CREF Market Outlook: Commercial Real Estate’s Four-Bucket Theory

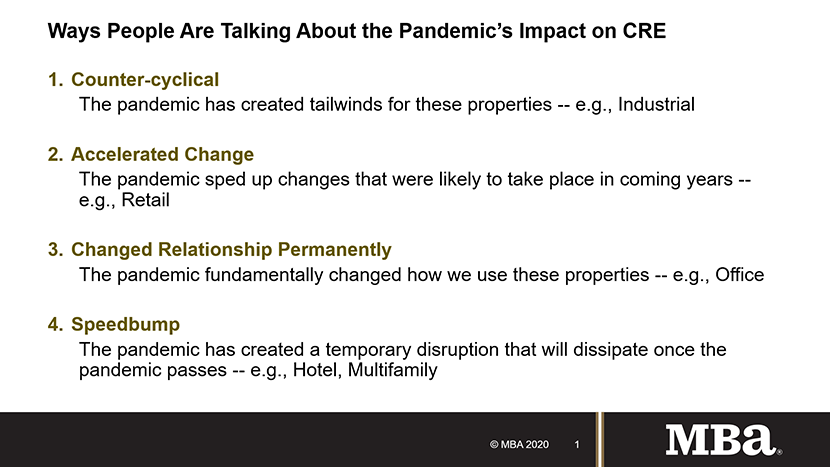

The pandemic has affected different commercial property types in very different ways, and they will likely perform differently when the economy bounces back, said MBA Vice President of Commercial Real Estate Research Jamie Woodwell.

Speaking at the Mortgage Bankers Association’s MBA Live Accounting and Financial Management 2020 conference, Woodwell noted some property types are acting counter-cyclically and others are seeing years of change compressed into months. “Some sectors are dealing with a major economic ‘speed bump’,” he said.

Woodwell cited four “buckets” he sees in commercial real estate at the moment. “The first is counter-cyclical. These are property types where the pandemic has actually created a bit of a tailwind in terms of incomes, operations and occupancy.” He said logistics, self-storage and single-family rental properties have tended to perform better this year than they did before the pandemic.

“The second bucket of properties is what I call ‘accelerated change’ types,” Woodwell said. “These are properties where there were changes taking place in the sector and since the pandemic we’re seeing those changes take place much more quickly. For example, retail, especially shopping malls. If you look at the move to e-commerce [and away from traditional retail]; we saw in just about two or three quarters movement to e-commerce that might have taken five to seven years if not for COVID.”

Woodwell’s third bucket is property types that the pandemic might have changed fundamentally. “Here, the poster child would be the office sector,” he said. “There are raging debates about getting back into offices. How quickly will companies get back to the office? Has the work-from-home movement become permanent? There are strong proponents on both sides. Personally I consider it binary. We can get together through Zoom and other technologies and you can have pretty good experiences that way. But it’s not quite the same experience as having everyone be in the same office or in the same ballroom for a convention.”

One future challenge Woodwell noted: When half of a company’s staff is on Zoom and the other half is in the office in person. “I think there are real questions about how effective that is,” he said. “So my hunch is that will pull us in one way or the other. That could be a positive for getting folks back into the office, allowing us to collaborate like we did prior to the pandemic.”

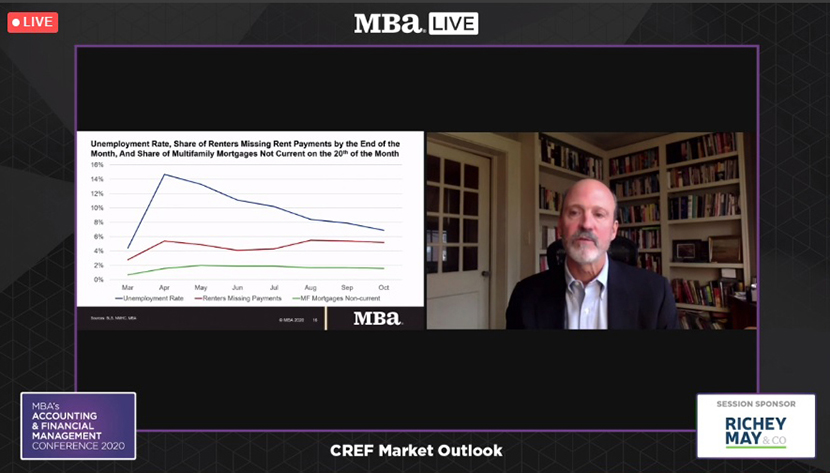

Woodwell called the final bucket “speed bump” property types. “These are things that were chugging along before COVID-19, but the pandemic recession created speed bumps for these properties,” he said. “The expectation is that they should get back to normal relatively quickly after COVID wanes. I’d put multifamily and hotels in this group.”

Right now hotels and apartments are in very different places, performance-wise, Woodwell said. “But after the pandemic, likely both will perform similarly to what they were doing before the pandemic,” he said.