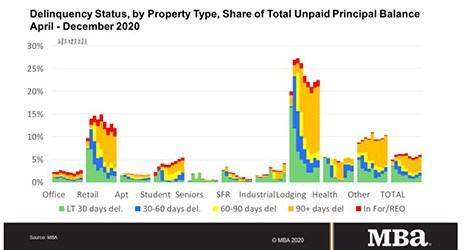

MBA: December Commercial/Multifamily Mortgage Delinquencies Rise

Delinquency rates for mortgages backed by commercial and multifamily properties Increased for the second month in a row in December, according to the Mortgage Bankers Association’s latest monthly MBA CREF Loan Performance Survey.

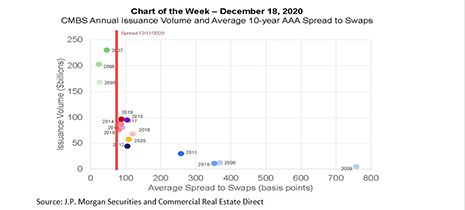

MBA Chart of the Week: CMBS Annual Issuance Volume

One way to gauge potential commercial mortgage-backed securities issuance volume is by looking at the spreads investors are willing to pay for bonds. Based on current new-issue spreads, 2021 could line-up to be a strong year.

MBA Chart of the Week: CMBS Annual Issuance Volume

One way to gauge potential commercial mortgage-backed securities issuance volume is by looking at the spreads investors are willing to pay for bonds. Based on current new-issue spreads, 2021 could line-up to be a strong year.

MBA: 3Q Commercial/Multifamily Mortgage Debt Up 1.5%

Commercial/multifamily mortgage debt outstanding rose by $57.0 billion (1.5 percent) in the third quarter, the Mortgage Bankers Association reported this morning.

CREF Market Outlook: Commercial Real Estate’s Four-Bucket Theory

The pandemic has affected different commercial property types in very different ways, and they will likely perform differently when the economy bounces back, said MBA Vice President of Commercial Real Estate Research Jamie Woodwell.

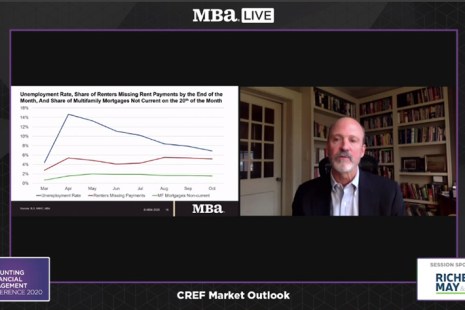

MBA: Commercial/Multifamily Mortgage Delinquency Rates Continue to Vary by Property Types, Capital Sources

Commercial and multifamily mortgage performance remains mixed, revealing the various impacts the COVID-19 pandemic has had on different types of commercial real estate, according to two reports released today by the Mortgage Bankers Association.