MBA: 4th Quarter Commercial/Multifamily Borrowing Falls 18 Percent

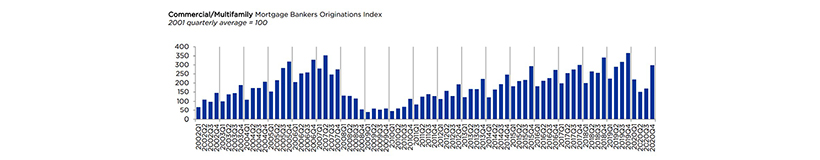

Commercial and multifamily mortgage loan originations fell by 18 percent in the fourth quarter from a year ago, but increased by 76 percent from the third quarter, according to the Mortgage Bankers Association’s Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations.

A preliminary MBA measure of commercial and multifamily mortgage originations volumes shows borrowing and lending in 2020 was 30 percent lower than in 2019, with all major property types and most capital sources – outside government-backed loans – seeing lower levels of activity.

“The last three months of 2020 were stronger than earlier quarters for borrowing backed by commercial and multifamily properties,” said Jamie Woodwell, MBA Vice President of Commercial Real Estate Research. “Commercial mortgage loan originations during last year’s fourth quarter were 18% lower than a year earlier, but up significantly from the very low third quarter. Borrowing and lending remain weakest for the property types most impacted by the pandemic – particularly hotel and retail buildings. Multifamily, led by government-backed financing from FHA, Freddie Mac and Fannie Mae, continued to see the strongest commercial mortgage activity.”

4Q Originations Decrease 18% from Year Ago

A decrease in originations for hotel, retail, office and health care properties led the overall decline in commercial/multifamily lending volumes when compared to a year ago. MBA reported a 79 percent year-over-year decrease in dollar volume of loans for hotel properties, a 72 percent decrease for retail properties, a 56 percent decrease for office properties and a 12 percent decrease for health care properties. Industrial property loan originations increased 15 percent, while multifamily property lending rose 14 percent.

Among investor types, the dollar volume of loans originated for commercial mortgage-backed securities declined by 64 percent year-over-year. MBA reported a 40 percent decrease for commercial bank portfolio loans, a 33 percent decrease in life insurance company loans and an 84 percent increase in the dollar volume of government-sponsored enterprise (Fannie Mae and Freddie Mac) loans.

4Q Originations Up 76% from 3Q

Fourth quarter originations for hotel properties jumped 411 percent compared to the third quarter. MBA reported a 136 percent increase in originations for industrial properties, a 111 percent increase for retail properties and a 77 percent increase for multifamily properties. Originations for health care properties increased 77 percent, while originations for office properties increased 26 percent.

Among investor types, dollar volume of loans for commercial bank portfolios increased 113 percent, loans for life insurance companies increased 100 percent from the third quarter; originations for GSEs increased 67 percent and dollar volume of loans for CMBS increased by 35 percent.

Preliminary 2020 Originations 30% Lower than 2019

A preliminary measure of commercial and multifamily mortgage originations volumes shows activity in 2020 was 30 percent lower than in 2019. By property type, originations for hotel properties decreased 77 percent from 2019, by 69 percent decrease for retail properties, by 50 percent decrease for office properties, by 27 percent decrease for health care properties, by 18 percent decrease for industrial properties and by 8 percent for multifamily properties.

Among investor types, 2020 versus 2019, loans for CMBS decreased 58 percent, originations for commercial bank portfolios decreased 44 percent and loans for life insurance companies decreased 39 percent. GSE loans increased 18 percent.

In late March, MBA will release its Annual Origination Summation report for 2020 with final origination figures for the year.

To view the full Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations report, click here.