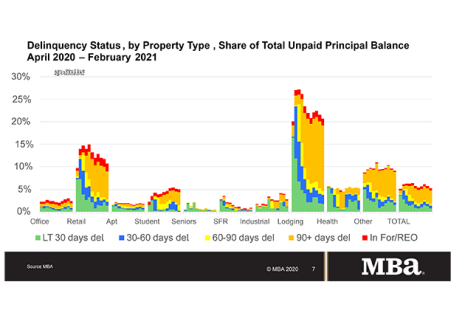

Delinquency rates for mortgages backed by commercial and multifamily properties decreased in February, as the COVID-19 pandemic’s impact on commercial and multifamily mortgage performance continues to vary by the different types of commercial real estate, the Mortgage Bankers Association reported.

Tag: Jamie Woodwell

MBA: February Commercial, Multifamily Mortgage Delinquency Rates Decrease

Delinquency rates for mortgages backed by commercial and multifamily properties decreased in February, as the COVID-19 pandemic’s impact on commercial and multifamily mortgage performance continues to vary by the different types of commercial real estate, the Mortgage Bankers Association reported.

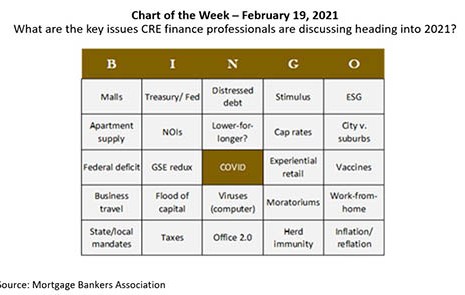

MBA Chart of the Week: CREF Bingo Card

MBA Research released its annual CREF Bingo card, covering top topics we expect to hear discussed in sessions, hallway conversations and receptions.

MBA Chart of the Week: CREF Bingo Card

MBA Research released its annual CREF Bingo card, covering top topics we expect to hear discussed in sessions, hallway conversations and receptions.

MBA: 2021 Commercial/Multifamily Mortgage Maturity Volumes to Increase 36%

The Mortgage Bankers Association says $222.5 billion of the $2.3 trillion (10 percent) in outstanding commercial and multifamily mortgages held by non-bank lenders and investors will mature in 2021, a 36 percent increase from the $163.2 billion that matured in 2020.

MBA Forecast: 2021 Commercial/Multifamily Lending to Increase 11% to Nearly $500 Billion

The Mortgage Bankers Association expects commercial and multifamily mortgage bankers to close $486 billion in loans backed by income-producing properties in 2021, an 11 percent increase from 2020’s estimated $440 billion, according to its latest forecast.

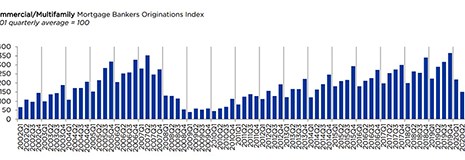

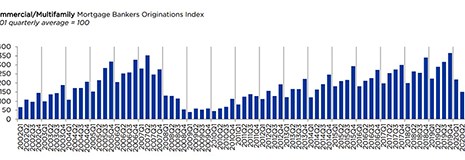

MBA: 4th Quarter Commercial/Multifamily Borrowing Falls 18 Percent

Commercial and multifamily mortgage loan originations fell by 18 percent in the fourth quarter from a year ago, but increased by 76 percent from the third quarter, according to the Mortgage Bankers Association’s Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations.

MBA: 2021 Commercial/Multifamily Mortgage Maturity Volumes to Increase 36%

The Mortgage Bankers Association says $222.5 billion of the $2.3 trillion (10 percent) in outstanding commercial and multifamily mortgages held by non-bank lenders and investors will mature in 2021, a 36 percent increase from the $163.2 billion that matured in 2020.

MBA Forecast: 2021 Commercial/Multifamily Lending to Increase 11% to Nearly $500 Billion

The Mortgage Bankers Association expects commercial and multifamily mortgage bankers to close $486 billion in loans backed by income-producing properties in 2021, an 11 percent increase from 2020’s estimated $440 billion, according to its latest forecast.

MBA: 4th Quarter Commercial/Multifamily Borrowing Falls 18 Percent

Commercial and multifamily mortgage loan originations fell by 18 percent in the fourth quarter from a year ago, but increased by 76 percent from the third quarter, according to the Mortgage Bankers Association’s Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations.