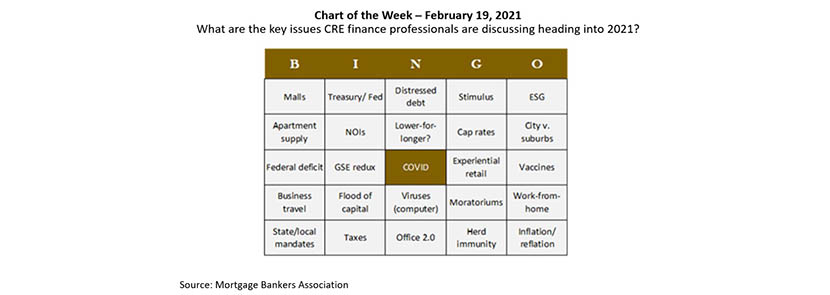

MBA Chart of the Week: CREF Bingo Card

MBA’s annual Commercial Real Estate Finance/Multifamily Housing Convention & Expo (CREF) always serves as key kick-off to the year, bringing together thousands of industry professionals to learn, share and network, and to re-assess their outlooks for the markets. Although this year’s conference was moved from San Diego to cyberspace, the conversations still provided essential insights about the year ahead.

As one of the many contributions to those conversations, MBA Research released its annual CREF Bingo card, covering top topics we expect to hear discussed in sessions, hallway conversations and receptions. We’ll take some credit that last year’s card (unveiled in early-February) did include a square for viruses, although hedging our bets, we combined physical and computer viruses in one spot. This year, COVID-19 replaces the center “Free” space as a forgone conclusion.

The range of other topics in this year’s CREF Bingo card demonstrates the variable state of commercial real estate finance as we start the year and – hopefully – wind down from the worst of the pandemic. Some of the topics (vaccines, herd immunity and the center-square COVID) relate to progress toward getting control of the virus itself. Others (malls, apartment supply, experiential retail, business travel, work-from-home, office 2.0, NOIs and cap rates) are very property-type specific, reinforcing the fact that this downturn has affected different property types in very different ways, as will the recovery.

Another set of squares (Treasury/Fed, stimulus, federal deficit, moratoriums, state/local mandates, taxes) relate to the government response to the pandemic, and how that response may change and affect CRE. A final group (ESG, city vs. suburbs, GSE redux, flood of capital, viruses – computer, inflation/reflation) includes longer-term trends that were in play before the pandemic and remain top of mind for CRE professionals.

- Jamie Woodwell (jwoodwell@mba.org)