CRE Performance, Outlook Varies by Bucket

Investors and lenders are grouping commercial properties into distinct “buckets,” and different buckets will likely perform differently as the economy bounces back from the Pandemic Recession, said MBA Vice President of CRE Research & Economics Jamie Woodwell.

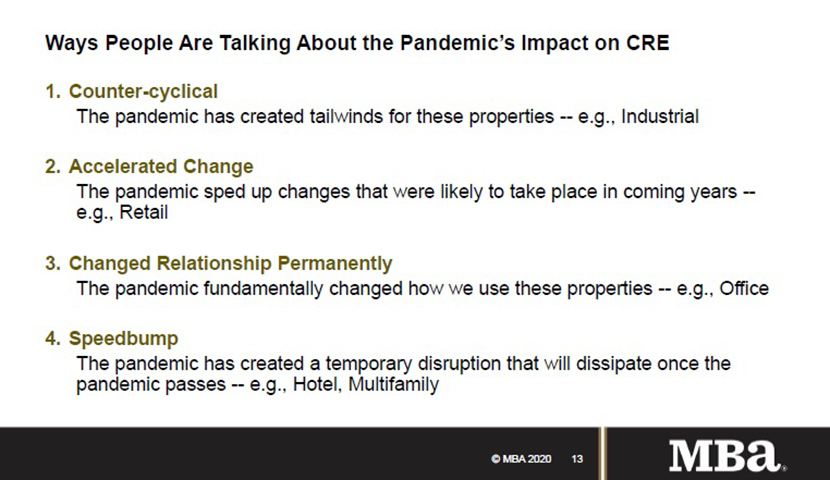

Speaking at the MBA CREF21 Convention & Expo, Woodwell said the first bucket is counter-cyclical. “These are property types where the pandemic has actually created a bit of a tailwind in terms of incomes, operations and occupancy,” he said. Logistics, self-storage and single-family rental properties are in this group and they are performing better than they did before the pandemic.

“The second bucket of properties is what I call ‘accelerated change’ types,” Woodwell said. “There was change taking place, but with the pandemic a lot of change became accelerated. For example, e-commerce. We saw several years of change come along in a just quarter or two,” he said.

Woodwell’s third bucket includes the property types that the pandemic might have changed fundamentally. “We see this in the work-from-home discussion and how we will use offices in the future,” he said. “The question is, has the pandemic fundamentally changed the way we do things?”

Woodwell called the final bucket the “speedbump” group. “In this group, things were chugging along before the pandemic and they will likely get sort of back to normal after the pandemic. I put hotels and multifamily properties in this group,” he said.

Last April MBA started tracking CRE loan performance to see how it would perform during the recession. “We use information from $2 trillion in loans that our member servicers have been helping us to collect,” Woodwell said. “In April and May 2020 there was a jump in delinquency rates for lodging and retail loans. Those sectors got hit the fastest by the pandemic. Office and industrial properties were much more muted in terms of overall delinquency rates.”

Woodwell noted that just as performance has differed by property type, it has also varied by capital source. “The commercial mortgage-backed securities market is where many hotel and retail loans lie. It’s seen higher delinquency rates than the GSEs, life companies and FHA, all of which were far more muted,” he said.

MBA will host a “deep dive” into its CRE research findings on Thursday, Feb. 11. Topics will include loan performance, mortgage bankers originations, servicing volumes/mortgage debt outstanding, upcoming loan maturities and MBA’s CREF Forecast for the rest of the year. All CREF Convention attendees are already registered. For any additional questions about registration contact CREFresearch@mba.org.

For additional commentary on the pandemic’s impact on the sector, visit MBA’s Commercial/Multifamily Market Intelligence Blog.